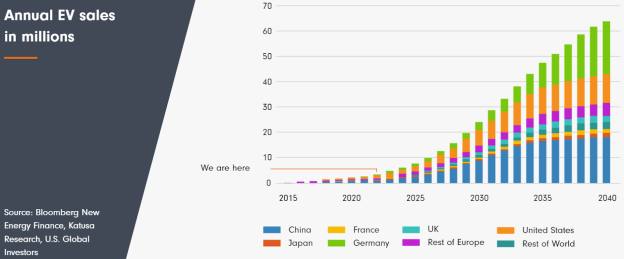

Amidst the volatility, uncertainty and fear that has driven stock markets in the last few months, it is easy to lose sight of the fact that most of the long-term global sustainability trends remain unchanged, and in many cases, strengthened or accelerated. Below are just three examples of long-term themes that we invest in for the fund, showing that we remain very early in the adoption of vital technologies like electric vehicles, offshore wind installations and innovative drug manufacturing methods.

These trends will continue regardless of short-term changes in interest rates or inflation, and in fact in some cases, are accelerated by recent moves: for example, the rise in energy prices is pushing governments to accelerate renewables investment4 and building efficiency measures5, and higher inflation is driving greater investment in automation and productivity tools - all key investment areas for the fund.

Jamie Harvey, portfolio manager, Fidelity Sustainable Global Equity Fund

Learn more about the Fidelity Sustainable Global Equity Fund

Sources & Footnotes:

- The Wall Street Journal Article, Russia War in Ukraine Exposes Weakness in ESG Fund. 1 April 2022.

- MIT Sloan Sustainability Initiative, The Aggregate Confusion Project.

- Financial Times Article, The fallacy of ESG investing. 23 October 2020.

- IEA, Oil Market Report - March 2022.

- Euractiv Article, EU urges building insulation push in bid to end reliance on Russian gas. 19 May 2022.

Important information

This information is for investment professionals only and should not be relied upon by private investors. The value of investments can go down as well as up and you may not get back the amount invested. Investors should note that the views expressed may no longer be current and may have already been acted upon. Reference to specific securities should not be interpreted as a recommendation to buy or sell these securities, but is included for the purposes of illustration only. Changes in currency exchange rates may affect the value of an investment in overseas markets. Investments in emerging markets can be more volatile than other more developed markets. The Fidelity Sustainable Global Equity Fund has the potential of having high volatility either due to its composition or portfolio management techniques. It can also use financial derivatives for investment purposes, which may focus on securities of companies which maintain strong environmental, social and governance (“ESG”) credentials may result in a return that at times compares unfavourably to similar products without such focus. No representation nor warranty is made with respect to the fairness, accuracy or completeness of such credentials. The status of a security’s ESG credentials can change over time. Issued by FIL Pensions Management, authorised and regulated by the Financial Conduct Authority and Financial Administration Services Limited, authorised and regulated by the Financial Conduct Authority. Fidelity International, the Fidelity International logo and F symbol are trademarks of FIL Limited. UKM1022/371106/SSO/NA