Article 5 / 5

Guide to the auto-enrolment reviewThree years on, is workplace pension engagement working?

Behavioural psychology has worked well so far for auto-enrolment.

According to the 134-page Maintaining the Momentum auto-enrolment review, published recently by the Department for Work and Pensions, by relying on people's lack of interest in engaging with their finances enough to make changes - the so-called inertia - auto-enrolment has been a success.

The report said even with the various changes to the pensions landscape over the past decade - such as the continued push towards defined contribution schemes, changes to pension taxation and, of course, the pensions freedom regime in 2015 - there has been no change to the "behavioural analysis" underpinning auto-enrolment.

Moreover, any positive incentives created by the government to promote higher levels of saving overall have not had the desired effect: unless people are given more than a nudge, they just don't tend to fend for themselves financially.

The review said: "In adopting auto-enrolment, the government recognised that 'informed choice' interventions had not changed people's pension saving behaviour, and that an intention to save did not usually translate into actual savings."

Auto-enrolment, therefore, has worked so far where other savings incentives and education has not.

"The Pensions Commission concluded that pension saving behaviour cannot be driven through change to attitude, knowledge and intention alone but also requires structural factors, such as the presence of defaults.

"Crucially, any engagement has to recognise individuals have many competing priorities and demands on their time, and it is important to understand the reality of individuals' lives in order to understand how, and when, to try to get them to engage with pension saving."

This has been brought home recently in 2016, when life and pension provider Aviva carried out research among 2,000 UK adults.

The findings were alarming. In answer to the question - what would you rather do on a rainy afternoon - the following answers were given:

- 31.5 per cent of Brits would vacuum.

- 23.9 per cent would change their bed-sheets.

- Only 22.1 per cent would review their finances.

- Of the under-45s, all would rather clean their bathroom than clean up their finances.

(Source: Aviva 2016)

Three-year review

Many of the UK's largest firms have commenced their three-year review, which necessitates engaging with staff and re-enrolling them into the pension scheme.

So far, those employers who have carried out the review have not reported significant numbers of people opting out after the three-year period.

Angie Kirkwood, senior policy manager for Scottish Widows, comments: "Some schemes are lower and some are higher, but across the board we are finding the 8 per cent to 9 per cent opt-out rates apply."

Chris Daems, director of Cervello Financial Planning, has also found the same low level of opt-outs. "Our experience is that opt-out rates after three-year reviews remain low, with some individuals deciding to stay in this time round, even if they opted out previously.

"This isn't down to increased engagement, however, but down to the nudges built into the auto-enrolment model."

Adrian Boulding, head of retirement strategy for Dunstan Thomas, believes the three-year review might be too early a timescale to really assess whether people are indeed staying in this time round.

He explains: "The latest data from The Pensions Regulator shows re-enrolment has now swept more than half a million people back into a scheme they had previously opted out of.

"It's too early to tell whether this is effective, as it may take more than one three-year re-enrolment cycle for them to get the message that saving in a workplace pension is the new normal."

Moreover, there are cessation rates to consider, too, says Kate Smith, head of pensions at Aegon.

"Opt-out rates don't tell the full story," she opines. "Cessation rates, where employees pay pension contributions then leave their scheme are almost double the 9 per cent opt-out rate, at 16 per cent - peaking at one to three months after being auto-enrolled.

"Too many people are building up micro-pension pots," she warns.

Are current employer communications working?

If people are seemingly staying in this time round, is it because they understand more thanks to improved communications and engagement strategies, or simply haven't had time to think about opting out?

"It is hard to monitor, on a policy whose success is founded on inertia, how the current engagement strategies are working," says Ms Kirkwood.

"We've employed a lot of targeted messages around the value of pension saving, and will be monitoring any changes in opt-out rates as step-ups are introduced."

She believes the introduction of the pensions dashboard - expected in 2019 - will help greatly, as individuals will be able to see their total retirement savings.

