Welcome to Asset Allocator, FT Specialist's newsletter for wealth managers, fund selectors and DFMs. We know you're bombarded with information, so each day we'll be sifting through the mass to bring you what you need to know, backed up by exclusive data and research.

Forwarded this email? Sign up here.

Daring to beat bond benchmarks

At the start of the month we examined the extent to which passives are now supplanting their active equity rivals in DFMs' affections. The answer was inconclusive: trackers and ETFs have a small but significant foothold in most equity sectors, and are clearly taking up more space than they once were. But there's still a long way to go.

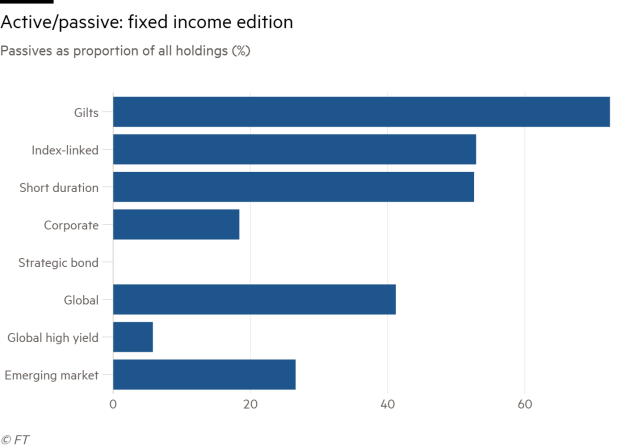

When it comes to bonds, you'd expect a slightly different state of affairs. With the returns on offer considerably lower, the pressure to cut costs is greater. That should play right into the hands of passives - and, as you can see from the chart below, our database largely bears this theory out.

Whereas passives accounted for more than 30 per cent of all DFM fund selections in just one equity asset class (the US), they do so in four of the eight bond sectors. The major exception is strategic bond funds, which remain completely free from passive competition.

When it comes to gilts, by contrast selectors have almost washed their hands of active management entirely: 70 per cent of picks are passive, and there's really only one active fund - Allianz Gilt Yield - holding back the tide.

It's a little different for global government bond funds - given the greater opportunity set available, some wealth managers are clearly more content to let active managers pick and choose.

That sentiment is magnified in the high-yield space, where just 6 per cent of selections are passive - a wise move given the worries surrounding the sector. And while the conventional active corporate bond fund may look like it's ripe for replacement by a tracker, worries about overly leveraged investment-grade credits mean its low ranking here makes sense.

We should reiterate the caveat that the chart doesn't show how much of a given model portfolio is in passives, or actives - just how many of the underlying fund selections. Either way, there's a case that trackers and ETFs are now the dominant players across fixed income as a whole.

Golden days are over

Safe havens are only useful if they work. And gold, for one, hasn't always traded as expected in recent times. A trade war between the world’s biggest economies has done little for the price, and while October's sell-off brought a brief fillip (and, in the UK, inflows for some gold funds), the precious metal lost its shine again in November.

The problem for bullion is that it just can't fight the Fed - rising rates and a stronger dollar are making things tough, irrespective of what else is going on.

That's weighing on minds. 7IM, which built up its biggest gold position in summer 2017 amid a “sea of negatives” for markets, has dropped the metal for other commodities. Tilney has also backed away from gold, noting in June that it had halved this exposure in favour of short-dated US Tips. Chief investment strategist Ben Seager-Scott says that while gold had “effectively substituted for distorted fixed income markets”, the latter wouldn't remain in that condition forever.

Even if dollar strength does subside again, there's reason to think headwinds will persist for bullion. Because the metal offers no yield, monetary tightening across developed economies increases the opportunity cost of holding it. And as Tilney and 7IM’s moves suggest, asset allocators believe they found solid protection elsewhere against inflationary shocks and other risks.

Here's Matthew Yeates of 7IM:

In historical periods such as 1994, characterised by rising inflation and weakness in both bond and equity markets, commodities were among one of the only asset classes that performed well. Even if we are not expecting raging inflation any time soon, we should be prepared for inflation shocks and taper tantrum-type events that can hurt both equities and bonds.

Holding on

The old adage that investors should simply buy the market dip has run into criticism over recent weeks, with good reason. As we have discussed, there are worrying signs that indices have become less reliable at bouncing back from lows than they once were, suggesting investors should rethink their old strategies.

Markets appeared relatively calm this morning, but we've seen one notable move that reiterates the risks of buying on weakness - in the short term at least.

Long-term Centrica investors could be forgiven a sense of de ja vu. The stock, which suffered its worst one day loss a year ago, has continued to look vulnerable. This morning shares were down by up to 8 per cent following news that the British Gas owner was still struggling to retain customers.

Those with exposure will have to ask whether this particular dip is worth buying, though some with decent positions will be pleased by reassuring noises on the stock's dividend.

The Schroder Income team had a 4.6 per cent stake at the end of October, while Ben Whitmore's Jupiter Income Trust was exposed to the tune of 3.1 per cent.

It's not just the income crowd feeling the pain this morning. Majedie's UK Focus fund had a 5.6 per cent position at the end of last month.