Wesylan has rolled out a ‘virtual face-to-face’ service for its 340-consultant strong advice unit in a move that it claims will boost profitability by saving up to two and half hours per meeting.

Following a pilot project which garnered a 97 per cent positive customer feedback the mutual, which provides specialist financial advice for doctors, dentists, lawyers and teachers, is rolling out the option to receive advice remotely using a screen sharing platform with a secure, encrypted internet connection.

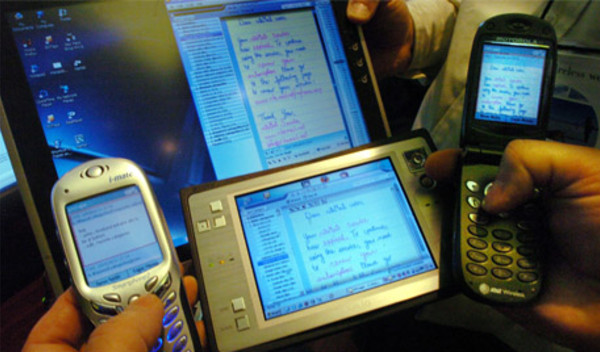

Wesleyan will use Vizolution’s ‘v screen’ technology as a platform allowing use on any internet-enabled PC, tablet or mobile device, so both customer and financial consultant see the same screen view and documents and papers can be shared.

It estimates that the firm’s 340 financial consultants could save up to 2.5 hours per meeting by doing things remotely, part of plans to expand within chosen markets of doctors, dentists, lawyers and teachers. There are also obvious environmental benefits, the group said.

Samantha Porter, Wesleyan’s group sales and marketing director, said: “Once a customer has an established relationship with their financial consultant, they do not necessarily want a face-to-face meeting every time they want to transact business.”

She was keen to stress that this is not a ‘simplified’ advice model, or a replacement for the firm’s consultants who deliver face-to-face advice.

“It’s designed to provide customers with the same level of service they’d have if they met an adviser in person, just that it’s done remotely.

“This isn’t for every customer in every situation, and those that would like to continue meeting face-to-face only will, of course, still have the choice to do that.”

Julia White, one of Wesleyan’s financial consultants involved in the pilot, added: “One of my clients was desperate to arrange a new mortgage. We completed the whole process remotely whilst they were in France, which was quick and convenient for us both.”

Last year, Craig Davidson, founder and compliance director at Reckitt House, launched a ‘virtual face-to-face’ advisory service, which he said can cut around half off the 3 per cent initial advice fee that is still being charged by many peers.

Speaking to FTAdviser, Alan Solomons, director of Alpha Investments and Financial Planning, said that he was pressing the service he uses, Dynamic Planner, to move forward with fact finds on their MyPlanner tool, which at the moment allows clients to complete a risk assessment and view their investments remotely.

“The aim of fact find on tablets, phones, home computers is to get clients to complete this in their own time rather than take up advisers time. Meetings via Skype are also a way forward and remote sessions using TeamViewer to see what the client has on their computer or other way round.”

Graeme Mitchell, managing director at Lowland Financial, said that while he does not currently use a formal remote advice tool, he has on occasion used Facetime and Skype to make meetings “more interesting”.

“I can see it would be handy for ‘old school’ direct servicing - but clients tend to come to us so travel down time is not an issue. I still feel face to face meetings are valued, getting clients away from the phone and other distractions helps them to focus on their own affairs.”

Mr Solomons agreed that face-to-face meetings have their place, but noted that each time you re-key things time is wasted and the chance for errors creep in.

“The financial advice software industry is years behind the accountancy profession, of which I am also a member, some of the software offered to IFA’s is obstructive, ill thought out and quite frankly appalling.

“Integration is required between back office and front office and financial planning software with trading platforms.

“Anything less is Dickensian and wastes time and allows errors to be made. Some software houses have people who have no idea what IFA’s really need and do, while some IFA’s do not have a vision for what the future holds and too easily accept what they have.”

peter.walker@ft.com