Article 3 / 4

Guide to global equity incomeWhy UK equity income remains a popular asset class

UK investors have long been drawn to UK equity income funds for their equity income exposure over and above other regions.

This home country bias has been backed up by some impressive dividend growth figures over the years, as well as several high profile UK equity income managers achieving stellar returns for investors, among them Neil Woodford, founder of Woodford Investment Management.

Figures from the Investment Association show net retail sales of UK equity income funds are fairly consistent.

The sector clocked up positive net retail sales in nine out of 12 months in 2016, as investors stuck with UK equity income funds.

The IA UK Equity Income sector was knocked off course in June last year, around the time of the referendum on EU membership as investors became jittery, prompting net retail outflows of £312m.

First port of call

“The UK equity income sector is the first port of call for investors,” says Adrian Lowcock, investment director at Architas.

“The UK market has always had a preference for paying dividends and there is no currency risk for investors to be concerned about.

“Even for those not looking for income, dividends make such a difference. Dividends reinvested are a big driver of returns and given that the FTSE 100 [index] hasn’t risen much since 1999 they have been the main driver of returns for investors.”

Hugh Yarrow, manager of the Evenlode Income fund, agrees: “There’s a strong dividend culture in Britain, and many UK-domiciled companies have produced strong, consistent real dividend growth over time.

“These growing, sterling-denominated income streams can form a helpful bedrock for the UK-based income investor for whom liabilities also arise predominately in sterling.”

Another reason for the popularity of UK equity income is the ongoing search for yield, particularly while interest rates are at rock bottom.

Investment trusts

The investment trust structure has proven to be a vehicle well suited to equity income funds as trusts can hold back some of the income they receive each year for leaner times.

“Known as ‘dividend smoothing’, this is a feature that has helped the investment company sector build up an enviable dividend track record, through the good times and the bad, and the UK equity income sector is a case in point,” acknowledges Annabel Brodie-Smith, communications director at the Association of Investment Companies (AIC).

Data from the AIC using Morningstar reveals £100,000 invested into the average UK equity income investment trust on 31 December 1996 would have generated an initial annual income of £3,700 by 31 December 1997, which would have turned into an annual income of £8,516 in the year to 31 December 2016.

Annual dividend growth was 4.5 per cent over this period, meaning over 20 years investors would have received £119,872 of income from this portfolio.

Figure 1: £100,000 invested in average UK Equity Income IT sector at 31 December 1996

Capital return (£) Income received (£) Income yield (%)

31-Dec-97 124,480 3,700 3.00%

31-Dec-98 134,050 3,831 2.90%

31-Dec-99 146,915 4,043 2.80%

31-Dec-00 149,019 4,245 2.80%

31-Dec-01 133,357 4,422 3.30%

31-Dec-02 98,196 4,578 4.70%

31-Dec-03 114,240 4,779 4.20%

31-Dec-04 128,902 4,825 3.70%

31-Dec-05 152,466 5,115 3.40%

31-Dec-06 178,430 5,570 3.10%

31-Dec-07 165,330 6,336 3.80%

31-Dec-08 115,902 6,874 5.90%

31-Dec-09 136,440 6,912 5.10%

31-Dec-10 162,799 7,043 4.30%

31-Dec-11 159,104 7,212 4.50%

31-Dec-12 177,042 7,594 4.30%

31-Dec-13 219,025 7,864 3.60%

31-Dec-14 220,115 7,990 3.60%

31-Dec-15 221,278 8,423 3.80%

31-Dec-16 226,907 8,516 3.80%

Source: AIC using Morningstar

Ms Brodie-Smith continues: “The UK Equity Income sector has always had a strong following, housing some flagship companies, many of which have been increasing their dividends each year for decades.

“Nine investment companies in this sector have been able to increase their dividend each year for 20 years or more, the ‘dividend heroes’ of the investment company sector."

Uncertain environment

Phil Smeaton, chief investment officer at Sanlam Private Wealth, which publishes the half-yearly Income Study, highlighting the UK income funds that are most successfully producing income for investors, observes the funds have largely defied market conditions to continue generating strong returns.

