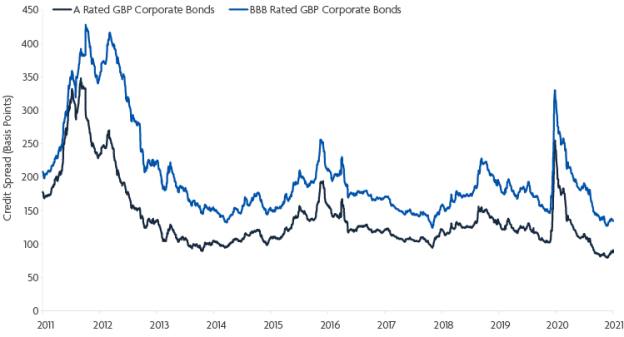

Source: Bloomberg, as at 31/3/21

Credit spreads are at historically low levels, but history shows that their tendency to revert rapidly to the mean should not be underestimated.

While equity investors may continue to anticipate strengthening performance into a reflationary growth environment, we believe credit investors would be wise to display greater caution. We reiterate that the upside in bonds is at all times capped by their defined and finite cash flows.

When market sentiment has led to credit spreads already anticipating a huge amount of good news, as is the case today, then incremental positive updates around vaccination and economic re-opening may be incapable of delivering future outperformance. It has been informative to us that sterling investment-grade corporate bond spreads have moved very little year to date despite increasingly bullish economic news and ongoing fiscal and monetary stimulus. This may signal the start of broader market exhaustion and/or unease with prevailing bond valuations.

In essence, there is a strong argument to be made that the so-called “beta trade” is complete in sterling investment-grade corporate bonds. If this thesis is accurate, then it is the more cautious investors who will be best placed both to cushion themselves against capital losses if sentiment should turn and spreads should widen, and indeed to capitalise on potentially attractive re-entry points that could materialise thereafter. Rotating into more defensive bonds now and reducing exposure to sectors and/or issuers where the current bull market has led to risk being mis-priced provides the platform to re-engage when valuations are more attractive. It is, we would suggest, a textbook example to support the arguments in favour of taking an active, pragmatic and risk-aware approach to the asset class.

How low can spreads go?

Credit spreads are currently at historically low levels, reflecting the very low level of additional interest that corporate bond issuers must pay to bondholders relative to the rates paid by the UK government on Gilts, despite the key differences in the risks to the holders. Our view is that credit spreads at these levels can only be justified if investors believe the world has entered a fundamentally new paradigm of global economic growth and fiscal/monetary accommodation.

In our opinion, new paradigm arguments are potentially dangerous and only surface at the peak of bull markets, and we believe that bond investors would be wise to look beyond this rose-tinted view of the world. In investment-grade credit, the new paradigm theory seems to combine two drivers which, to us, are mutually exclusive: (i) that the world is moving into a period of robust economic growth (“the roaring 20s”), and that (ii) central banks and governments in this period of robust growth will continue to provide unbridled liquidity and fiscal support to markets. With covid-19 still ongoing, with concerns around global asset bubbles, with increasing focus on inflation risks, and with economic growth rates picking up as the world emerges from lockdown, we believe that risks to current complacency are high. Valuation is a poor short-term timing tool in markets, but history teaches us that from current valuations prospective future excess returns in credit will be poor.