PARTNER CONTENT by POLAR CAPITAL

This content was paid for and produced by POLAR CAPITAL

Think of Brazil and you might conjure up images of carnival, Copacabana, picanha and football but away from the cities the greater part of Brazil lives simply, with a large proportion of Brazilians earning the minimum wage. The new president is Luiz Inacio Lula da Silva (Lula) and his marginal victory over the incumbent, Jair Bolsonaro, was secured by voters in the poorer regions.

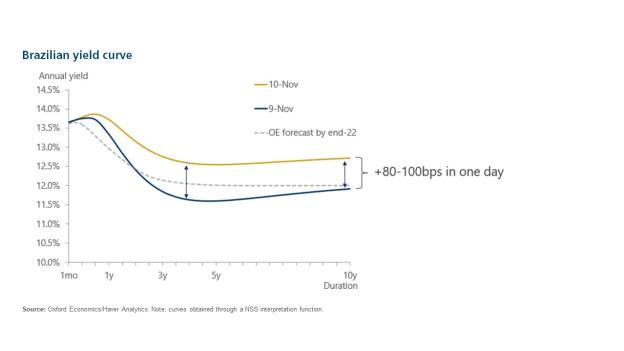

Following the election result on 2 October 2022, the equity market rallied slightly before selling off a few days later. Its government bond market sent a starker signal a few weeks later, with yields moving up to 100bps in a single day on 10 November following comments Lula made regarding social priorities and the appointment of a left-leaning economic team.

I visited Brazil a couple of weeks later, at the end of November, and this time in Brazil has left us as a team incrementally cautious – it is hard not to be against this backdrop, particularly with weak domestic economic activity and fiscal uncertainty. However, China has since reopened – historically Brazil is one of the markets best correlated with Chinese strength – the dollar has lost ground and the commodity cycle has started picking up again. A mild recession expected later this year should help cool inflation and, having been among the first to raise rates, Brazil should be among the first to cut again towards the end of 2023. However, any constructive outlook can only be based on a sound new economic plan from the new government.

The market, having gone through the initial election relief rally, rolled over into the fear stage of digesting this transition, then sunk a little deeper with the rebellion stage (characterised by the riots). As we finally get to the stage of action from policymakers, things have improved and there is potential going forward to reach a stage of hope.

Balancing the books

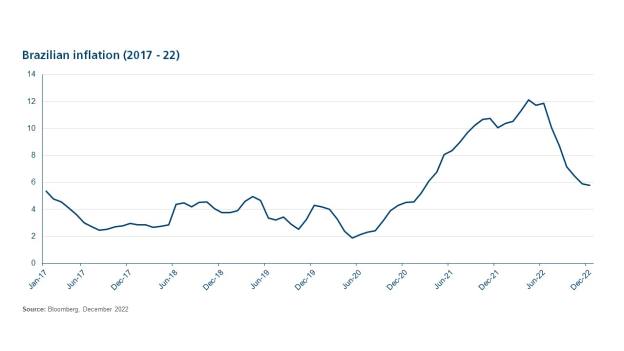

This year will be one of slower growth for the country, coming off the back of strong GDP growth in 2022 (2.9%1). Consensus forecasts are for c0.8%2 growth this year, mostly lowered due to higher-for-longer interest rates, fiscal slippage risks and tepid consumer demand. Wages have been falling, but labour markets have already started improving and consumers in aggregate have accumulated savings built up during the pandemic to draw from which could provide an unexpected source of growth. While inflation is down from the April 2022 peak of c12%3, it remains elevated at c6%4 and is not expected to correct quickly from there, according to the Deputy Head of the Brazil Central Bank with whom I met.

The new administration has been clear there will be more spending which may be positive for growth but redoubles concerns on debt and fiscal discipline. Delivering on this successfully, without losing control of the currency or inflation and taking all segments of the country with them, will not be easy.

