Article 1 / 4

One year of Trump: A guide to investing in the USIs the US equity market overvalued?

Global stockmarkets remained buoyant in 2017 and none more so than the US equity market, which remains in a multi-year bull run.

The S&P 500 index was on a winning streak last year, defying critics who thought the first year of Donald Trump’s presidency would hail a period of volatility for stocks.

Instead, the index delivered total positive returns, when dividends are included, every month in 2017, according to FT.com.

Seven Investment Management (7IM) reveals Mr Trump’s first year in office was the first calendar year in the history of the S&P 500 with no negative months – a statistic that President Trump would no doubt take credit for.

But he probably wouldn’t be so keen to admit while the index has climbed steadily since he took office, it has not performed as well as it did under former president Barack Obama’s first year.

The S&P 500 was up 19.97 per cent since Mr Trump’s inauguration on 20 January 2017, until the end of December 2017, but 7IM points out this is “a long way short” of its performance during Mr Obama’s first year, when the index was up 44.73 per cent.

But the S&P 500 saw an even more impressive run of performance during Bill Clinton’s presidency, research by 7IM shows, who presided over a 263.25 per cent rise in the S&P 500 during his term in office – an annualised return of 17.49 per cent.

Although the S&P 500 has reached impressive highs under previous presidents, investors have been displaying caution about how much further US equities have to go and whether the low volatility environment signals a market correction is due.

Looking beyond valuations

Ritu Vohora, equity investment director at M&G Investments, believes valuations across the Atlantic do look stretched, trading as they are at levels not seen for 20 years.

She attributes much of the rise to multiple expansion, rather than earnings growth and flags that this raises questions about sustainability.

“There are also other anecdotal warnings signs – M&A is at high levels, headline unemployment is very low and interest rates are rising,” Ms Vohora warns.

“At the sector level, contrary to popular belief, tech is not the most expensive sector, mainly because the strong returns over the past few years have been followed by strong earnings. Energy is the most expensive, as earnings have declined for the past five years contributing to the high P/E [price to earnings] levels.”

In spite of the market as a whole looking expensive, she believes there are factors which “argue for an upward grind higher”.

“Headline growth rates of US corporates continue to surprise to the upside, with mid-teens growth achieved for the total market. Furthermore, following a long period of underinvestment in traditional capital equipment since the GFC, US corporates are beginning to increase spending again on capacity; this will fuel growth.

“Also, most macro indicators continue to be very strong; US PMI is at levels last seen in the industrial expansion of 2003-4 for example, and monetary conditions remain accommodative, with low inflation allowing the Fed to raise interest rates very gradually,” she adds.

But Dan Kemp, chief investment officer Emea at Morningstar, urges investors: “The US equity market is incredibly diverse, so it is important to look beyond the expensive headline valuation metrics and understand the fundamental appeal at a more intricate level.

“Using a long-term fundamental approach, we find that six of the 10 sectors are currently marked as significantly overvalued on a valuation-implied basis. Unsurprisingly, this includes some of the so-called hot sectors, including technology, but also consumer discretionary, materials and industrials.”

He adds: “We find the primary drivers of these overvaluations are stretched profit margins combined with high prices relative to long-term cash flows.”

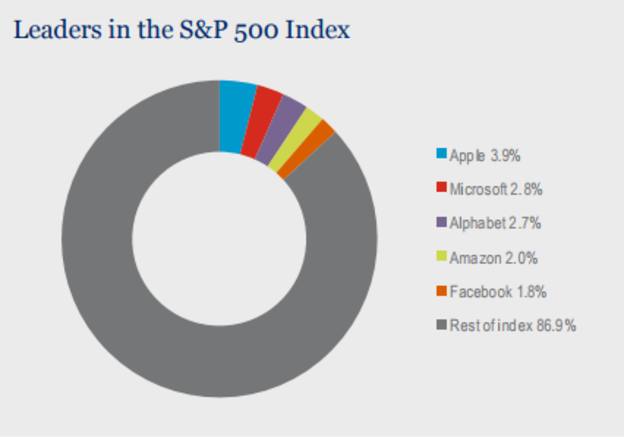

Technology stocks have been leading the S&P 500 higher, with the Faang stocks – Facebook, Amazon, Apple, Netflix and Google – accounting as they do for more than 10 per cent of the index.

