The managers of Baillie Gifford’s £1.2bn Monks Investment Trust have blamed “short-termist” institutions for the vehicle trading on a discount to NAV, as they move forward with a plan to tilt the investor base towards retail investors.

Lead manager Charles Plowden, who took over the portfolio with deputies Malcolm MacColl and Spencer Adair in March 2015, said the team had made a “decent start” in performance terms but could benefit from a shake-up of the investor base.

“We have been looking to find stable, long-term shareholders,” said Mr Plowden.

“The share register has moved from institutional shareholders, a lot [of whom] are not natural long-term holders and play the discount or are doing [short-term] asset allocation.

“Around 13 per cent has moved into retail hands. There’s a small proportion still to transition. Then we can get some proper tension in the valuation and bring down the discount.”

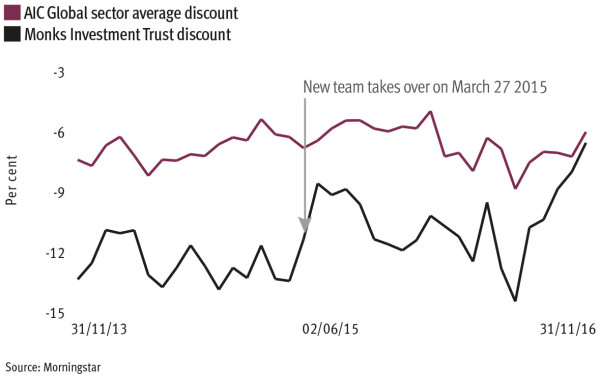

Having peaked at 14.5 per cent in June, the discount has since tightened to 6.6 per cent.

The plans come at a crucial time for the trust, which has seen returns pick up with the arrival of a new team, performance having previously been dubbed “disappointing” by analysts.

Since the team took over on March 27 last year, the trust has achieved an NAV return of 27.9 per cent according to FE Analytics, versus 20.1 per cent from its FTSE World benchmark.

However, Charles Murphy, an analyst at Panmure Gordon, poured water on the notion of using retail investors to close the discount and said only performance could improve the situation. He added that the presence of short-termist value investors was a “perennial issue”.

“Investors back performance. They very rarely back potential for performance,” he said. “There are a few discount-oriented investors who buy a trust because it’s cheap. But they tend to sell a bit and then wait for it to tighten further. So if the Monks team continues to deliver the performance, then investors who are short term will slowly sell. More to the point, the long-term investors will buy.”

He warned a deterioration in performance could trigger the opposite trend, with long-term investors departing and “value players” rushing in.

Alan Brierley, director of Canaccord Genuity’s investment companies team, added: “The problem for investment trusts is it takes some time, maybe 12 to 18 months, for investor perceptions to change. If the Monks performance is sustained, we would expect to see the shares recover. But it’s not going to happen overnight.”

However, he disputed the idea that short-termist institutions were present among the trust’s investors: “They are long-term investors – it’s just that they have a value tilt.”

James Budden, director of retail marketing and distribution at Baillie Gifford, said the reshuffle of the trust’s shareholders would help Monks enjoy similar success to that of the asset manager’s flagship closed-ended offering, the Scottish Mortgage Trust.

“We want to encourage these shares to be bought by long-term holders,” he said. “Then there is no stock overhang, and an excess of demand over supply. The end result is the trust trades on a premium and may issue new equity to satisfy this demand like Scottish Mortgage.”