Introduction

This is reflected in the S&P 500 index, which rose 64.6 per cent in the three years to November 25, with only Japan’s Nikkei 225 index posting anywhere near that gain, rising 50.6 per cent in that same period.

With this rise having outpaced earnings growth, US equities can look expensive compared to other regions, such as Europe and Japan. Figures from the Investment Association show net retail sales of North America funds have fluctuated, perhaps for this reason, with inflows of £150m in July, followed by £14m in outflows in August, and then more inflows of £78m in September this year.

Jeff Rottinghaus, manager of the T Rowe Price US Large-Cap Equity fund, observes: “The current US market expansion has now lasted more than 80 months, with common stock indices up more than 200 per cent since the spring of 2009. While lingering questions remain over the extent to which weakness in global demand growth will create a drag on US activity, we continue to see encouraging signs of improvement in the overall US economic backdrop.”

Mr Rottinghaus believes market valuations have fallen from the peak levels seen earlier in 2015 and are now closer to their long-run averages.

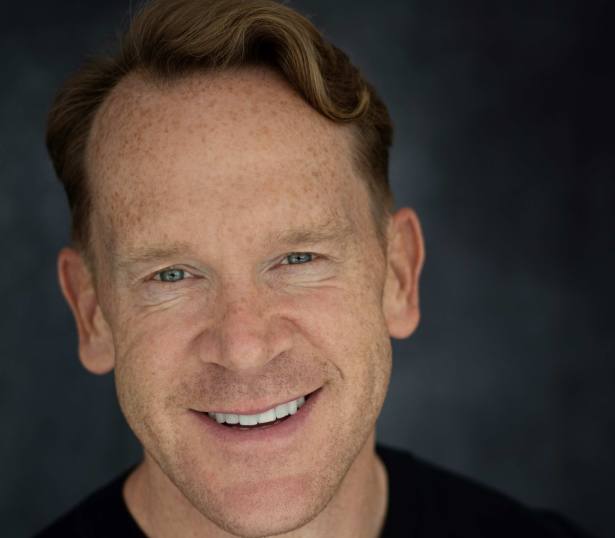

Kully Samra, managing director at Charles Schwab UK, is also largely positive on the outlook for US companies, despite concerns over the region’s manufacturing sector.

He explains: “The US economy is currently bifurcated, with manufacturing recently near contraction territory, but services showing healthy growth. Given the 12 per cent and 88 per cent respective weights in the economy, a broader recession is unlikely. In addition, the outperformance of the industrials sector since the August-September correction suggests the worst may be over for the manufacturing sector.”

At the forefront of US investors’ minds has been the Federal Reserve’s timing of an interest rate rise. The impact of the initial increase in rates on US stocks is up for debate.

Mr Samra cautions: “Although we believe the dollar is in a long-term bull market, there is some historical precedence for the dollar to retreat a bit once the Fed starts to raise rates – call it a ‘buy the rumour, sell the news’ scenario.”

But Mr Rottinghaus says: “From an historical perspective, a mixed picture emerges when looking at past equity performance during previous periods of rising rates. In some instances, small-cap cyclical names have led markets higher, while during other periods, large-cap defensive names have delivered stronger performance.”

He remarks: “We don’t expect a modestly higher level of rates will have a meaningful impact on US economic activity or on aggregate levels of corporate profitability. As such, we anticipate further gains, albeit at a more modest pace, from the US equity market.”

THE PICKS

JPM US Select

Co-managed by Susan Bao, Thomas Luddy and Helge Skibeli, this fund has delivered consistently strong returns over one, three, five and 10 years. It generated an impressive 140.4 per cent return over 10 years to November 25, against the 98.5 per cent average return of the peer group, according to data from FE Analytics. This has earned it a place in the Investment Adviser 100 Club 2015 for the third year running. Launched in July 1995, this £276m fund counts banking giant Wells Fargo, retail group Lowes and media company Time Warner among its 10 largest positions.

Neptune US Opportunities

Felix Wintle is the manager of this £336m fund that launched in December 2002. The objective is capital growth through investing in a fairly concentrated portfolio of between 40 and 60 firms. It is the second best performing fund in the IA North America sector in the 10 years to November 25, having generated 152.2 per cent, data from FE Analytics shows. Information technology accounts for 28.6 per cent of its portfolio, with healthcare the second largest sector weighting at 26.1 per cent.

EDITOR’S PICK

Old Mutual North American Equity

This £866m fund won the North American Equity fund category at this year’s Investment Adviser 100 Club Awards. Since December 2004 it has been run by Amadeo Alentorn, Mike Servent and Ian Heslop, who have managed to deliver on their aim of long-term capital growth. In the five years to November 25 the fund returned 114.8 per cent, compared to the IA North America sector average of 79.7 per cent. Its largest sector weighting is to information technology at 19.6 per cent, with healthcare accounting for 13.2 per cent. This is reflected in its top 10 holdings, which include Apple, Gilead Sciences and Microsoft.