Brazil remains relevant

Benefits of a huge internal market and being highly cost competitive in the production of a number of soft commodities are significant advantages and, due to the abundant natural resources and forward action, Brazil’s energy mix is also much greener than the majority of other countries. Additionally, the country is developing truly world-leading technologies. It remains an economy that commands worldwide importance.

Lula has long been a man with ambitions for himself and for his country to be seen on ever-bigger stages, to have a seat at every table. As the leader of Brazil, he wishes to be a global leader so we could see free trade agreements, conspicuous presidential visits and reciprocal arrangements. Lula has spoken openly since the election about wanting to make a contribution to the “construction of a peaceful world order based on dialogue, the strengthening of multilateralism and the collective construction of multipolarity”. It is hugely positive that foreign policy looks set to be much more open and active again now, which could improve the outlook for foreign direct investment and future growth.

Investing in Brazil

Brazil’s equity market is notoriously as volatile as its cities are vibrant. The Ibovespa Index is concentrated in a few large-cap names in the energy and banking sectors which dictate direction and are high beta to external factors such as commodity prices, China’s fortunes and movements in the dollar (negatively correlated). However, this tells nothing of some of the home-grown quality companies that can get lost under the index heavyweights. While right now the domestic story on Brazil is less than optimal, expectations have been extensively reset among many of the high quality, growth names we look at. Historically, since 2000 Brazilian equities have returned an average of 20%5 during easing cycles, with the materials sector most positively geared to the upside.

For now, in the Polar Capital Emerging Market Stars Fund we have a slight underweight to Brazil. We own three long-term businesses with fundamental attractions across the technology, healthcare and financials sectors and keep a watchlist of other quality-growth companies that stack up against our existing portfolio and under our investment process. We have exited any names that were not true leaders in their industries or where we saw any sign of financial vulnerability given the economic environment – these were the biggest takeaways from the time spent on the ground in Brazil meeting companies.

It was clear from these meetings that management teams’ investment appetite to spend is just that bit more cautious, costs are being watched more closely to preserve or grow margins and the heady days of growth at all costs are behind us in favour of balancing profit.

Top-down positives are already in place to support Brazil: a softer US dollar, China’s reopening and stronger iron ore and soya bean prices. If Lula can remedy the fiscal overhang, Brazil could really outperform. That is a very big ‘if’, and history does not smile on the chances of a socially minded administration turning around a very poor fiscal stance, though there are always investment opportunities along the way.

Like many, we are in wait-and-see mode. We would like to really buy Brazil, especially with many structural problems elsewhere across the emerging markets universe, but we need clarity, and we need a reason. We are increasingly positively minded that we are at the beginning of a new commodity upcycle, where the size of demand for certain, especially green, commodities will surprise everyone – so it could just be that Lula is about to do it again.

Naomi Waistell

Fund Manager, Polar Capital Emerging Market Stars Fund

Discover more about the Polar Capital Emerging Markets Fund

Footnotes

1. https://www.reuters.com/world/americas/brazils-economic-activity-rises

2. https://www.reuters.com/world/americas/brazils-economic-activity-rises

3. Bloomberg; December 2022

4. Bloomberg; December 2022

5. LatAm Equity Year Ahead: Stocks for 2023. Thu Dec 08 2022 (jpmorgan.com) (page 10)

Risks

- Capital is at risk and there is no guarantee the Fund will achieve its objective. Investors should make sure their attitude towards risk is aligned with the risk profile of the Fund.

- Past performance is not a reliable guide to future performance. The value of investments may go down as well as up and you might get back less than you originally invested.

- The value of a fund’s assets may be affected by uncertainties such as international political developments, market sentiment, economic conditions, changes in government policies, restrictions on foreign investment and currency repatriation, currency fluctuations and other developments in the laws and regulations of countries in which investment may be made. Please see the Fund’s Prospectus for details of all risks.

- If the currency of the share class is different from the local currency in the country in which you reside, the figures shown in this document may increase or decrease if converted into your local currency.

