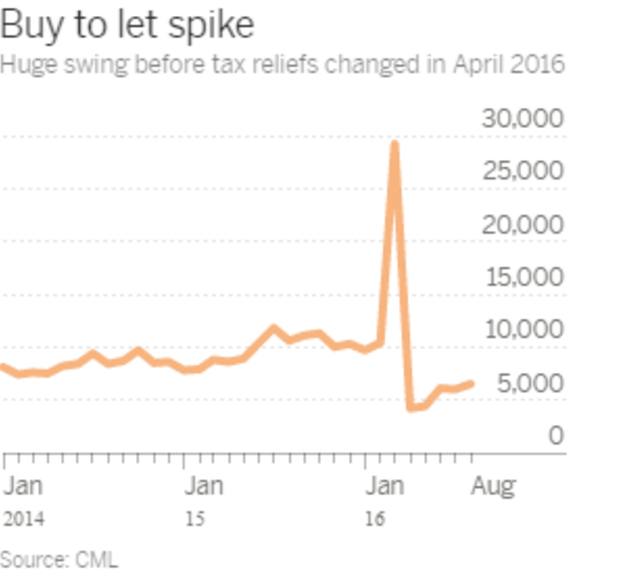

Buy-to-let and new house purchases have suffered a sharp fall since the government's changes to landlord taxation and higher stamp duty came into effect.

Brexit talk, tax treatment on buy-to-let and a general uncertainty in the economy has seen a swing to people remortgaging and a huge slump in the number of new home and buy-to-let mortgages, data from the Council of Mortgage Lenders (CML) has revealed.

In its latest market data, the CML said: "The stamp duty tax change in April created a distortion in the first and second quarter of this year, but data for July and August shows a market where transactions still look soft for buy-to-let.

"This looks set to continue, given that lenders have been tightening affordability criteria in anticipation of the forthcoming interest tax relief changes in April 2017, coupled with the Prudential Regulation Authority’s stress tests, which come into effect in January 2017."

In March, there were 29,200 buy-to-let properties sold. In August, there were just 6,500. In August 2015, the figure stood at 10,600.

New house purchases have also fallen since the start of 2016. In March this year, there were 99,200 new house purchases; in August this was down to 64,100 - approximately a third less than at the end of Q1 this year, according to the CML data.

The data also shows a swing to remortgaging activity. There were 47,400 loans for remortgaging in August 2016, up from 45,300 in March this year.

In the Summer Budget 2015, shortly after the General Election, the government announced that buy-to-let landlords would receive a lower rate of tax relief on mortgage payments - a flat rate of 20 per cent tax credit - under changes to the taxation of mortgage interest.

Landlords can no longer deduct the cost of their mortgage interest from their rental income, so tax will be applied to the rent received, rather than net rent - that which is left of the rent after the mortgage interest has been paid.

Then in the Autumn Statement 2015, the then chancellor George Osborne announced a 3 per cent stamp duty hike for buy-to-let landlords, whether they had two or 20 properties.

Henry Woodcock, principal mortgage consultant at Iress, said: "The huge spike in buy-to-let lending in March came in a rush to beat that 3 per cent stamp duty change, but there are still a lot of lenders who support this market, particularly specialist lenders."

"There have been so many hits on that part of the market, and more coming in next year. It had been a growth generator for the market over the past few years but with all the changes, I suspect it will be a flat line going into 2017."

CML analyst Mohammad Jamei said although there had been a slowdown in new house purchases, the overall picture was not gloomy, with the CML's estimate of gross mortgage lending for September is £20.5bn, up 2 per cent compared with the same period a year ago.