Fairstone is looking to offer a retirement income to advisers who want to sell their business before stepping aside, in a move that puts it in competition with rival wealth firm St James's Place.

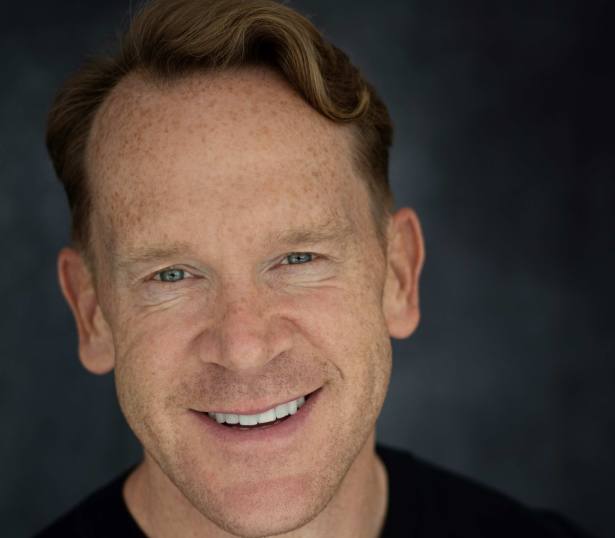

Chief executive Lee Hartley said the only other company he knew of which offered such an arrangement was SJP so he hoped to offer advisers choice.

The proposition is aimed at advisers who want to sell to consolidator Fairstone, work with the company for a brief period to migrate the business across and then retire.

Mr Harley said: “We will find out a high quality adviser to be your successor and we will pay you a small capital sum.

“We will give you 15 years of retirement income based on the revenue transferred in and any new revenue generated from that business.

“We are confident we will be able to put that into a highly tax efficient structure. This is a capital model rather than an income model.

“We want to do that because we want to widen the scope of our proposition to high quality advisers.”

Mr Hartley said the proposition could be particularly useful for advice businesses with only one lead adviser.

Since 2011 Fairstone has used its “downstream buyout model” – which sees the company take a stake in a firm before integrating it and buying it – to acquire 43 firms.

The company currently has 300 advisers and oversees £7bn of client assets with £4bn in funds under management.

Mr Hartley said the market Fairstone is looking to acquire in is so large his company could keep going for several years.

He said: “The addressable market for us is so big that if we take a 10-year view I cannot see us stopping or slowing down our acquisition programme in that period.”

Mr Hartley added that consolidators which buy firms before integrating them are likely to come into difficulty.

He said: “In 2011 we were buying businesses in the traditional way but through that experience we realised that all the win is in the integration.”

damian.fantato@ft.com