Analysts are split over the viability of Alliance Trust's decision to shift to a multi-manager strategy, with some aggrieved over its similarities to Witan but others expressing hope in greater competition in the global equity space.

Alliance Trust's shares rose 2.4 per cent on the news it would sell Alliance Trust Investments (ATI) to Liontrust, therefore ending its contract with the manager for its global equity strategy. Instead, the £3bn trust will become a multi-manager vehicle managed by consultancy Willis Towers Watson.

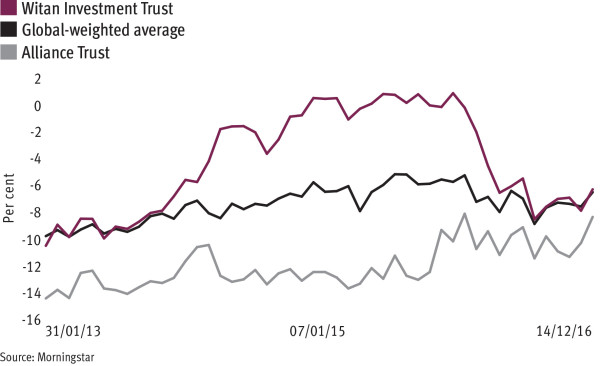

The shift puts it in direct competition with the £1.6bn Witan Investment Trust - the only other trust operating on a multi-manager global equity framework. While the former has an ongoing charges figure of 0.99 per cent, Alliance Trust has committed to a charge of 0.6 per cent.

However, analysts suggest a shift towards Witan's strategy could prove fruitless for the Alliance Trust, given a sharp decline in the former's premium to net asset value during the year, which now stands at a 6.3 per cent discount.

Simon Elliott, research analyst at Winterflood, said it was not clear how this version of Alliance Trust will substantially increase the fund’s appeal and relevance.

“We believe that these proposals are underwhelming and we would not be surprised to see a significant amount of opposition to them or, at the very least, apathy," he added.

Christopher Brown, head of investment companies research at JPMorgan Cazenove, said the move was not differentiated enough and "superficially similar" to Witan, but without the latter's hard discount control mechanisms.

“Sure, Alliance’s will be a more focused approach than Witan’s, but this will bring its own challenges in the form of the construction of the overall portfolio and any resulting gaps," he added.

Alliance Trust said that it will select eight different fund managers mainly focused on global equities to each create portfolios of 20 best ideas stocks, pushing the trust’s overall total number of underlying stocks from 60 at present to up to 200.

The trust also reinstated a share buyback programme and doubled its return target from a 1 per cent outperformance of the MSCI World index to 2 per cent.

It was these factors that led other analysts to be more optimistic. Charles Murphy, investment funds analysts at Panmure Gordon, said the move could be viable given the lack of competition in the multi-manager global equity space.

"There's always space for more than one doing the same strategy in the marketplace," he said.

Cantor Fitzgerald director of investment companies research Monica Tepes was even more positive.

"I think both can thrive, this is by no means a crowded space. Assuming both perform satisfactorily, Alliance Trust would also have a light edge with lower fees and larger market cap," she added.

Alliance Trust's decision comes after a review of its strategy - ignited by activist investor Elliot Advisors in 2014 culminating in the resignation of high profile figures such as Katherine Garrett-Cox.

But Anthony Leatham, head of investment trust research at Peel Hunt, said he was “underwhelmed” by the overall proposal and that he would prefer the trust to focus on generating returns.

“We prefer to focus on the prospects for improved performance and struggle to generate the same level of enthusiasm that the board and new manager have," he added.

The new fund of funds approach could be an even more conservative strategy than previous attempts to revive the trust, all of which had produced limited outperformance at best, Mr Leatham added.