Mr Daems thinks that more needs to be done with engagement especially as the auto-escalation kicks in. He says: "We may need to look at engagement in more depth as minimum contributions increase over the next few years, as this may have more of an impact than the three-year review."

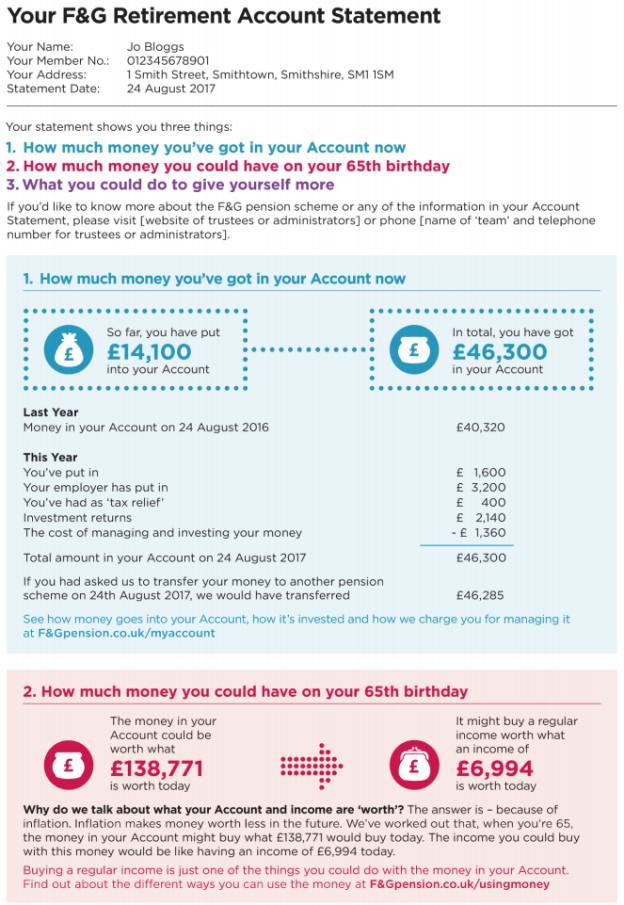

One of the key ways to improve engagement is through the annual benefit statement.

Yet according to the Maintaining the Momentum review, this is a missed opportunity, because too often these are complicated, lengthy documents that do not explain to the recipient how much they have, how much they need to save and how their money is performing.

Over the past few months, the DWP has discussed prototype statements with a "wide range of stakeholders" and tested informally, to create a proposed simplified pensions statement.

This statement, which can be found in Annex 5 of the review, is compliant with all the current pensions legislation and has, according to the DWP, been "very well received and gained positive feedback".

According to Lee Hollingworth, head of defined contribution consulting for Hymans Robertson, the proposed simplified pensions statement will go a long way to helping communications improve across the board - but could go even further.

"There is a strong desire by both the industry and government to have clearer communication and increase engagement with employees about auto-enrolment and their long-term saving," he says.

"The examples proposed are a significant step forward, but they could and should go further. Some context is needed to make saving tangible to the individual, which is where a retirement income target can really help - setting a clear goal and providing clarity on the likelihood of achieving this goal."

Communicating the contribution rise

One of the most important aspects to consider over the next couple of years is keeping employees engaged and informed as their contributions rise to 8 per cent - and possibly beyond that level.

Without proper communication, there is a danger that the existing rules on auto-enrolment escalation will eventually force employees to choose between receiving a minimum 8 per cent total contribution in their pension or opting out.

This is the view of Tom Selby, senior analyst for AJ Bell, who comments: "The government, employers and wider pensions industry will soon have to face up to the crucial question of how to get auto-enrolment contributions up to a level which will provide a decent retirement income.

"As policymakers consider options for going beyond 8 per cent, the ‘all or nothing’ nature of opt-outs should be revisited.

"The last thing the UK needs is a hike in minimum contributions to, say, 12 per cent of earnings causing droves of savers to quit pensions altogether."

