With a return to a former president, Brazil is set to go through a period of change. The world, and investors, are watching as President Lula must balance key social and economic policies alongside fiscal discipline. During a recent trip to the country, Polar Capital Emerging Market Stars Fund Manager Naomi Waistell saw for herself how Brazil is at an important crossroads. She explores the positive top-down environment that could encourage Brazil to evolve into the country many want to see it become.

Think of Brazil and you might conjure up images of carnival, Copacabana, picanha and football but away from the cities the greater part of Brazil lives simply, with a large proportion of Brazilians earning the minimum wage. The new president is Luiz Inacio Lula da Silva (Lula) and his marginal victory over the incumbent, Jair Bolsonaro, was secured by voters in the poorer regions.

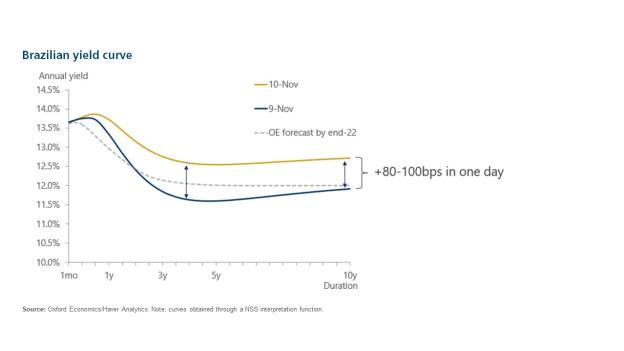

Following the election result on 2 October 2022, the equity market rallied slightly before selling off a few days later. Its government bond market sent a starker signal a few weeks later, with yields moving up to 100bps in a single day on 10 November following comments Lula made regarding social priorities and the appointment of a left-leaning economic team.

I visited Brazil a couple of weeks later, at the end of November, and this time in Brazil has left us as a team incrementally cautious – it is hard not to be against this backdrop, particularly with weak domestic economic activity and fiscal uncertainty. However, China has since reopened – historically Brazil is one of the markets best correlated with Chinese strength – the dollar has lost ground and the commodity cycle has started picking up again. A mild recession expected later this year should help cool inflation and, having been among the first to raise rates, Brazil should be among the first to cut again towards the end of 2023. However, any constructive outlook can only be based on a sound new economic plan from the new government.

The market, having gone through the initial election relief rally, rolled over into the fear stage of digesting this transition, then sunk a little deeper with the rebellion stage (characterised by the riots). As we finally get to the stage of action from policymakers, things have improved and there is potential going forward to reach a stage of hope.

Balancing the books

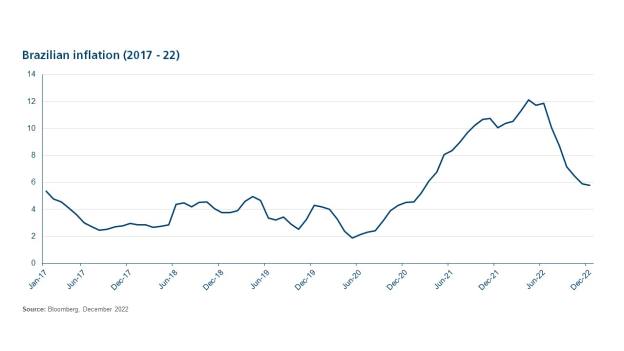

This year will be one of slower growth for the country, coming off the back of strong GDP growth in 2022 (2.9%1). Consensus forecasts are for c0.8%2 growth this year, mostly lowered due to higher-for-longer interest rates, fiscal slippage risks and tepid consumer demand. Wages have been falling, but labour markets have already started improving and consumers in aggregate have accumulated savings built up during the pandemic to draw from which could provide an unexpected source of growth. While inflation is down from the April 2022 peak of c12%3, it remains elevated at c6%4 and is not expected to correct quickly from there, according to the Deputy Head of the Brazil Central Bank with whom I met.

The new administration has been clear there will be more spending which may be positive for growth but redoubles concerns on debt and fiscal discipline. Delivering on this successfully, without losing control of the currency or inflation and taking all segments of the country with them, will not be easy.