Schroders’ Matthew Dobbs has said he can understand why investors are cautious about stockmarket investing, with equity valuations reaching similar levels to the run-up to Black Monday in 1987.

On Monday 19 October 1987 global stockmarkets tumbled, driven by concerns about the world economy and high stock valuations, in what became known as Black Monday.

According to Schroders, the Dow Jones fell 22.6 per cent on Black Monday alone.

The previous record one-day fall set by the Dow Jones was 12.8 per cent during the Wall Street Crash of 28 October 1929.

Mr Dobbs, head of global small cap at Schroders, was in London at the time of the stockmarket crash in 1987.

He said: “It is easy to understand why investors might be concerned about investing in stocks now. Stockmarkets continue to reach new highs and equity valuations are similar now to what they were in 1987.

“But there is a big difference today: the risk-free rate is very different.”

He added: “What I mean is that the yields on bonds and interest rates in banks, where there are fewer risks to losing your investment, are now very low compared to the dividend yield on the stockmarket, which is around 4 per cent.”

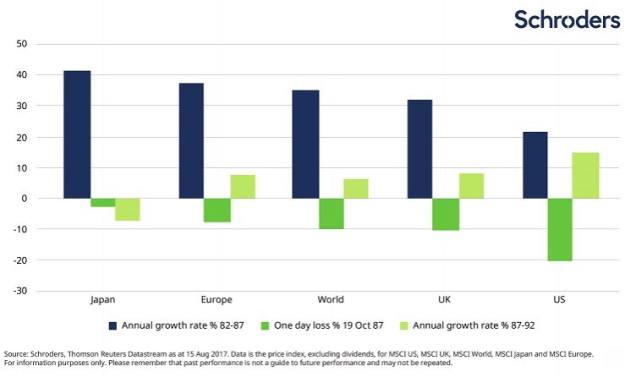

Figure 1: The performance of stocks before, during and after Black Monday

Source: Schroders, Thomson Reuters Datastream

The blue column, in the chart above, shows the annual rate of return for stocks in the five years leading up to the crash, the dark green column is the percentage change in stocks on Black Monday and the light green column is the annual rate of return in the five years after Black Monday.

The yields on 10-year government bond yields in Japan, Germany and the US were 9.9 per cent in 1987 and as much as 10.1 per cent in the UK.

But today the highest yield among those countries is 2.9 per cent for US bonds, Schroders reported, while in the UK it is 1.28 per cent, while Germany and Japan are close to zero.

Schroders pointed out while high stock valuations can contribute to a fall “they are not necessarily the catalyst”.

It pointed out that valuations in the US, UK and Europe are higher now than they were in 1987, yet stockmarkets continued to hit record highs.

But Mr Dobbs said he still did not think too much money was going into stockmarkets, despite investors not being paid much for having money in the bank or in bonds.

Andrew Rose, equities fund manager at Schroders, said: “At the time you felt it was the end of the world, but looking back it was just a blip. The UK and the US stockmarkets rebounded strongly in the late 80s and throughout the 90s.”

He questioned whether Black Monday could happen again.

“Procedures are now in place to prevent stockmarkets falling so far, so fast. There will always be market peaks and troughs but over the long term, stocks have delivered superior returns,” Mr Rose concluded.

Darius McDermott, managing director at Chelsea Financial Services, told investors not to panic during a market crash.

“If you sell, you are crystallising losses. If you hold, it may take a bit of time, but your investment should recover,” he said.

“Long-term investors are invariably better off ignoring short-term market movements - even the most dramatic.”

eleanor.duncan@ft.com