Here are some classic problems and potential solutions to them.

1. With both equity and bond portfolios struggling, what are the alternatives?

In the first six months of 2018, UK equities were flat, the majority of emerging market equity markets were down and most fixed income portfolios were slightly negative.

While overall these are not huge losses it is the first time a combined equity and bond portfolio is struggling.

Traditionally, when equities are up then bonds are down, and vice versa. However, this inverse correlation has been broken. Between 2009 and 2018 we witnessed a generally positive environment where equities and bonds were both up, mainly as a result of government intervention.

This correlation has flipped, with both equities and fixed income both slightly down year to date. Most investors have not experienced this situation before. In this environment, putting risk first and being diversified are more important than ever.

To offset equity and bond markets falling in tandem, investors are diversifying their portfolio to include a wider range of asset classes.

This environment is more conducive to actively managed strategies, with liquid alternatives and unconstrained fixed income assets resonating with investors.

However, individuals should not forget the time horizon of their investments and the need to manage liquidity levels. For example, some investors are building illiquidity mismatches into their portfolios.

This was a pattern adopted by some investors in 2006-07 and did not fare well when markets fell in 2008.

2. How can I adapt to the changing fixed income environment?

The biggest theme we have seen in our client portfolios over the past three years is the reduction in the percentage allocated to fixed income.

This has been driven by the end of the 30-year fixed income bull market, although 2018 is the first year when fixed income losses have occurred.

In adapting to the changing fixed income environment, investors have turned to more unconstrained and flexible fixed income mandates, have shortened duration risk and increased their allocation to floating rate products. Investors have also replaced bond exposure with liquid alternatives and multi-asset funds.

3. Will I take on more risk in my portfolio if volatility increases?

Some investor portfolios continue to meaningfully understate risk. This is being driven by a perceived lack of attractive investment opportunities, which in turn can lead investors to take on more portfolio risk. Currently, there are limited returns to be found in bonds and most equities are fairly priced.

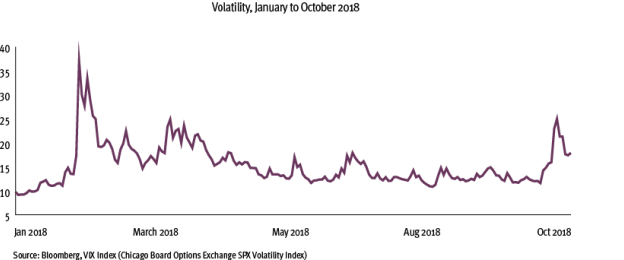

An absence of corporate defaults is sending some investors down the credit spectrum to find yield, but many may not understand the level of risk they are taking on as credit default rates have typically been low in a period of reduced volatility.

If volatility returns, investors will get an unwelcome surprise. Investors are taking on much greater levels of risk in portfolios to secure a similar return target, and they may not even realise it.

For example, clients could surprisingly find their money is moved from a conservative to a moderate risk portfolio with the intention of securing a similar return target, and yet they will be taking more risk than they wanted to.

To date, this risk has been lying dormant in portfolios. However, investors will soon find themselves exposed if volatility increases. In these circumstances it is important advisers are frequently speaking to their clients to manage the risk and return expectations of their investments, and ensure they can handle that potential level of drawdown in the future.

4. How will changes in interest rates affect my fixed income portfolio?

Most fixed income investors will seek to hedge currency exposure, and historically this will have usually cost just a few basis points.

However, the divergence of the US in the current economic cycle with a rise in interest rates means the cost of hedging has become more expensive. So, while US fixed income funds are generating an average yield of 2 per cent, this is all but eradicated when you factor in the cost of hedging.

For the last five years, investors have not really had to worry about this.

But with interest rates rising, this is something we expect to move higher up their list of considerations, particularly as the performance of funds globally will eventually become increasingly differentiated.

5. Is there a benefit from an unconscious exposure to growth stocks?

Over the past three years equity investors benefited from having a bias towards growth stocks.

Many investors have benefited by making a correct tactical asset allocation call on this but we have also noticed that many adviser portfolios are also unconsciously overweight growth due to two other unrelated, and not deliberate, factors.

The first factor is investors, consciously or not, favour funds that have performed well in the last one, three and five years. Whether they are called ‘growth’ in name or not, most funds that have outperformed in recent years carry a significant growth bias.

The second factor is the dramatic rise in the use of index funds which, being market cap weighted in the construction process, are increasingly dominated by growth stocks that make up bigger and bigger proportions of these indices each day.

It becomes a virtuous cycle for growth stocks and the funds that invest in them but something that leaves investors much more exposed to growth in their portfolios than they may realise, or indeed want.

Investors need to be prepared for the switch that will eventually happen, as at some stage value will make a comeback. Preparations among some investor groups are already under way, with some institutional investors starting to move back into value.

James Beaumont is head of the portfolio research and consulting group at Natixis Investment Managers