As the year comes to an end, we’re presented with an opportunity to both reflect on the past year and look forward to what 2023 might have in store.

Despite the consensus earlier this year being that the UK was returning to a “new normal” post Covid, with the conflict in Ukraine causing intense political uncertainty, inflation levels hitting record highs, not one, but two changes at number 10, a disastrous ‘mini-budget’, and a cost-of-living crisis affecting households, this year hasn’t borne any semblance to normality.

Markets have been turbulent, with only 10.6% of funds delivering positive performance in the year, to 31st October (FE fundinfo), and many of those funds and sectors that performed well during the pandemic having suffered since. The property sector has not been an exception, with REITs trading at unprecedented discounts, whilst many of the open-ended funds invested in direct property, are once again facing gating issues as their cash balances have been unable to meet investor redemptions.

Whilst the issues with open-ended direct property funds is one which has been highlighted on many occasions since the Brexit referendum in 2016, it’s the REIT market which we are particularly interested in at Gravis. It’s here that we see an opportunity, a chance to take advantage of current valuations of best-in-class companies in sub-sectors set to benefit from four mega trends: ageing population, generation rent, digitalisation and urbanisation.

The last few months have been noticeably irregular, with REITs trading at a -32.9% discount to Net Asset Value (NAV) as at 18th November1, compared to a -12.4% average discount to NAV over the last 10 years1. Both a bull case and bear case for UK REITs can be identified, however in Gravis’ view there is cause for optimism.

Before examining the bull case, we’re seeing three factors dragging REITs lower. The first of these is high inflation and high base rates, leading to increasing funding costs for real estate companies. The Bank of England is expecting inflation to remain above 10% in Q4 2022 and Q1 20232, whilst investment bank economists are forecasting that the Bank of England base rate is likely to peak at 4.25% in Q2 2023 (with an upper forecast of 5.0%)1. To be bearish on this, there would need to be a belief that rates will be higher than this forecast – without this, they would be in line with market expectations, and therefore already factored into pricing.

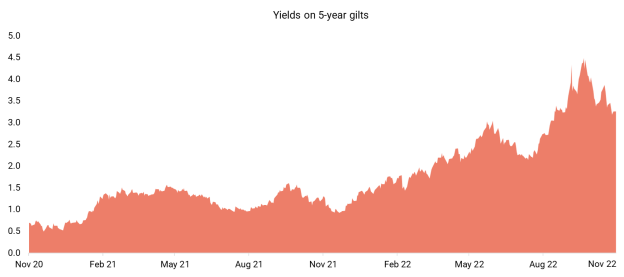

The second element considers yields. Sustained, high levels of inflation leads to high bond yields and rising property valuation yields. Yields on 5-year gilts recently spiked to greater than 4.0% (see fig. 1).

(Fig. 1 - data as at 18th November 2022, source: Gravis Advisory Research, Bloomberg)

To follow the bear case argument, you would need to believe in stagflation, high inflation with no economic growth, and the 5-year forward rates rising back above 4%. Instead, we’ve witnessed yields have come off from their highest levels most recently.