Wealth managers notch up an unwanted record; Fund selectors face another gating test

Welcome to Asset Allocator, FT Specialist's newsletter for wealth managers, fund selectors and DFMs. We know you're bombarded with information, so each day we'll be sifting through the mass to bring you what you need to know, backed up by exclusive data and research.

Forwarded this email? Sign up here.

Glass half empty

An unwanted record was confirmed yesterday: UK investors have now notched up four consecutive months of retail fund outflows. And it’s DFMs who are doing much of the damage.

Figures from the Investment Association show £859m was withdrawn from open-ended funds in January. That’s not quite as severe as the fourth quarter’s average monthly redemption of £2bn, but it hardly indicates confidence in the early-2019 market rebound.

Dig out some older data and it’s apparent that this run of outflows is now even worse than that seen in the early months of the financial crisis. It supersedes the three months of redemptions recorded at the turn of 2008 - although the data was calculated slightly differently back then.

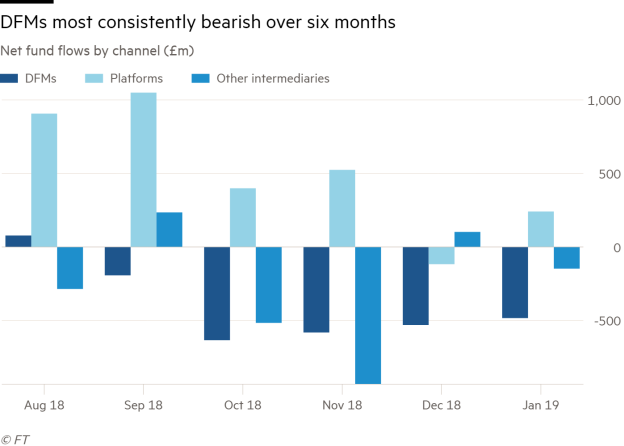

What’s more, discretionary fund managers are leading the way. DFMs have now pulled money from funds for the past five months, and there wasn’t much sign of the run-rate easing in January.

Again, this is the worst figure on record. The previous peak of nervousness was the three opening months of 2016 in advance of the Brexit referendum (discretionary-specific data only extends as far back as 2012).

This time, one mitigating factor is that wealth managers can no longer fall back on a structural tailwind of advisers outsourcing their investment business. It’s much easier to keep investing money when there are large numbers of assets coming through the door - and vice versa.

As the chart shows, on-platform business hasn’t been quite as cautious, though the bulk of these assets still sit with advisers and direct investors using D2C providers rather than DFM model portfolios. It’s discretionaries who look the least convinced by the current market rally.

The question now is what kind of convincing they will need. The answer may not be that pleasant: it’s one of those old investment contradictions that more pain might be needed before confidence can return.

An absolute struggle

The renewed struggles of open-ended property funds have left many wealth managers expecting suspensions to arrive sooner rather than later. But as is so often is the case, the bigger crisis was taking place elsewhere: it’s another absolute return fund, rather than a property portfolio, that’s gated investors this week.

The City Financial Absolute Equity fund has long been known for its volatility; most recently we highlighted its significant levels of gross exposure back in December. Lately those price moves have all been in one direction: the fund lost 19 per cent in 2018.

Still, redemptions were minor in the three months to the end of January, according to data provider estimates - even in the context of the fund’s relatively small £180m asset base.

So it’s clear, if there were any doubt, the news that City Financial itself is facing a bleak future has been the catalyst for suspension. And DFMs may have again had a role to play, just as they did in the property fund saga of 2016.

As of the turn of the year, a couple of discretionaries did still have exposure to the strategy within their model portfolios, according to our MPS tracker. These positions weren’t material, and it seems likely that wealth managers’ first-mover advantage came into play again in recent days. Given the size of City Financial, some other investors may not have even seen the reports of its struggles.

DFMs can’t be held responsible for the suspension, of course - and a crystallised loss is probably preferable to an uncertain future in this case. But this might be more evidence of the outsized power they now wield in the retail investment world.

Extend and pretend

The theme of the next couple of weeks might be the implicit becoming explicit. The two sets of negotiations currently in the back of investors’ minds - US-China trade negotiations and Brexit - are approaching their end of March crunch points.

By which we mean they were approaching until the US confirmed its intentions to kick the can. The US ambassador to China has confirmed a mooted March 27/28 Trump-Xi summit has been pushed back to an unspecified point in the future.

Those dates will be ringing a few bells domestically, too: they're scheduled to be the last days in which the UK remains a member of the EU. But March 29 may no longer be the historic date that many had expected. Reports that Theresa May will seek to extend the departure process herself may prove wide of the mark, but Parliament looks likely to do so next week.

That is, of course, if there isn’t a delay to the attempts to delay the exit date. Either way, all signs point to a further wait for allocators.