Alongside this, environmental, social and governance issues have become widespread in the public consciousness.

ESG is traditionally seen as being done within an organisation, but effective know your supplier processes can help organisations have a wider ESG impact.

By identifying those in the supply chain who may be involved with illicit practices, such as modern slavery, corruption and money laundering, businesses can help to stop the bad actors at source and have a broader societal effect.

Why KYS is an essential tool

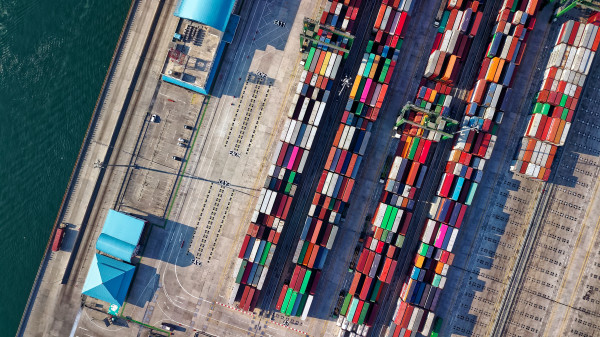

The world economy is accelerating in its interconnectedness. As such, many businesses may be unaware they are engaging with criminals.

As links in the supply chain, those carrying out illicit activity might be in distant or under-regulated regions. They could also be a sanctioned entity operating under false pretences.

Without a thorough investigation of an organisation’s supply network, including owners, practices and products, activity could be undetected for years.

The war in Ukraine and subsequent international sanctions regime means scrutiny on supply chains is high.

With many organisations evaluating their KYS methods to avoid reputational damage and regulatory scrutiny, businesses that take it further use their KYS process to have an ESG impact that will stand out from the crowd.

Methodologies to implement KYS

Many illegal activities carried out by organisations are driven by a single owner, who is often hidden behind an opaque business structure.

Consequently, it’s imperative to identify the ultimate beneficial owner for supply chain visibility. By negating anonymity, it’s difficult for bad actors to hide their wrongdoings.

Technological solutions are necessary for effective KYS checks. Enormous digital databases enable the continuous monitoring of supply chains at a scale that humans cannot match.

Through the analysis of real-time data, identifying suspect entities is more efficient and supply chain professionals can focus their efforts on making business critical decisions.

Automated insights allow for the optimisation of the KYS process and help organisations cut off their involvement with suspect owners.

Removing a revenue stream to such an individual hinders their operation and by making illicit activities, such as illegal deforestation, harder to fund, the harder it is for the activities to take place.

A greater need for ESG in today’s landscape

ESG measures are more imperative than ever before. Climate change, impacted by human actions such as deforestation, is helping to cause recent natural disasters like flooding in Pakistan.

Worldwide, it is estimated that as many as 50mn people are living in modern slavery.

While both of these are unlawful, they are happening on too large a scale for them to not be effecting the legitimate economy and business practices.

KYS checks are an invaluable tool for identifying and expelling illicit practices from supply chains and the world.

Businesses can take responsibility to create positive change through KYS and have their ESG impact reverberate through wider society.

Alex Pillow is director, market strategy, for Moody's Analytics KYC