He is heartened that despite the political and economic uncertainty of the past year UK income funds have been “only mildly affected”.

“The most obvious benefit to UK income fund investors is on the income side: many UK dividend-paying companies are multinationals with significant dollar denominated earnings and revenue,” he points.

“It is also important to note that equities do continue to have an important role to play in income generation, but as evidenced by the change in fund rankings, this has become a trickier and more volatile asset class to navigate than in the past.”

Mr Smeaton cautions: “There are potential opportunities that investors can exploit, including reaping larger dividends from the translation effect and investing in stocks at a discount. However, it is also undeniable that the UK is entering an environment which has not been experienced before.

“The risk of uncertainty is high and there are many questions unanswered about the UK’s exit from the EU which could potentially have a positive or negative effect on the markets.”

This is one reason investors may want to diversify their equity income stream rather than relying solely on the UK’s reputation for delivering dividend growth.

Mr Lowcock believes diversification of income is important.

“For income seekers the most important thing is stability of the income being generated. To protect against shocks, such as a Brexit crash, investors need to be diversified,” he asserts.

“Also the UK market does not have a monopoly on dividends and indeed dividend growth. Some of the best income payers are overseas countries, also some of the best returns are from companies with growing dividends and it is worth getting exposure to that growth.”

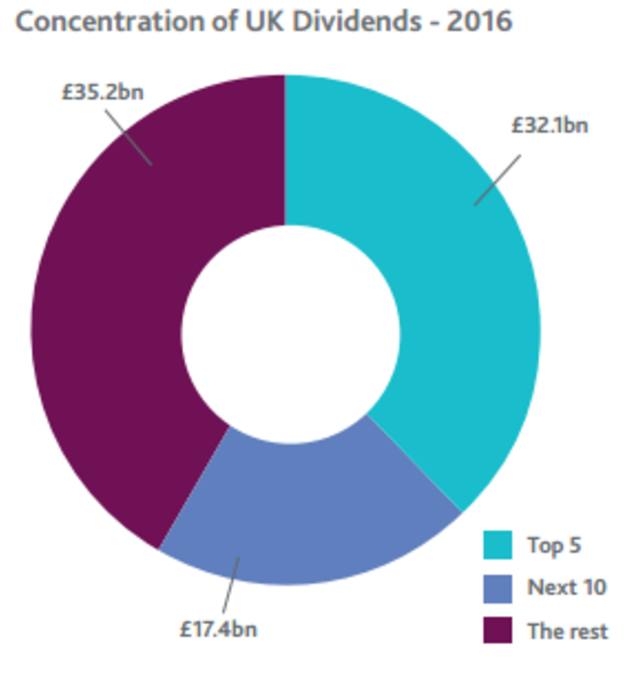

Source: Capita UK Dividend Monitor

Diversifying for dividends

Mr McDermott says he has been advising his clients to invest in global equity income funds for the past five years on the basis he thinks UK investors should diversify.

No-one is suggesting investors should avoid the UK altogether as it has been and remains one of the best dividend-paying countries globally.

Andrew Jones, global equity income manager at Henderson Global Investors suggests: “There is a longstanding dividend culture and management teams appreciate the importance of income in total shareholder return.

“At present the [UK] market is quite concentrated though, with the largest 20 stocks accounting for two-thirds of market income. In addition the payout ratio (the percentage of profits companies pay as dividends) is also high in relation to history so a degree of diversification is sensible.”

Colin Morton, manager of the Franklin UK Equity Income fund observes: "I think medium term I don’t see anything that’s changed over the last year or two that means equity income isn’t going to remain a pretty good area to look for investment over the medium to long term.

"What happens over the next 12 months is very difficult, we’ve got all the things with [president] Trump going on, we’ve got Brexit going on so we really don’t know what that’s going to mean in some ways.

"However, if you can still identify good companies, paying good dividends where you think those dividends are sustainable and can grow, there’s still a strong case for that type of investment."

eleanor.duncan@ft.com