The weak pound has pushed dividend payouts in the UK up by £1.9bn in the third quarter, according to Link Group’s latest dividend monitor.

Investor payouts in the UK totalled £31.4bn in the period, a 1 per cent gain on the same period last year when removing the impact of BHP, which de-listed from the London Stock Exchange earlier this year.

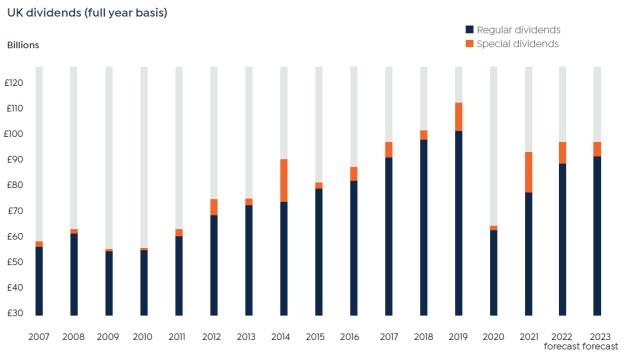

The surge in strength in the dollar will add £5.7bn onto UK dividends this year, according to Link Group, which has upgraded its expectations for dividends in 2022 by 5.5 per cent year-on-year.

This means it expects dividends in the UK to reach their pre-pandemic levels in 2025.

UK dividends since 2007

Source: Link Group

The strong dollar increases dividends in the UK as the majority of larger companies in the UK have strong overseas earnings, which are normally paid in dollars.

Dividends in the third quarter this year were weaker than expected, after drops in payouts from consumer basics and mining companies.

The drop in mining dividends, which were down 21.3 per cent, contributed to a 7 percentage point drop in the overall level of payouts in the quarter.

However, oil and gas dividends were up 18.9 per cent year-on-year, and banks and financial companies saw their dividends jump 49.2 per cent, or £2.7bn, extra in the quarter.

Special dividends were down 43 per cent year-on-year to £3.3bn, however underlying dividends rose 4 per cent to £28.1bn.

Ian Stokes, managing director, corporate markets UK and Europe at Link Group, said the economic backdrop in the UK and wider world has “deteriorated markedly” in the last three months.

“Nevertheless, the high yield of the UK stock market signifies that more of the value of UK equities is grounded in the stream of dividends it provides.”

Although this means a lower growth profile for companies in the UK, he added, it means capital value is less sensitive to higher long-term bond yields.

“Moreover, we do expect UK companies to continue to deliver dividend growth over the medium and long term, which provides a level of insulation against the rising cost of living.”

Fund manager of Henderson High Income Trust, David Smith, said: “While the economic outlook is particularly uncertain and will likely put pressure on corporate profits, history shows that dividend income is much less volatile than profits over time, so long as balance sheets are strong and dividend cover is robust.”

“Thankfully, UK corporates strengthened balance sheets and reset pay-out ratios during the pandemic,” he added.

sally.hickey@ft.com