DFMs face up to the latest multi-asset threat; US allocations demand a rethink

Welcome to Asset Allocator, FT Specialist's newsletter for wealth managers, fund selectors and DFMs.

Forwarded this email? Sign up here.

New faces

Wealth managers are no stranger to the need for new products to drive growth. But given the sheer volume of new funds coming out of the woodwork in recent years, most could be forgiven a sense of launch fatigue.

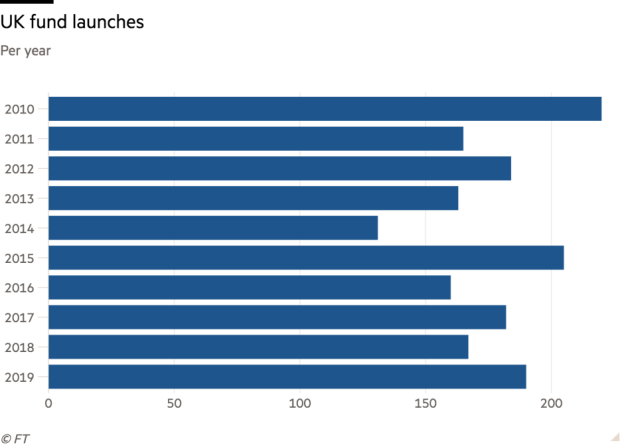

Last year we noted that 2018's tumultuous end had consigned some fund launches to the backburner, but stronger market conditions have put paid to that. As the chart below shows, UK fund launches were back in force last year.

The data, provided by Lipper at Refinitiv, might dash hopes that rising costs, a preference for investment trust structures when it comes to niche asset classes and even the Woodford affair might dent providers' enthusiasm for open-ended product launches. But given that DFMs have been on the lookout for funds in once derided areas such as European value and commodities, it's worth seeing just what kind of launches are getting the green light.

New funds, such as Rob Burnett's latest venture, are plugging other gaps, with a smattering of products across the usual asset classes. But there's mixed news, too: a good chunk of the new entrants are accounted for by asset managers and even wealth firms extending or launching unitised multi-asset ranges. It's another reason DFMs will want time to focus on running portfolios rather than being swamped with new offerings.

Unleashed

As far as investment sentiment goes, “bullish but not euphoric” is a long way from how many investors felt even six months ago. But global fund manager data suggests the high spirits 2019 ended on are not done just yet.

Bank of America Merrill Lynch research points to more of the optimism we witnessed in Q4. Fund manager cash levels have stayed at the lowest level since March 2013 for a third consecutive month, while global equity allocations rose to a 17-month high on the back of greater expectations of growth and inflation. Commodity weightings reached their highest level since March 2012 and EM, one of 2019’s big disappointments, has become the top equity overweight.

One explanation is the retreat of various concerns that spooked investors in 2019. Recession fears have faded and global corporate profit expectations are up. And after last year’s inversion, the US yield curve is broadly expected to steepen in the next 12 months.

Other consensus views are driving plenty of these trades. In a reaffirmation of a view commonly hold among analysts, the survey points to the US dollar being seen as at its second most overvalued point since 2002.

But if EM and other strategies are in vogue as a dollar weakness play, not every asset has captured the limelight. The research notes that there is still “zero love” for oil stocks, even as broader commodities gain in popularity.

However, with the US and China making recent trade progress, the survey also points to a fresh bogeyman for markets. The trade war is out as the biggest perceived tail risk, only to be replaced by the 2020 US election outcome.

Oh dear

It didn’t take long for the regulator’s first intervention of the year. In a “Dear CEO” letter to adviser firms, the FCA has set out a tougher approach when it comes to some of its key concerns. Among these are cases where consumers receive unsuitable advice for their needs and objectives or pay too much in fees or charges.

Two years on from the advent of Mifid II, the pressure on advisers could again result in mixed fortunes for wealth firms. Cost and suitability concerns may well drive some intermediaries away from using discretionary portfolios – while others see outsourcing as an easier way to handle a growing regulatory burden. It’s one area where discretionaries will need to haggle for both new, and existing business.

Also notable is the FCA’s continued scrutiny of DB transfer work, and whether this passes muster. With intermediaries under even more pressure to get things right, what was once a healthy source of asset flows looks more likely to dry up.