Article 1 / 4

Guide to advising vulnerable clientsHow the regulator defines a vulnerable client

But while there is an element of truth in claiming older people are generally more vulnerable, thanks to age and in some cases, age-related dementia, the truth is anybody can become a vulnerable client at any time.

As the Financial Conduct Authority’s (FCA’s) 2015 Occasional Paper: Consumer Vulnerability stated: “Vulnerability can come in a range of guises and can be temporary, sporadic or permanent in nature.”

It can hit any person at any time, whether old or young, and as a result, this “fluid state needs a flexible, tailored response from firms”, the FCA paper stated.

It added: “Multi-layered vulnerability, and sudden changes in circumstances, are particular indicators of high risk”.

According to Jacqueline Berry, director of My Care Consultant, vulnerability is squarely “on the agenda of regulators across industries and professions”.

She comments: “Ensuring customers in vulnerable circumstances are treated not only fairly but also with empathy and sensitivity to their circumstances, is a growing priority.”

What constitutes ‘vulnerability’?

Tony Gammon, director and head of client service at Thesis Asset Management, states: “There are a number of trigger points that might cause us to classify a client as ‘vulnerable’.

“There is no exhaustive list, but it would include those with a physical disability or illness, mental health problems, divorced, bereaved, low language skills, advanced in years or very young.”

Keith Richards, chief executive of the Personal Finance Society (PFS), highlights the potential risk factors that can contribute to vulnerability in the context of financial services, as outlined in the Practitioner’s Pack attached to the Occasional Paper.

These are:

- Physical disability.

- Severe or long-term illness.

- Mental health problems.

- Low income and/or debt.

- Caring responsibilities (including operating a power of attorney).

- Being ‘older old’ – over 80, which is correlated with physical or mental impairment.

- Being young (correlated with less experience).

- Changes in circumstances, such as job loss, bereavement or divorce.

- Lack of English language skills.

- Non-standard requirements or credit history, such as armed forces personnel returning from abroad.

Stephen Lowe, group communications director for Just Group, comments: “Vulnerability can occur suddenly or gradually, be temporary, permanent or fluctuating.

“In fact, most people can expect to become vulnerable at some point, a situation which can be made worse by low income, debt or poor treatment by financial services firms.”

For Claire Trott, it is therefore essential for firms to make sure they are acting with appropriate levels of care.

She explains: “Vulnerability has a broad definition and proves there are more vulnerable clients out there than one might initially think.

“Moreover, people might not realise they are vulnerable, and might not be permanently so, but only because of changing circumstances over time.”

How prevalent is vulnerability?

Given the list above, it is reasonable to suggest the average financial adviser to be able to pinpoint at least one client that could fit into one or more of these categories.

Mr Richards says: “Almost any clients or prospective clients of a financial advice firm can, and most likely will, be subject to some of the above at some point in their lives.

“Clients who find themselves in vulnerable circumstances are seldom typical, as vulnerability is personal.

“That said, whatever the manifestation of vulnerability, they have some commonality – namely being less likely to best represent their interests and more likely to suffer harm of some kind.”

During the FCA’s research into financial vulnerability, it discovered the scale of this in the UK was immense.

