DFMs' top picks to overcome global equity ambivalence; Selectors get ready for stalwarts' exit

Welcome to Asset Allocator, FT Specialist's newsletter for wealth managers, fund selectors and DFMs.

Forwarded this email? Sign up here.

World leader

Historically speaking, wealth managers’ relationship with global equity funds has tended towards ambivalence. With one obvious exception, these strategies aren’t seen as a necessary part of most portfolios.

That said, there’s still a place for such funds on buy-lists – they remain more popular than sector-specific strategies, even at a time when tech and healthcare are beloved by many an investor. And global income funds are particularly important for DFM strategies tasked with producing a reliable yield for their investors.

But as we reported back in June, discretionaries have been fighting more than one battle on this front. Payouts have been cut, and their go-to picks in this space have fallen from favour.

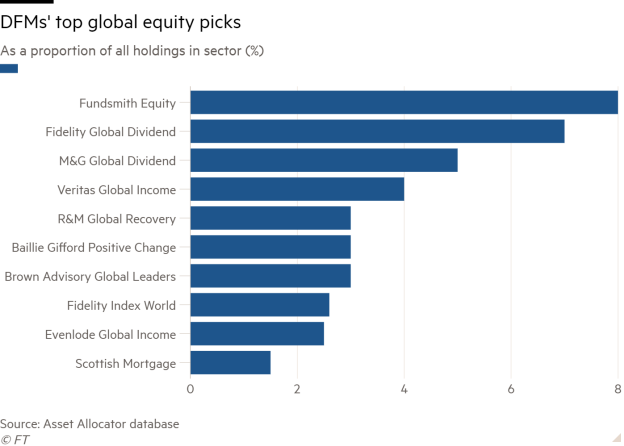

That means the chart below looks rather different to how it once did. Our fund selection database indicates the beneficiaries of the money leaving Artemis and BNY Mellon Global Income have included Fidelity, Veritas and M&G.

On the growth side of things, there remains just one standout. Fundsmith Equity is more than twice as likely to be owned as any other global growth strategy, despite the ESG push having bolstered the credentials of funds like Baillie Gifford Positive Change.

Selectors have had ample chance to look again at buy-lists this year, and many thoughts are turning to profit taking. Yet Terry Smith’s strategy now features in more firms’ models than it did at the start of the year. It may be more than £20bn in size, but there’s no sign yet that DFMs are growing more cautious on the UK’s single biggest strategy.

Core holding?

The forthcoming retirement of Stephen Harker and Neil Edwards from their Man GLG Japan CoreAlpha strategy, announced last week, will bring the curtain down on the careers of two of the most respected equity investors in fund selectors' eyes.

As is increasingly the case these days, succession planning has been in place for some time now: Jeff Atherton, who will take over as lead manager next year, is far from unknown to DFMs.

But there are reasons to think the changes might prompt a reconsideration from some – simply because the fund has split opinion for a long time now.

This isn’t so much a reflection on the managers as it is on Japan itself. Fund buyer sentiment on the country tends to oscillate quickly, and when allocations form a relatively small part of the typical portfolio, they’re that much easier to change.

At the same time, CoreAlpha’s value approach means it will often form a part of selectors’ debates about whether now's the time to dial down growth exposure.

What that means are situations where one DFM buys in at the same time as another sells out – still a surprisingly rare phenomenon as far as fund selection goes. This year, the fund’s retained its place as one of the most actively traded (if that is the right word) strategies in our fund selection database. It’s unlikely that a manager move, however carefully planned, will do anything to change that state of affairs.

Private plans

Fund managers and fund buyers’ growing interest in unquoted equity investments has attracted plenty of interest – and the odd unmitigated disaster – in recent times. But less has been said about private credit. Typically an institutional offering, the FT notes a growing number of providers have been establishing themselves in the space over the past 18 months.

While wealth managers who’re comfortable with closed-ended strategies have dipped their toe in strategies that dabble in this part of the investment universe, they remain very much a minority. Established providers haven’t yet sprung up in Europe or the UK to the same degree they appear to be doing in the US. And buyers will be particularly conscious about the question of liquidity. But trends like these do tend to make their way to the wealth market eventually: it may not be a question of if, but when.