Invesco Perpetual bond managers Paul Causer and Thomas Moore have slashed exposure to subordinated financial debt, months after the fund firm identified this as the “most appealing” theme in credit markets.

Mr Moore, who runs the firm’s £148m High Yield fund with Mr Causer, said the team had significantly lowered a subordinated financials allocation, reducing the weighting by around 10 percentage points compared with March 2016’s level.

“One major opportunity last year was in subordinated financials. At that time, Paul [Causer] brought up the allocation. With the last market rally in the second part of the year, the relative attractiveness of the sector was reduced,” he said.

The cut in exposure, carried out through a combination of sales and “natural roll off”, marks a change of stance within Invesco Perpetual’s bond team, which has favoured such instruments at a time when credit in general is seen as expensive.

In February this year, the firm’s head of fixed income products Lewis Aubrey-Johnson described subordinated financials as “the most appealing credit theme” for the team.

That came at a time when the fixed income unit said it remained wary of duration risk, while only favouring certain individual high-yield names.

According to a note from the firm, its Corporate Bond, Monthly Income Plus, Distribution and Tactical Bond vehicles each had at least 20 per cent of assets allocated to subordinated bank debt at the time. Invesco Perpetual also runs an £88.4m Global Financial Capital fund that invests primarily in “fixed interest and other debt securities and shares of banks and of other financial institutions”.

“The logic there is it was spectacular value,” said Mr Moore of the subordinated financials trade. “Now it’s merely a good relative value opportunity. That’s in the context of a European banking sector that has largely got its house in order in terms of shoring up the capital base.”

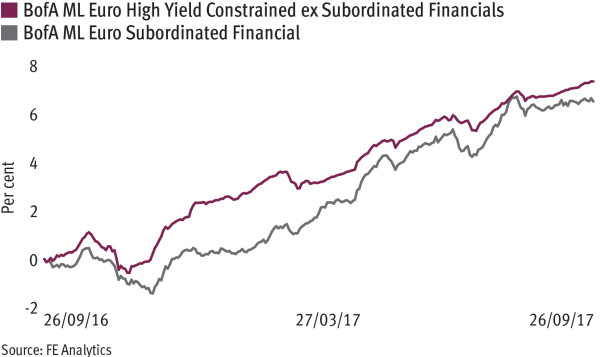

The decision follows strong performance from the subsector – though its level of outperformance has narrowed in 2017.

The Bank of America Merrill Lynch Euro Subordinated Financial index is up by 6.1 per cent year to date versus the 5.5 per cent rise in the same provider’s Euro High Yield Constrained excluding Subordinated Financials index, according to FE Analytics.

Elsewhere, the managers of the High Yield fund have increased their allocation to US credit, again with a focus on idiosyncratic stories. The team has also reduced exposure to BB-rated credit in favour of nominally weaker credits. They believe bondholders are no longer being adequately compensated in the BB space.

“There’s a variety of high-yield indices that tend to be dominated by BB credit,” Mr Moore added. “In terms of relative value and yield it’s my view that is an area where we are no longer being paid what we would want.

“We have taken up the allocation to B. We are focusing on companies that are BB or BBB [in terms of prospects] but happen to have a B balance sheet. They have a bit of leverage but these companies have a competitive advantage. We think they could prove defensive.”

At the end of August, they had a 34.5 per cent weighting to B-rated credit, although a substantial 35.3 per cent was still allocated to BB debt.

According to FE Analytics, the High Yield fund has returned 15.4 per cent over three years, compared with an average of 13.8 per cent from its IA Sterling High Yield peer group.