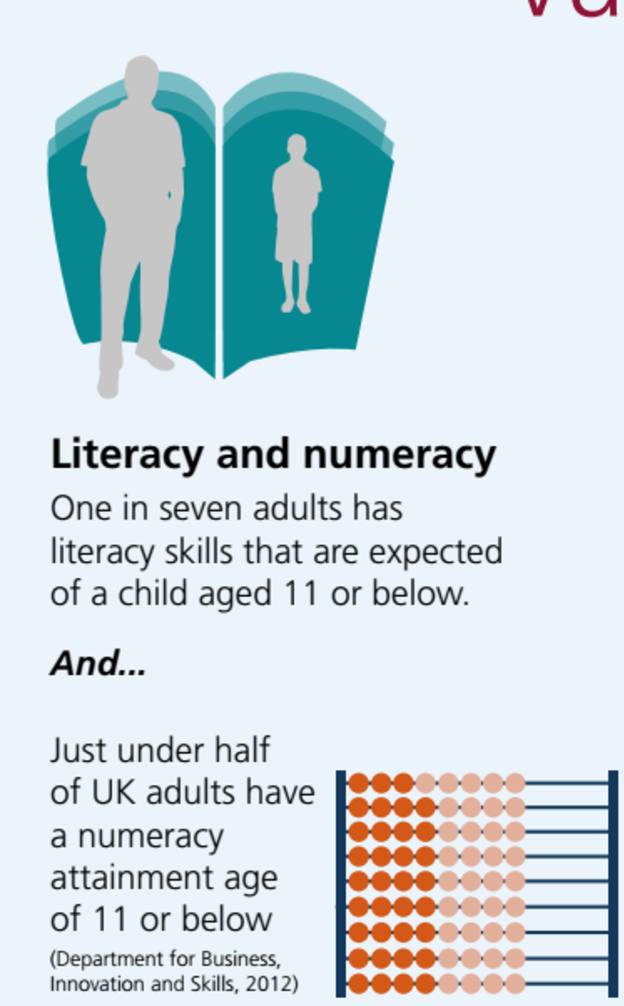

In terms of literacy and numeracy, for example, the Department for Business, Innovation and Skills found one in seven adults had the literacy skills of a child aged 11 or below, while just less than 50 per cent had a numeracy attainment age of 11 or below.

There are currently 800,000 people in the UK living with various degrees of dementia, which Age UK expects to double in the next 40 years, and this affects one in every six people aged 80 and over.

Moreover, there are more than 1.4m people in the UK aged 85 and over; a proportion of the population which is set to double in the next 20 years and nearly treble in the next 30 years, according to Age UK data.

Ms Berry adds: “While there are no conduct rules in respect of how the FCA expects firms to respond to this issue, a coherent, consistent and robust approach to vulnerability in delivering good client outcomes for all is a growing expectation from the FCA.”

Some client vulnerabilities may be more easily discernable than others, but others will need to be ascertained by the adviser through a tailored and positive conversation.

In some cases, clients might actually hide certain things if they feel unable to talk about them, such as mental illness.

But just because certain conditions or circumstantial vulnerabilities might be less obvious, does not mean the adviser does not need to deal with clients in a certain fashion.

Indeed, the regulator is clear that advisers must have a proper process in place to help identify and tackle vulnerabilities head-on so that all clients are given the very best personal advice.

For Claire Barker, managing director of Equilaw, much of this should be common sense: “My view would be someone who needs more help on an objective basis than another client.

“It could pertain to mental ability, intelligence, physical frailty, special needs or, in terms of age, someone who potentially has less time to buy their way out of a mis-sold or mis-purchased product.”

Mr Richards adds: “Ongoing consideration is needed as to the extent to which these risks apply to a firm’s business model, target market and/or customer base.”

How does the regulator want firms to act?

According to the 2015 Occasional Paper, the FCA was clear financial services firms – from large lenders to small advisory firms – had a duty of care to the client.

The paper stated: “Vulnerability is not just something to do with the characteristics of the consumer – it can be created or exacerbated by the policies and practices of firms.

“The way firms design their systems and processes can make a huge difference to the ease with which consumers interact with them.

“Training staff to listen and understand, equipping them with flexible options and, where appropriate, providing staff with the ability to refer particular problems to specialists within a firm that have the expertise and discretion to address difficult situations can also help.

“Rather than designing products and processes for a mythical perfect customer, we believe the broad range of experiences of real consumers needs to be taken into account.”

The FCA has not forgotten this: in the years since the paper came out, it has explored how vulnerable customers are treated in the mortgage lending industry.

Recently, the FCA’s 2017 Mission Statement set out how firms needed to “consider user needs”, as this would be included in how the FCA makes its regulatory decisions.

On page 24 of the FCA’s 2017 Mission Statement, it reads: “Understanding vulnerability is central to how we make decisions.

“Consumers in vulnerable circumstances are more susceptible to harm and generally less able to advance their own interests.

“So we will prioritise consumers who are unable to shop around over consumers who can shop around but choose not to do so.”

Therefore, by extrapolation, firms should also consider vulnerability when dealing with one client over another. A cookie-cutter approach to advice simply will not do.

As Mr Lowe avers: “The onus is on advisers to recognise vulnerable clients and to have processes in place to ensure they are protected from financial or psychological detriment.”

Dealing with clients on an individual rather than a formulaic basis should, in practice, address the regulatory requirements.

Mr Richards adds: “The individual circumstances of each client should be clearly evident within any personal recommendation of suitability – in essence, everyone is vulnerable if their individual circumstances are not appropriately taken into consideration.”

simoney.kyriakou@ft.com