Clearing up some of the myths about protection is one of the first things an adviser must do when talking to clients about insurance.

It is easy to get carried away by headline-grabbing stories about insurers who did not pay out, but statistics show this is the exception, rather than the rule.

Moreover, people stung or put off protection because of scandals such as payment protection insurance (PPI) may need to be reassured of the differences between PPI and income protection (IP).

But how can advisers clear up this fog of mistrust and confusion?

Payouts

Clients worried that they won't get a payout if they need to claim on their IP should be encouraged by the latest claims statistics from the Association of British Insurers (ABI), according to Stephen Crosbie, protection director at Aegon.

He comments: "It is well known that a key barrier to closing the protection gap is a lack of confidence in providers to actually pay claims.

"Despite industry figures showing the highest number of payouts ever, there is still a perception among some consumers that few claims are paid."

In November last year, the ABI issued statistics showing that in 2015:

- £131m was paid every day to customers by UK insurers and long-term savings providers.

- £9.9m of this was from protection policies such as critical illness cover, income protection and life insurance.

- The UK insurance industry is the largest insurance market in Europe and the fourth largest in the world.

Yet as Mr Crosbie adds: "As an industry we need to work together to make better use of these positive figures to alleviate the consumer doubt that continues to linger."

Damian O'Connor, managing director of Roxburgh Financial Management, comments: "The majority of cases when income protection does not pay can be explained by non-disclosures, or claims within the deferment period where a client has returned to work before that has been completed.

"Advisers and clients can also be guided incorrectly by experiences in certain plans where the underwriting and claims process has been different, and where many plans have built-in exclusions or limitations."

The same is true for the group income protection (GIP) market.

Research from Group Risk Development (Grid) has revealed 14,600 people received payments in 2015, to the value of £347m a year.

This approximates to £950,000 a day, with the average claim amount standing at £21,884 a year.

"This should dispel the myth that GIP is only for the higher paid", says Grid spokesman Katharine Moxham.

In 2016, Drewberry launched a campaign to help bust the myth that insurers do not pay out.

The team ran a survey which found one in five people were put off buying protection because of a belief the insurer would not pay out.

Yet the ABI research revealed a payout rate in 2015 of 97.2 per cent across critical illness, income protection and life insurance.

"Eighty-seven per cent of guesses fell short of the official ABI statistics", says Tom Conner, director at Drewberry. "Given how valuable this protection can be, it is a worrying trend."

Won't happen to me

The biggest concern, according to many respondents to this guide, is that people don't see the point of income protection as they don't think they will be unable to work.

Advisers spend hours explaining the best way for clients to make the most of their investments but do not do enough to protect the income that provides the financing for those investments.

Mark Dennison, principal of LightBlue UK, comments: "The assumption you will always have an income is the cornerstone of all your life plans, and when you lost that income, you can lose everything else along with it.

"Making sure it is protected is essential."

Andy Simmons, senior income protection specialist at VitalityLife, points out: "There are ways of engaging the member beyond the core purpose of financially protecting themselves and their family.

"For example, Vitality's wellness programme informs members of their health risks, motivates them to engage in healthy activities and rewards them for doing so.

"So it is important to show income protection does what it promises, while reminding clients they can benefit from the policy not only in sickness but also in health."

Too expensive

Some clients may think individual income protection or group income protection is too expensive.

