Just in case advisers and providers didn’t have enough to worry about in April, from the 21st of this month those without a mobile-friendly version of their website will start to be penalised in terms of Google rankings.

The change should take about a week and there are no ‘degrees’ of mobile-friendliness in the new algorithm: you’re either in or out. If you’re one of the many insurers, asset managers or, yes, advisory firms that aren’t already mobile-device adapted, then prepare to start losing business to those that are.

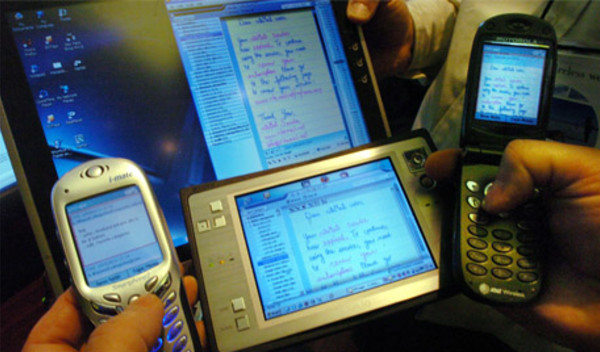

When someone searches for ‘financial adviser’ or ‘life insurance’ on anything other than a PC or laptop - which frankly, is a hell of a lot of the time for most people these days - those with sites approved by Google will jump above those not compatible with smaller screens.

Dropping just a few places, or disastrously off the first page, in search results could potentially cost providers many millions of pounds worth of customers and mean IFAs could be losing younger clients to their more web-savvy rivals.

Integrated brand and communications company Living Group looked at the web presence of FTAdviser’s Top 100 Financial Advisers last year, praising the likes of Brewin Dolphin, Towry and Rathbones.

However, it also found the majority of advisory firms had no responsive features on their websites, nor did they provide a mobile version.

Only 30 per cent used responsive web design to enable browsing on desktop, tablet and mobile devices, and of the remaining 70 per cent, only Rathbones provided a dedicated mobile website.

Michael Ward, managing director of Eclipse Financial Systems, who claims to have built over half of all the online protection comparison quote and apply systems in the UK over the last 12 years, warned that if your website is not optimised for mobile you’re ‘throwing money away’.

“People want to transact on their mobile devices where it is convenient, but at the moment advisers and providers are not making the journey easy enough for potential customers.

“If you take some of the big life insurance players for example and visit their website on your mobile, you’ll be taken to their desktop website page, where it is simply too difficult to transact or do anything.

“As soon as anyone lands on a desktop page via their mobile they will just drop off because it is not a good enough customer experience for them.”

From the other point of view, those who do ensure their websites are fully responsive and optimised for mobile, will be set to benefit.

Mr Ward explained that Google will look favourably on those who have made their websites customer friendly and you may even be upgraded in Google search results, meaning more ‘free’ traffic, potential customers and less spend on pay-per-click advertising.

peter.walker@ft.com