Introduction

Our winning funds had to pass a rigorous set of quantitative screens just to enter the Investment Adviser 100 Club. For those not familiar with the Club, it’s a selection of the UK’s 100 best funds and fund managers based on short- and long-term outperformance, and a set of strict screening factors.

Our winners then had to contend with a panel of five leading experts, which assessed a range of factors to ensure the very best can truly could be called the leading active managers in the UK.

Active management has once again come under intense scrutiny this year for failing to deliver. Our winners represent the industry’s counter-argument.

Looking ahead, it’s clear that scrutiny over price and performance isn’t going to go away. Nor should it. But there’s a big opportunity for active managers on the horizon. Should current market volatility continue, their merits are likely to come into even sharper relief.

There are also other signs that fund groups are addressing some of the criticisms levelled against them. It’s true there are still too many active funds, with many failing to justify the fees they charge.

However, I think the time when the industry simply launched funds for the sake of it is long gone. Firms are increasingly focused on the areas in which they can offer something different – long may it continue.

In the pages that follow, we divulge the full list of 2015 winners so you can find everything you need to know about the best products available in the UK*.

I would like to take this opportunity to thank the panel of expert judges for taking the time to share their knowledge. Thanks also go to the Investment Adviser 100 Club member asset managers, who provided us with countless pages of in-depth information on their funds to help with the judging process.

We hope you find the Investment Adviser 100 Club results an interesting read.

*Five-year actual return figures to May 2015 and total assets are current.

Dan Jones is editor of Investment Adviser

IA 100 Club Awards

The Judges

James Calder from City Asset Management

Mr Calder joined City Asset Management as research director from Baring Asset Management where he managed several funds in his role as head of multi-manager. Before that, he spent time at Berry Asset Management and Tilney Bestinvest.

Gavin Haynes from Whitechurch Securities

Mr Haynes is managing director of Bristol-based discretionary fund manager Whitechurch Secuirties. Mr Haynes has been managing private client portfolios since 1997 and is a leading commentator in the industry on collective investments and portfolio management.

Meera Hearnden from Parmenion Investment Management

Ms Hearnden is a senior investment manager at Parmenion where she is involved in all aspects of the team’s work including portfolio risk analysis, asset allocation and fund research. She holds the Investment Management Certificate, Financial Planning Certificate as well as a BA in Economics and International Studies and MSc in International Business Economics, and has been a regular contributor of financial commentary. Prior to joining Parmenion she spent 15 years at Hargreaves Lansdown as a senior analyst in the fund research department.

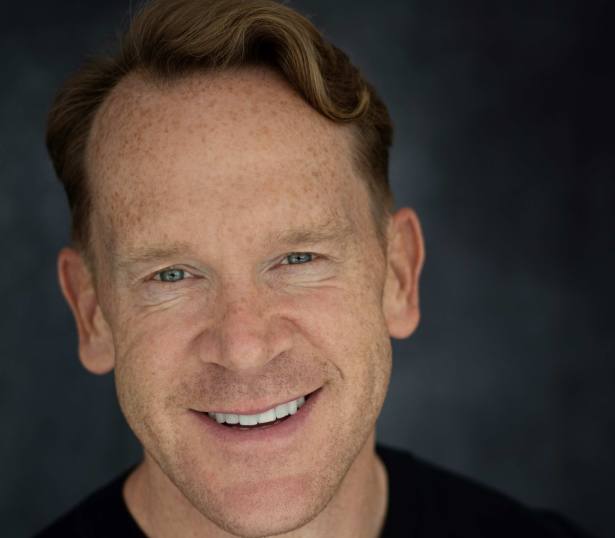

Stephen Peters from Charles Stanley

Mr Peters is co-head of collectives research at Charles Stanley and co-fund manager of the Charles Stanley Collectives Portfolio Service. A regular media commentator, Mr Peters is knowledgble on all aspects of the active fund management industry, with investment trusts a particular area of expertise and he sits on a number of industry committees. He joined Charles Stanley in 2007, having previously worked at Hewitt Associates.

Jim Wood-Smith from Hawksmoor Investment Management

Mr Wood-Smith is head of research at the Exeter-based boutique Hawksmoor Investment Management. He trained as a fund manager and investment analyst in the 1980s, spending more than 20 years in the City before joining Hawksmoor at the start of 2014.

In this special report

100 Club Awards 2015: UK Equity

100 Club Awards 2015: UK Smaller Companies

100 Club Awards 2015: Specialist Sectors and Assets

100 Club Awards 2015: Global Equity

100 Club Awards 2015: Sterling Strategic Bond

100 Club Awards 2015: European Equity

100 Club Awards 2015: Passive Investment Group

100 Club Awards 2015: Mixed Asset Income

100 Club Awards 2015: Absolute Return