He thinks one way to reduce opt-outs would be to provide an 'opt-down' process for any employees who feel they could not afford any further increases beyond the 8 per cent.

Mr Selby explains: "Anyone who has either opted out or opted down would then periodically be re-enrolled to the higher minimum level every three years as per the current system, with the option of opting out or opting down each time.

"By doing this, the government could potentially increase pensions adequacy without increasing opt out rates and casting huge numbers of savers into the retirement wilderness."

But such measures will need better thought, especially around communication.

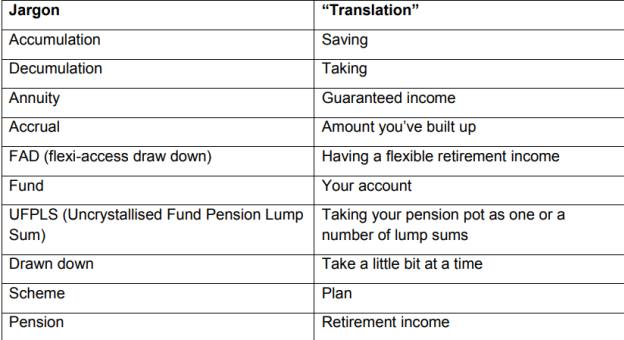

Jargon-busting

One of the biggest barriers to engagement and understanding is that persistent issue of jargon.

According to the review, trade union Usdaw commented that too much written communication had a prevalent and persistent use of "unnatural, complicated and nonsensical words that are used across the industry".

They said this was a "critical barrier" to encouraging engagement. And the words are not necessarily words or phrases, such as 'Uncrystallised funds pension lump sum' or 'glidepath' or 'superannuation', which might jump out to those working in the industry as possible mind-benders.

According to a workshop carried out by the Association of British Insurers, there were many words the general public just found baffling.

When the concept was explained to them, the group of lay people in the workshop came up with simplistic replacements for those words, which they felt meant more to them and to the wider, non-financially literate public.

These are outlined in the table below:

Source: ABI/DWP

The DWP has pledged to work with government and industry to help make communications simpler but, as Jon Greer, head of retirement policy at Old Mutual Wealth, points out, there is a "growing epidemic of financial illiteracy within the UK".

He says: "Inertia can only go so far, particularly given pensions freedoms require people to be more engaged with their later life provision."

Age behaviour and engagement

Young people seem so far to be less likely to opt out, if figures from the Pensions Policy Institute are anything to go by.

Vince Smith-Hughes, retirement income expert for Prudential, cites recent figures showing that 7 per cent of people aged under 30 have opted out, with the figure rising to 23 per cent for people aged over 50.

Low opt out rates among the youngest in society - those who are often considered cash-strapped, facing high rents, high student debt and the prospect of waiting until their 40s to get onto the housing ladder - is extremely positive.

And yet their financial engagement - as the Aviva research suggested earlier - showed they would rather scrub the rings off their bathtub than spring-clean their finances.

There are myriad reasons why this should be the case - perhaps those in their 50s have already built up a significant pension pot in previous jobs, and do not want to breach the lifetime allowance limit - but Mr Smith-Hughes thinks the main reason might be less positive.

"People aged 50 and over probably opt out because they think they are too old to make a difference to their retirement.

"The message for them is that even saving for 10 or 15 years can give them a sizeable lump sum in retirement.

"Even if you are looking at shorter periods of time, the advantages of tax relief and employer contributions means it can be pretty unbeatable as a method of saving."

At 25 or 55, however, the message seems to be the same: tell people the benefits of a pension simply and repeatedly.

As Mr Boulding states: "There is just one simple message we need to get across. If you pay into a workplace pension, your employer pays in too.

"And if you do opt out, you can always catch up on your contributions by paying more in later, but you can never re-capture those lost employer contributions."

simoney.kyriakou@ft.com