Carbon pricing risk is a hidden threat to returns. Here’s why.

Some investors are taking on more risk than they realise by assuming it’s ‘business as usual’ for heavy carbon emitters. In a new normal where emitting carbon incurs higher financial penalties, investors need to consider carbon pricing risk – the gap between the current carbon price and the price they might have to pay in the future in a 1.5-2°C world.

When we discuss climate with investors, we find there are often misgivings. Yes, we’re told, ESG and climate are important – but it’s hard to understand exactly how important, and harder still to integrate these concerns into a portfolio.

These misgivings often reveal a sense of dichotomy. On one hand, mounting evidence compels us all to make a climate impact with our portfolios; on the other, our fiduciary duty instructs us to act in the best financial interests of the principal.

Recently, we have been looking for a way to bridge the gap between financial risk and climate risk, and to help investors connect the dots between the climate imperative and the pursuit of the optimal risk-adjusted return.

In our view, integrating carbon pricing risk is a compelling way of doing just that.

Carbon pricing risk: an increasingly necessary metric

Let’s examine what we call ‘carbon pricing risk’. To be more specific, we’re referring to what might happen to a portfolio when we account for the carbon price in our risk analysis.

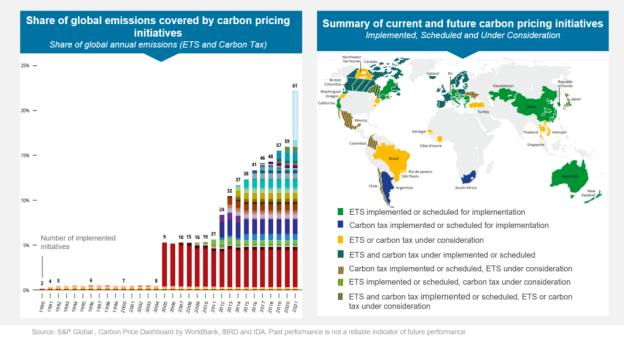

Carbon pricing is a network of global initiatives designed to curb emissions. In the first chart below, you can see that 23% of global emissions are now ‘covered’ by carbon pricing initiatives such as carbon taxes and emissions trading systems. The red bar shows EU allowances, and the big blue bar on the rightmost column is China.

This chart shows carbon pricing schemes are growing globally. The second chart shows how these schemes are spread around the world.

Source: S&P Global, as of December 2021.

Carbon pricing is proliferating, and even though it is still a nascent initiative and remains complex and fragmented, it will improve over time.

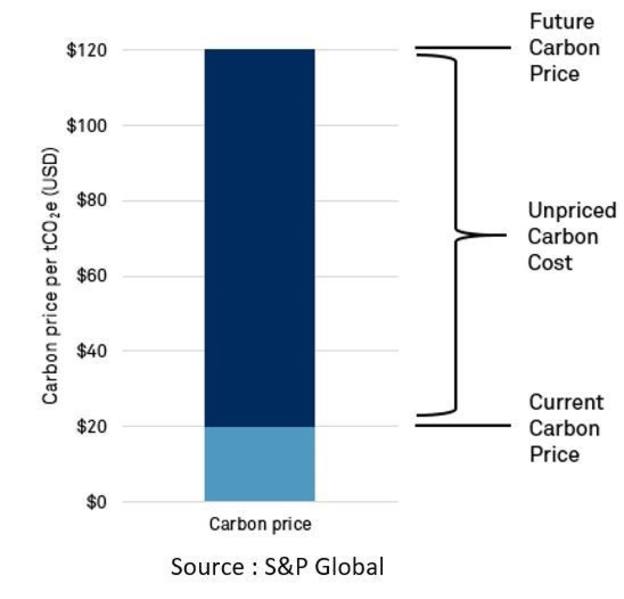

Unpriced carbon cost

When viewing the issue through a data scientist’s lens, a key metric to look at is unpriced carbon cost. This is the difference between what a company pays now in terms of carbon price and what it will pay in future. For this we use data from Trucost, part of S&P Global.

Trucost defines three carbon price scenarios in its methodology. In each of these forecasts, carbon prices rise dramatically over the coming years – meaning a growing gap between current and future price, and thus a greater unpriced carbon cost. Given carbon pricing schemes are one of the main tools in the policymaker’s kit, we are confident in our view that the carbon price will only continue to increase over time.