PARTNER CONTENT by WESLEYAN

This content was paid for and produced by WESLEYAN

It’s a well-worn piece of investment advice, but there’s no escaping the mantra that ‘time in the market beats timing the market’.

The UK market turbulence experienced in the past twelve months has been exceptional. From the waves of the Kwarteng emergency statement to the impact of the Russian war on Ukraine, there have been ‘once in a generation’ circumstances causing market movements.

But when clients see the balance on their investment accounts apparently in freefall, the fear they feel is very real.

Many will question whether is it time to cut their losses, or hold their nerve?

The temptation to move investments to what feels like a safer environment, like a savings account, can be overwhelming, particularly for older clients or those approaching retirement.

But, With Profits funds could be one way to reassure them and ensure they stay invested.

Learning from the past

While the current economic situation is unusual, experience still tells us that the fixed rate bond market recovery will happen.

But this will likely see slow progress, so many investors may prefer an alternative approach that takes some anxiety out of investing.

It is easy to understand the appeal of a multi-asset, smoothed fund that offers low volatility and a strong historic performance.

A Stocks and Shares ISA invested in a smoothed With Profits fund, means some of the fund’s returns are held back during times of strong performance and favourable market conditions and then ‘released’ as a cushion during periods of weaker market and fund performance.

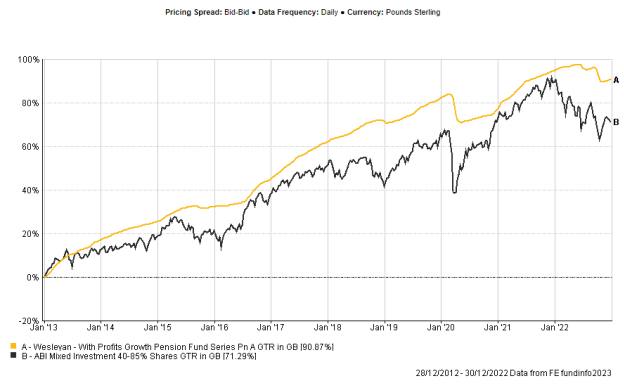

The formula to smooth out fluctuations in the asset value enables rapid response to large market movements. This avoids the need for sharp or unexpected corrections, which can be more commonplace elsewhere in the With Profits marketplace. The actively managed Wesleyan With Profits Growth Fund, has achieved a cumulative return of 90% over the last decade.

A safer structure

Wesleyan’s mutual status and financial strength means that, in addition to the returns generated by their investments team, investors’ returns can also be boosted through a share of the profits.

Part of this comes from the potential distribution of surplus capital – and investors in the With Profits Growth Fund typically receive a share of this.

“A smoothed With Profits Fund means clients can simultaneously benefit from reduced volatility, while also working towards real growth.”

So, we can see that, by their very structure, smoothed With Profits Funds tackle the day-to-day fluctuations in value challenge head-on and deliver consistent returns to help protect against short-term fluctuations in value.

They can hold a significant amount of higher-risk investments alongside lower-risk assets, from UK and international equities to property, cash, and other assets, which help to power long-term returns.

A smoothed With Profits Fund means clients can simultaneously benefit from reduced volatility, while also working towards real growth.

Rebalancing risk and reward

That’s reassuring, especially in periods of high-inflation, such as we’re seeing now, when cash kept in fixed-rate savings accounts loses its purchasing power over time.

And when we look back at other periods of high inflation, we see that investments were the best way of achieving real growth.

With inflation showing no signs of slowing in the coming months, and the market still showing signs of choppy waters, a smoothed With Profits fund held inside a Stocks and Shares ISA can help reduce risk while opening the door to real rewards.

It’s one way to help your clients make the most of the investment opportunity, whilst minimising worry.

Wesleyan provides access to its flagship With Profits Fund to the intermediary advice sector via the Novia platform. For more information, please visit: www.wesleyan.co.uk/intermediaries

Find out more

.png)