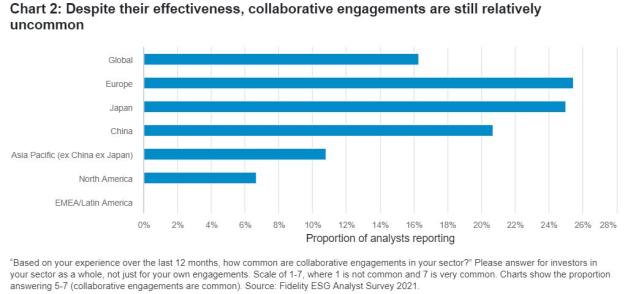

So why is collaborative engagement not more common? Historically, asset managers have been understandably wary of collaborating with each other for fear of revealing aspects of their investment approach to competitors or breaching compliance rules. Voting at the annual shareholder meetings of investee companies was typically handled by separate teams and was not under the direct oversight of portfolio managers and analysts.

However, the rise of ESG-focused investing has shifted attention towards growing the pie for all rather than simply trying to claim a larger share of a fixed pie. Analysts and managers now typically play a much more active role in voting decisions. Changing culture is hard though, especially as investors might have to work together for extended periods to push through ESG changes.

Recent examples of Fidelity’s collaborative engagements include Climate Action 100+, a five-year investor-led programme to promote clean energy use among key greenhouse gas emitters, and Building Sustainable Protein Supply Chains, a multi-year investor campaign focused on the food production and retail industries.

The best ways to drive change in E, S and G

The survey also found that investor engagement is the most important driver for change in governance practices, while regulation is slightly more effective when it comes to environmental and social practices.

Governance changes are generally quicker to implement and easier to monitor than ‘E’ and ‘S’ factors. Speed is important because the length of time that equity and bondholders are invested in a company might be shorter than the time needed to make environmental and social changes. For example, splitting the roles of chief executive and chairman is easier to enact and measure than, say, changing the technology used in manufacturing.

A consumer discretionary analyst who covers North America sums it up: “It’s not that engagement is ineffective per se for ‘E’ and ‘S’, but it takes longer to implement, is more nuanced and harder to measure, and takes more time to see the end result. Engagement remains important, but so does getting behind more regulated approaches for improvement.”

Nonetheless, investor engagement - whether collaborative or one-to-one - has an important role to play when it comes to propelling environmental and social change. Moreover, regulation and engagement are increasingly intertwined, because a company’s compliance with regulations is often the measuring stick that investors use to evaluate environmental and, to a lesser degree, social factors.

An analyst covering European automakers notes: “Because of the huge cost of developing electric vehicles, carmakers desperately need to convince their investors of their compliance strategies in order to gain access to capital at a lower cost. Similarly, the risk of brand perception of a car company which consistently fails to comply with regulation is another way these sources of influence work in tandem. Thus, whilst regulation may be the dominant driver, in my experience, it works in combination with investor and consumer pressure.”