Orbis multi-asset manager Alec Cutler has flown in the face of received wisdom by going long the UK pound and short the US dollar.

The manager of the Orbis Global Balanced fund said sentiment towards the two major currencies meant they were no longer trading close to their underlying values.

The value of the pound relative to the dollar has fallen from $1.48 to almost $1.20 since the EU referendum last June, accelerating a downward trend that stretches back to mid-2014.

With the US Federal Reserve having raised interest rates on March 15 and the UK no closer to clarity over the terms of its departure from the EU, sterling touched a two-month low against the greenback last week.

Mr Cutler said: “Near-term commentary on sterling is negative, but on a purchasing power parity (PPP) basis it is materially cheap.

“We were underweight sterling into July last year and have been cranking it up since. The sentiment is very negative so there is an opportunity there.”

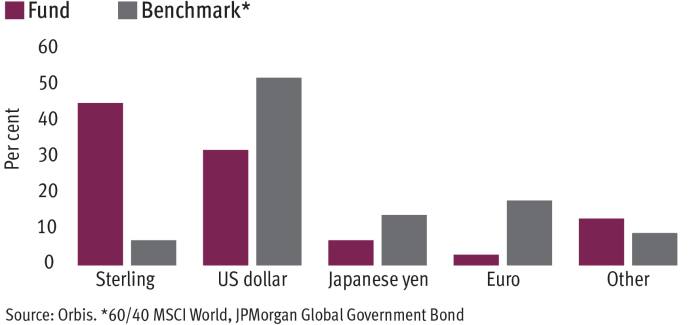

The exposure to sterling in the Global Balanced fund is 45 per cent, compared with its average position of 40 per cent. By contrast, the fund’s exposure to the dollar is 32 per cent.

Mr Cutler said he was not as convinced as most market commentators about the future strength of the US currency.

“The sentiment on the dollar is very high, but on a PPP basis it is expensive,” he said.

“Mirroring the sentiment around sterling, it seems like everyone thinks you are an idiot if you do not think the value of the dollar is going to go higher.”

While the value of sterling has been hit by the Brexit vote, the bullish sentiment towards the US dollar has been stoked by improving economic indicators and the prospect of multiple interest rate rises in 2017.

“Everyone thinks higher [interest] rates and economic activity drives currencies higher, but there is little evidence that is true. The reality is more complicated,” the manager said.

Mr Cutler also sounded a warning to managers still bullish about government bonds due to the asset-purchase programmes being enacted by central banks across the world.

The manager has the lowest possible exposure to bonds in his fund, at 15 per cent, and said many investors were underestimating the risks of holding government debt.

“Central banks are ripping off the savers of the world and that is unsustainable,” he said.

Mr Cutler’s contrarian instincts have served investors well so far. The Orbis Global Balanced fund has delivered 54 per cent since launch in January 2014, compared with the average return of 25 per cent by its peers in the IA Mixed Investments 40-85% Shares sector, the firm’s figures show.