It has been an unusual 2017 for UK equity income funds. The Investment Association (IA) made drastic, and somewhat controversial, changes to yield requirements, paving the way for exiled funds to return to the sector.

The move ends the requirement for vehicles in the UK Equity Income sector to yield 110 per cent of the FTSE All-Share index over three years, with this figure now lowered to just 100 per cent.

Failure to achieve 90 per cent of the index yield in any one-year period will still result in a product being removed from the peer group.

The March changes received mixed reactions from income managers. Some funds, such as those from Rathbones and Schroders, quickly returned to the sector. But it remains shunned by bigger names such as Invesco’s Mark Barnett, and Neil Woodford’s latest Income Focus vehicle. Montanaro has also opted to keep its income offering out of the sector.

It was a difficult period for sector keepers as the trade body bandied around several ideas but received no consensus among its membership. Some managers whose funds never struggled to reach the former 110 per cent requirement, such as Neptune’s Robin Geffen, remain critical of the change.

The summer brought new toils, with Mr Woodford’s flagship Equity Income vehicle suffering a torrid period of stock-specific issues.

The bad news for income investors was that many of these companies – such as AstraZeneca, Imperial Brands and British American Tobacco – are mainstays for several large income strategies.

The average fund in the sector has shed 1.1 per cent in the past three months, compared with a 0.7 per cent decline for the FTSE All-Share.

The weakening outlook for stalwart dividend payers such as pharmaceutical and tobacco companies has prompted some fund buyers to question their use. AstraZeneca’s share price fell 15 per cent in the period following an unsuccessful drug trail.

While this should be a normal part of stock investing, 30 of the of the 87 funds in the IA UK Equity Income sector count the pharma giant as a top-10 holding.

Asset allocators say these problems highlight broader threats facing the peer group. Hawksmoor portfolio manager Ben Conway notes: “This definitely signals tougher times ahead, but mainly for the managers of huge UK equity income funds that have to own the mega-cap stocks that generate income.”

Other fund buyers, such as James Calder of City Asset Management, say they are beginning to mull alternatives – with enhanced income or maximiser funds, or even alternative investment trusts, potentially being a more secure source of income.

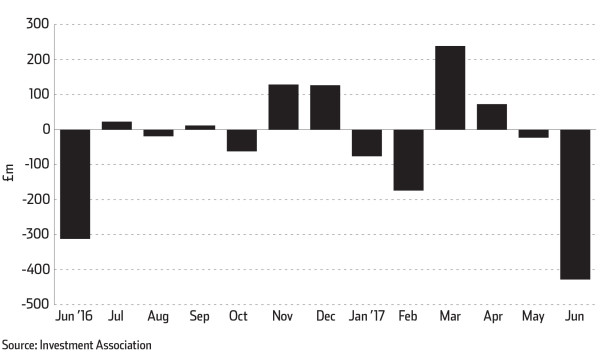

Such concerns, amid anxieties over the outlook for UK equities in general, are beginning to feed through into sales. June saw the sector suffer £428m of net redemptions – its biggest monthly outflow in 12 months.

While the UK All Companies sector has become used to witnessing chunky outflows, income funds have remained resistant. Negative sentiment could be seeping through, but only forthcoming sales figures will confirm this theory.

The picks

Premier Optimum Income

Chris Wright manages this £95m vehicle, and its small size allows the use of less-trodden stocks while retaining the stability of large-cap holdings. The manager’s top position of his 60 holdings is in insurer Legal & General, part of a 40 per cent allocation to financials. There is also some exposure to the likes of Imperial Brands and BP. This strategy has not hampered Mr Wright’s yield nor his performance: the fund currently yields almost 7 per cent. Over three years it has returned 31 per cent, versus a 24 per cent sector average and a 23 per cent rise by the FTSE All-Share index.

Miton Multi Cap Income

This £950m fund is managed by Gervais Williams and Martin Turner, and is evidence that investors do not need large-cap holdings to find income. The vehicle yields a strong 3.9 per cent, which is above the FTSE All-Share’s 3.5 per cent. It comprises 130 holdings, most of which reside in the FTSE 250 or the Alternative Investment Market. The managers have delivered 41 per cent over three years and 129 per cent over five years – far above both the sector average and its benchmark.

Editor’s pick

Man GLG UK Income

Henry Dixon’s fund strives for a good balance of high yield, stock diversification and strong capital growth. He has managed the £239m vehicle since 2013, investing in some of the more common names, but using 68 holdings with varied weightings. His top position is in Rio Tinto, along with heavy exposure to housebuilders and financials. With a yield of 4.2 per cent, the fund is targeting a healthy income. Performance has also been strong, with Mr Dixon returning 52 per cent since taking over, compared with a 31 per cent sector average and a 30 per cent gain by the FTSE All-Share index.