2. Why use options?

We buy out-of-the-money option payers in order to profit if credit spreads widen significantly from a market sell-off. This provides us with an effective hedge, with losses limited to the upfront cost of the option.

Some key benefits of this strategy include:

- Cost effective: when volatility is low options can provide a cost-effective way of hedging the portfolio. Typically, we budget 0.75% per annum for hedging cost.

- Convexity: as the market sells off further, our option hedges become more powerful, making them an effective hedge against significant market shocks such as in Q1 2020.

- Dynamic: flexibility to tailor the exposure to changing market dynamics.

We believe that this process of incorporating options into the Unconstrained Credit strategy is essential to outperforming in both bull and bear markets. Given the strong market rally through 2019, we had been increasing our hedge exposure during late 2019 and into Q1 2020 as we perceived there was a build-up of risk in the market which could result in a pull back.

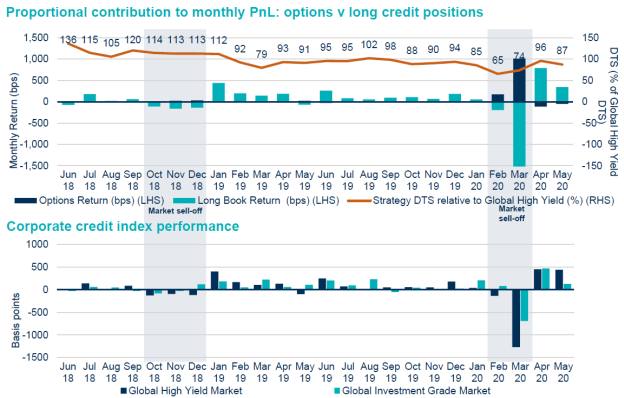

The reality was obviously much worse than anyone could have expected: in March 2020, markets sold off amid fears about the impact of the coronavirus on the global economy and a collapse in oil prices, the power of incorporating an options-based strategy was evident (see figure 1).

Figure 1. Proportional contribution to monthly PnL: options v long credit positions

Past performance is not a reliable indicator of future returns.

Source: Federated Hermes, as at 31 May 2020. High-yield market performance is that of the ICE BofA Merrill Lynch Global High Yield Constrained USD Hedged Index. Investment-grade market performance is that of the ICE BofA Merrill Lynch Global Broad Market Corporate USD Hedged Index.

3. How has the strategy performed during the coronavirus pandemic – and what role did options/hedges play?

In advance of the crisis our view had been that markets offered little value and, as a result, we entered the crisis with less risk than at any time since the launch of the strategy. From 24 February and into March 2020, credit markets sold off heavily as a dispute over oil production between Russia and Saudi Arabia rattled investors fearing a coronavirus-driven global recession. During this time, we actively adjusted the options overlay as the market moved downwards. This enabled us to take profit on positions and ensure that our Unconstrained Credit Strategy remained protected as much as possible should the market continue to sell off.

Having increased options positions going into the crisis, our portfolio management team actively adjusted the options overlay as the market moved downwards, taking profit on positions and ensuring the strategy remained protected as much as possible should the market continue to sell off. As risk increased at the end of February, our team quickly scaled up options exposure – reaching a peak of 147% of NAV in notional terms on 3 March.

As spreads widened and options moved into the money, we took profit and rolled positions into longer dated, bigger notional, further out of the money contracts. Figure 2 shows the increase in the average strike as the Crossover moved wider, demonstrating how a rapid widening of options positions has the potential to add considerable value. For further granularity, we also added smaller positions with the same maturity but different strikes.