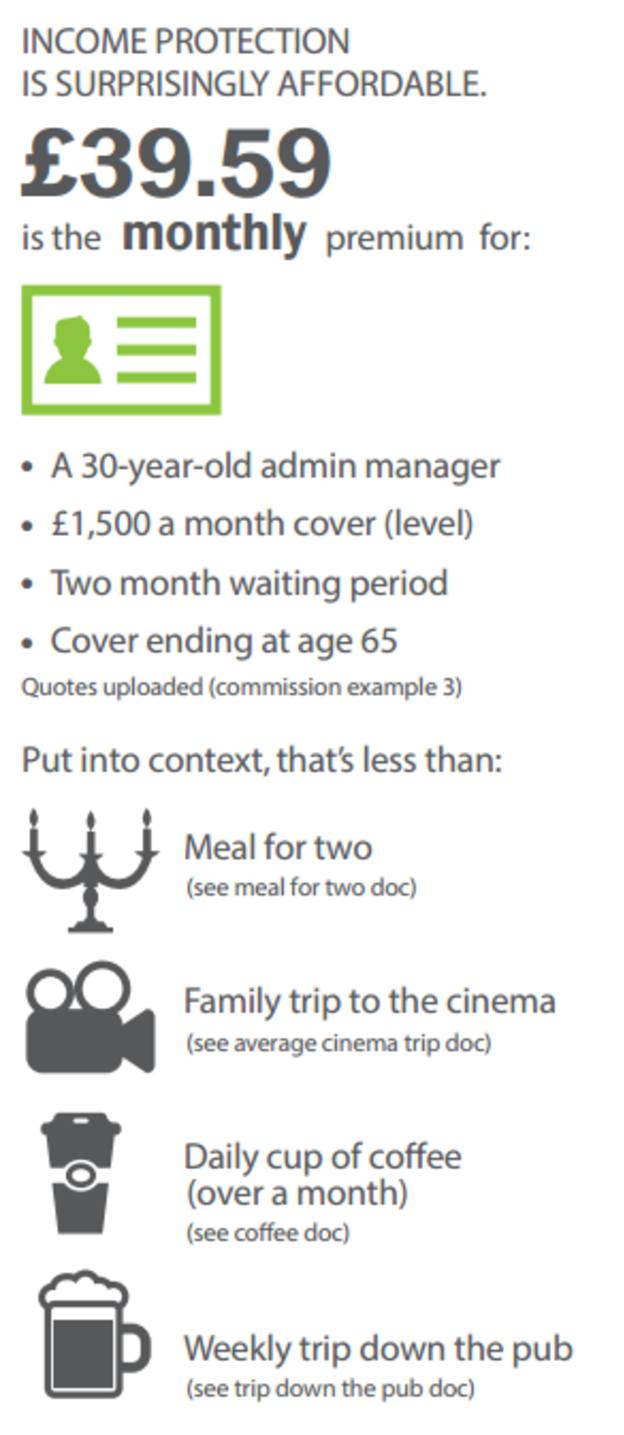

But respondents to this guide have said the average cost of income protection for a healthy person in their 30s should be about £30 a month.

That is just 10 expensive coffees from a high-street coffee chain, as LV's infographic below illustrates.

Figure 1: How income protection could be affordable (source: LV)

Steve Bryan, director of intermediary for Legal & General, comments: "Advisers need to address the misconceptions surrounding the cost of income protection.

"This form of protection has been viewed as an expensive product, but there are many affordable options available.

"Once someone understands the potential impact a loss of income can have on themselves or their family, the advantages of an income protection plan will outweigh any concerns over cost."

As for employers worried about cost, latest figures from Grid put the average group income protection cost at less than 1 per cent of payroll, and can be as little as 0.25 per cent.

Individual income protection is also cheaper than people may think. Mr O'Connor adds: "The premium cost is very manageable, with a variety of deferment periods and budget plans available across all occupations."

Need for case studies

Case studies showing how individual and group IP policies are a good way to demonstrate to clients the value of taking out cover individually or through the workplace.

According to Group Risk Development (Grid), having such policies in place not only provides a much-needed payout when people are hospitalised, but benefits attached to many of these plans can help people get back to work.

In some cases, early intervention can help rehabilitate someone before they need to rely on claim payouts to pay their bills.

Grid's Ms Moxham adds: "In 2015, group risk providers helped 1,878 people back to work through an active intervention before they reached the point of becoming a claim for IP payments.

"This represents 25 per cent of the claims submitted in 2015, and demonstrates the value added beyond paying claims."

Canada Life Group Insurance's table of real examples of companies and the cost in percentage terms as a proportion of salary is shown below.

| Company overview | Employees | Salary Roll | Quote A rate | Quote A cost | Quote B rate | Quote B cost |

| Cyber security | 15 | £870,500 | 0.073 | £635.47 | 0.087 | £757.34 |

| Event Organisers | 10 | £364,052 | 0.314 | £1,143.12 | 0.358 | £1,303.31 |

| Importer of Chemicals | 5 | £248,000 | 0.169 | £419.13 | 0.207 | £513.67 |

| Bespoke Jeweller | 4 | £209,500 | 0.55 | £1,152.25 | 0.688 | £1,441.14 |

| Data compression software | 11 | £500,907 | 0.185 | £926.68 | 0.218 | £1,091.98 |

| Commercial Kitchen design & manufacture | 10 | £246,991 | 0.552 | £1,363.39 | 0.619 | £1,528.87 |

| Specialist printers | 19 | £969,707 | 0.317 | £3,073.97 | 0.378 | £3,665.49 |

As Paul Avis, marketing director of Canada Life Group Insurance, comments: "Group income protection is also remunerative for advisers - at 30 per cent commission for every year."

Jeff Woods, business development director for Sesame Bankhall Group, says: "There are also some very good risk calculators on protection providers' websites, which advisers can use with their clients to assess the risk and demonstrate the need.

"There is a wide range of products available that cover nearly every need and scenario. There is almost always a way for advisers to offer this valuable cover to their clients who need it."

Promote the benefits

Nick Homer, group protection manager for corporate propositions at Zurich, says it is important to focus on the benefits of group protection for corporate clients.

He calls group income protection: "a valuable employee benefit that can help businesses run more efficiently."

His checklist of benefits include:

- GIP can help mitigate the peak costs of employee absence.

- Claims management approach offers early intervention and specialist rehabilitation support, which helps employers to:

- Deal with workplace absence, particularly mental health and musculo-skeletal conditions;

- Retain experienced staff by optimising their opportunity to return to work;

- Meet their duty of care obligations and the requirements of the Equality Act;

- Ensure consistency and independence in the management of long-term absence.

And with the support attached to plans in helping people get back to work, this can be valuable for employer and employee.

Paul Litster, managing director of Specialists4Protection, comments: "Most employers think their employees do not value benefits such as income protection.

"But with 77 per cent of employees we polled in 2016 admitting to feeling financially insecure, knowing they will get a replacement income if they are ill or injured is something they care about.

"Income protection covers a percentage of an absent employee's salary, reduces loss of productivity and recruitment costs, and frees up human resourcing time which typically goes on absence management."

simoney.kyriakou@ft.com