Article 5 / 9

Retirement freedoms special report - April 2015Are we tech-ready?

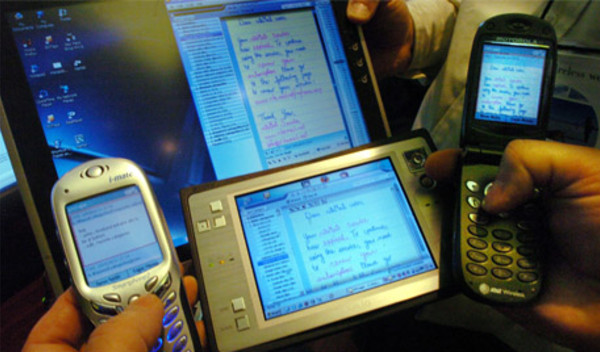

The retirement freedoms will represent an overnight revolution in the way individuals can fund their retirement. But the way individuals access financial services has been undergoing a more drawn out shift over the past decade and more, as they increasingly move towards online plans and transactions.

But how equipped are the platforms to facilitate the new freedoms? There are fears that the comparatively short period since the new regime was first touted a year ago has not allowed sufficient time for platforms to develop appropriate technology.

Any excitement around the possibilities presented has been tempered by the realisation of the work involved, and the difficulty in preparing while the goalposts have kept shifting.

Bill Vasilieff, chief executive of Novia, cites this tinkering as the biggest obstacle, “They are still changing it as we go along. Some of the finer points will not be met. And some of them, like the ability to take lump sums without crystallising, [platforms] need to do.”

However, the entire industry is likely to be facing similar difficulties, “Platforms won’t be ready, nor will anyone else for that matter,” Mr Vasilieff adds.

Within platforms there will be different levels of readiness. Sleeker, newer platforms should be sufficiently adaptable to cater to the new freedoms. But a likely issue is – predictably – going to come from legacy systems. Many big life offices are already stretched, having to deal with a sudden spike in auto-enrolment as this year’s staging dates hit.

The need to accommodate Mifid II, Basel III and other huge regulatory shifts, means life companies will be unlikely to have resources available to ensure their platforms are up to date.

Mark Polson, principal at Edinburgh-based consultancy the lang cat, identifies this problem, “There is no push from salespeople. Lifecos don’t want this to happen because they are not ready.”

Flex for tech

While newer platforms may be flexible enough to adapt functionality, the big insurers will still have many old personal, stakeholder and group pensions and so on, often on with-profits contracts. The logistical challenge involved lead many life offices to not bother trying, instead accepting they will lose the business of any retiree who wants to take any route outside of an annuity.

Mr Polson adds, “I don’t think you can plan a business for all these things hitting at the same time. I don’t think they are negligent; they are just in the eye of the storm.”

While open life offices – and their customers – are likely to face challenges, it is the closed firms that could cause the biggest headache. Mr Polson asks, “What do Resolution Group do with this stuff, how do you get your money out of Pearl, because they’ve got absolutely no interest in doing it?”

However, Phoenix Group, which houses Pearl and Resolution along with AMP, NPI, Alba, London Life and other closed books, insists it will be ready. Shellie Wells, head of media relations, says, “We will allow our customers to take the full encashment from age 55. More complex products such as drawdown and partial UFPLS, which we believe our customers should be offered through an advice process, will be made available through a partner. We are currently going through the due diligence process with this company and expect to have this in place for 6 April.”

Furthermore, Ms Wells states Phoenix’s current transfer times are an average of less than 10 days.

Are direct-to-consumer platforms any better equipped? Nutmeg has emerged in the post-RDR years as a low-cost investment platform that offers non-advised clients a portfolio tailored to a self-assessed risk profile. It recently launched a pension product focused on the accumulation phase and is now planning a flexi-access product to focus on the decumulation stage.

Details are still to be announced but Nutmeg’s chief operating officer, Phillip Bungey suggests it aims to cater for retirees living longer, recognising that existing retirement funding options have struggled to keep up with increasing life expectancy. “We see the pension as a growth investment,” he says.

Even for those platforms that do get everything ready, there are likely to be further tweaks necessary. As Bill Vasilieff says, further legislative change is inevitable, “The government will keep meddling with pensions. It’s captive money. They can change the rules any time.”