When it comes to optimising dividends to shareholders, investment trusts enjoy a number of advantages over their open-ended peers.

Their closed-ended structure makes it easier for them to invest in high-yielding, but less liquid asset classes such as property and infrastructure. They can hold back up to 15 per cent of their portfolio income each year, so income during good years can help to supplement leaner years. Yields can also be enhanced with the judicious use of gearing.

Another income management mechanism is gaining traction. Under a revision to the 2006 Companies Act to bring UK-domiciled investment companies in line with offshore products, investment trusts are able to pay out realised profits as well as income as part of their distributions to shareholders.

The change to the Companies Act was introduced in April 2012 but it has only recently been attracting interest as a number of investment trusts have sought to use these powers to enhance their dividend yield.

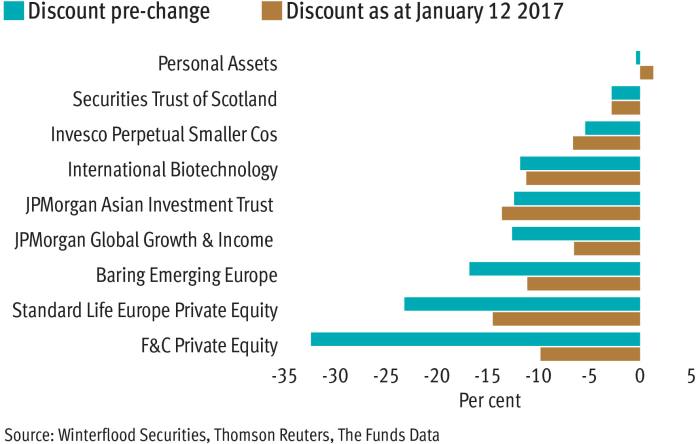

In 2015 and 2016, around 10 trusts introduced a capital distribution policy, according to data from Winterflood Securities, Thomson Reuters and The Funds Data. As the hunt for income in an ultra-low rate world remains strong, it is likely more trusts will follow suit.

There are two observations to make about this trend. First is the variety of trusts that are turning to capital distributions, with investment mandates ranging from global biotechnology to private equity to Asia and emerging markets.

The second is the distribution approach being taken, with around half of trusts establishing a policy to distribute a specific percentage of their net assets each year, typically 4 per cent. The appeal of offering a predictable – and attractive – income stream has meant some trusts have subsequently seen a marked narrowing in the discount to net asset value (NAV) at which their shares trade.

However, moving to a capital distribution policy has raised questions among shareholders, analysts and advisers. It may be an effective tool for boosting dividends and narrowing discounts, but what level of capital distribution is safe and sustainable? Are investment trusts in danger of eroding their future capital base in an effort to meet investor appetite for income today?

These are the types of questions that managers and the investment trust boards they work for have to address before asking shareholders to vote on a change in dividend policy.

In particular, exploring what might be a sustainable percentage of NAV to distribute each year, given the wide range of market conditions and returns a trust is likely to experience.

How the asset base of a trust is likely to respond to a particular withdrawal rate will depend both on investment factors, namely the level and dispersion of assumed market returns and manager alpha achieved, as well as specific structural factors such as a vehicle’s cost base and gearing policy.

It is also the case that a distribution policy can’t afford to be set in stone. The more frequently the board is able to reset the NAV withdrawal rate, the more resilient the asset base is likely to be against performance downturns. This enhanced resilience does, however, come at the expense of the predictability of future dividend levels.