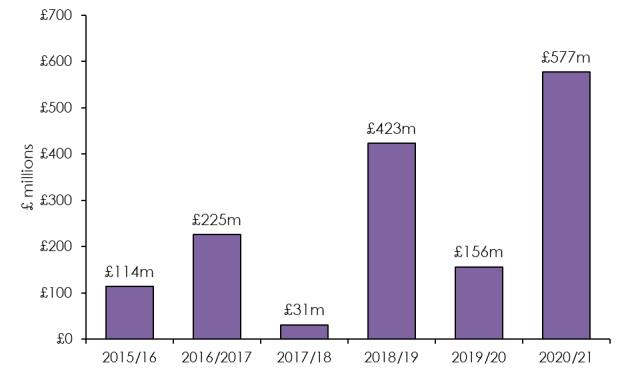

Financial Conduct Authority fines have increased nearly four-fold to £577m this year, with high street banks being the largest contributors.

The surge in fines comes after Natwest was fined £265m at a court hearing after it admitted it had failed to prevent money laundering.

Within a few days, HSBC Bank was also fined £63.9m for failings in its anti-money laundering processes, after it used automated processes to monitor hundreds of millions of transactions a month to identify possible financial crime.

According to law firm RPC, this end of year flurry has taken FCA fines to their highest value in six years.

RPC said this showed that when regulated businesses committed serious failings, the FCA was prepared to levy severe fines and, in circumstances such as failures around money laundering, the FCA may pursue a criminal prosecution.

The increase in fines in 2021 was dominated by the two banks, as well as a £150m fine for Credit Suisse for failures in its anti-bribery controls and a £90m fine for Lloyds for treating consumers unfairly in the renewal of their home insurance.

The number of fines also increased by 57 per cent in the past year – from seven to 11.

But RPC said financial penalties did not capture the entire array of the FCA's enforcement.

“As well as non-financial penalties, the FCA has a number of tools at its disposal such as withdrawals of authorisation and variations of permission to prevent businesses carrying out certain activities,” it said.

Source: FCA. Year end December 17 2021

Jonathan Cary, partner at RPC, said: “This year, financial institutions have again been reminded that the FCA will not hesitate to impose sizeable fines – sometimes in the hundreds of millions – for serious failings.”

“While the increase in the value of fines is striking, that alone, does not capture the complete picture of the FCA's enforcement activity over the last 12 months. The FCA has a range of other tools it is increasingly prepared to use beyond imposing a major fine. Having permissions withdrawn or varied can be even more serious for a regulated firm.”

He added: “While resource does remain an issue, having managed to clear some large cases and with the efforts to rationalise its caseload, the FCA will be looking to ramp up its enforcement activity in the year ahead.”

sonia.rach@ft.com

What do you think about the issues raised by this story? Email us on FTAletters@ft.com to let us know