Important Information

This is a marketing communication and does not constitute a solicitation or offer to any person to buy or sell and related securities or financial instruments. Any opinions expressed may change. This document does not contain information material to the investment objectives or financial needs of the recipient. This document is not advice on legal, taxation or investment matters. Tax treatment depends on personal circumstances. Investors must rely on their own examination of the fund or seek advice. Investment may be restricted in other countries and as such, any individual who receives this document must make themselves aware of their respective jurisdiction and observe any restrictions.

A decision may be taken at any time to terminate the marketing of the Fund in any EEA Member State in which it is currently marketed. Shareholders in the affected EEA Member State will be given notification of any decision and provided the opportunity to redeem their interests in the Fund, free of any charges or deductions, for at least 30 working days from the date of the notification.

Further information about fund characteristics and any associated risks can be found in the Fund’s Key Investor Information Document (“KIID”), the Prospectus, the Articles of Association and the annual and semi-annual reports. Please refer to these documents before making any final investment decisions. Investment in the Fund concerns shares of the Fund and not in the underlying investments of the Fund. These documents are available free of charge at Polar Capital Funds PLC, Georges Court, 54-62 Townsend Street, Dublin 2, via email by contacting Investor-relations@polarcapitalfunds.com or at www.polarcapital.co.uk. The KIID is available in Danish, Dutch, English, French, German, Italian, Spanish and Swedish; the Prospectus is available in English. ESG and sustainability characteristics are further detailed on the fund’s prospectus and websites (https://www.polarcapital.co.uk/gb/professional/ESG-and-Sustainability/Responsible-Investing/ and https://www.polarcapital.co.uk/gb/professional/Our-Funds/ Emerging-Market-Stars/#/ESG).

A summary of investor rights associated with investment in the Fund is available online at the above website, or by contacting the above email address. In the United Kingdom and Switzerland, this document is provided and approved by Polar Capital LLP which is authorised and regulated by the Financial Conduct Authority (“FCA”). Registered address: 16 Palace Street, London SW1E 5JD. Polar Capital LLP is a registered investment adviser with the United States’ Securities and Exchange Commission (“SEC”). Polar Capital LLP is the investment manager and promoter of Polar Capital Funds PLC – an open-ended investment company with variable capital and with segregated liability between its sub-funds – incorporated in Ireland, authorised by the Central Bank of Ireland and recognised by the FCA. MJ Hudson Fund Management (Ireland) Limited. acts as management company and is regulated by the Central Bank of Ireland. Registered Address: Ferry House, 48-53 Mount Street Lower, Dublin 2, Ireland.

Benchmark

The Fund is actively managed and uses the MSCI Emerging Market Net Total Return Index as a performance target and to calculate the performance fee. The benchmark has been chosen as it is generally considered to be representative of the investment universe in which the Fund invests. The performance of the Fund is likely to differ from the performance of the benchmark as the holdings, weightings and asset allocation will be different. Investors should carefully consider these differences when making comparisons. Further information about the benchmark can be found www.msci.com. The benchmark is provided by an administrator on the European Securities and Markets Authority (ESMA) register of benchmarks which includes details of all authorised, registered, recognised and endorsed EU and third country benchmark administrators together with their national competent authorities.

Third-party Data: Some information contained herein has been obtained from third party sources and has not been independently verified by Polar Capital. Neither Polar Capital nor any other party involved in or related to compiling, computing or creating the data makes any express or implied warranties or representations with respect to such data (or the results to be obtained by the use thereof), and all such parties hereby expressly disclaim all warranties of originality, accuracy, completeness, merchantability or fitness for a particular purpose with respect to any data contained herein.

Country Specific Disclaimers Please be aware that not every share class of every fund is available in all jurisdictions. When considering an investment into the Fund, you should make yourself aware of the relevant financial, legal and tax implications. Neither Polar Capital LLP nor Polar Capital Funds plc shall be liable for, and accept no liability for, the use or misuse of this document.

Find out more