Figure 1: The five largest US companies in the S&P 500 index are technology firms

Source: Rathbones/Datastream

Evan Bauman, portfolio manager of the LM ClearBridge Aggressive Growth fund, cautions: “The largest cap companies in the technology and internet sectors represent the most crowded area of the market and you can see this impact in the price-to-earnings growth, or PEG ratio, of the Russell 3000 Growth index.

"The PEG ratio measures how much an investor is paying for earnings growth and the PEG for the index is at its highest point in the last 10 years.

“For the mega-cap tech and internet names that have come to be known as the Faangs, much of their advance has been led by continued money flow toward passive investing and less by improving fundamentals.”

Overstretched or more to go?

For some, like Viktor Nossek, director of research at WisdomTree in Europe, this sector now looks overstretched.

He reasons: “The risks are that any disappointment coming from one major stock in the next quarterly earnings release may reverberate negatively across the equity sector.”

But others, such as David Coombs, lead manager of the Rathbone multi-asset portfolios, says he has not been topping up technology holdings for some months in the expectation of some kind of short-term pullback.

“We don’t believe these companies are overvalued – their prospects for growth remain strong, debt is under control and cash flow is strong,” he confirms.

Mr Coombs reveals from 31 December 2016 to 5 December 2017, the S&P 500 Information Technology index rose 34 per cent, compared to the flagship S&P’s 18 per cent rise.

But he notes the sector’s short-term correction came in early December.

“What seemed to be simply early profit-taking after a strong year accelerated following the passage of the Senate’s tax reform bill,” Mr Coombs explains.

He points out: “Meanwhile, the tax plans have the laudable inclusion of allowing companies to immediately expense investment in plant and equipment for the next five years.

“That makes it more compelling for companies to invest now and reap the benefits of better productivity and higher revenues in the future. Industrials, which we own quite a lot of, would do very well out of this – as would the banks that would finance much of the spending.”

The corporate tax overhaul – the first legislative victory for Mr Trump – may signal a turnaround in fortunes for some areas of the equity market.

Russ Mould, investment director at AJ Bell, observes: “What you can see in the US right now is a move from the tech sector to sectors which should benefit more from a cut in US taxes, namely banks, industrials and more domestically-focused areas like housebuilders, food retailers and even downtrodden general retailers.

“Tech is populated by multinationals who already have low corporate tax rates so they will benefit less from the US corporate tax cut, although other momentum-driven sectors like biotech have slipped a little too, so there may be more to it than just the tax reforms.”

So should investors be concerned about US stockmarket highs?

Most investors will be positioning their portfolios with a long time horizon anyway, so even if there were to be a correction, their investments should ride out any short-term pain.

Mark Sherlock, portfolio manager, US SMID (Small and Mid) Cap fund at Hermes Investment Management, believes there is justification for questioning valuations.

“I think it is the right way to be thinking, to acknowledge that these multiples are towards the high end of their historic average. I don’t think anyone can make the case the US market is looking screamingly cheap at this point,” he admits.

Correction versus recession

However, he thinks investors need to differentiate between the chances of a market correction and a full-blown recession.

“An outright 2008-09 event where the market pulls back 30-40 per cent and we’re talking about recession. I think that’s not likely in the coming quarters,” he states.

“What is perfectly likely is a market correction, by which I mean a 10 per cent-type event, and they are part of investing in this sort of asset class – indeed, any equity asset class.

“There will be pullbacks and there will be points where the market wants to pause for breath.”

eleanor.duncan@ft.com