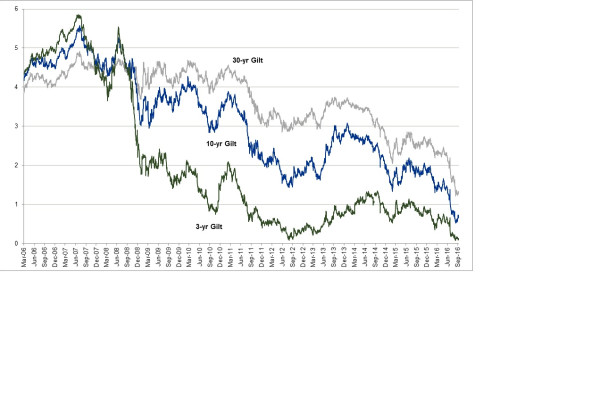

Given the low interest rate environment prevalent since 2009 and the decline in bond yields over the past eight years, investors seeking an attractive yield are looking at alternative assets, and at infrastructure in particular. While the yields on offer are attractive, do investors fully understand the asset class and are the risks clear?

Since 2006, a number of investment companies have listed on the London Stock Exchange and these have grown in scale as their investment proposition has attracted further investors. Some of these investment companies now have a 10-year track record, showing consistent and robust performance, including during the financial crisis.

Today there are three main groups of LSE-listed infrastructure investment company:

• five infrastructure funds focused principally on making equity investments into core infrastructure assets;

• three infrastructure debt funds investing in debt lent to infrastructure assets; and

• six renewables funds which invest in operational renewable energy assets such as wind farms and solar parks.

Their shares are traded like any other listed equity. A number have traded for a considerable time at sizeable premiums to their prevailing net asset value per share, which brings with it the risk that share prices may fall back to NAV at some point in the future. It should be noted though that even at these price levels, these companies offer yields and potential total returns that should prove attractive to many investors on the basis the shares are held for the long term.

The listed investment companies have a closed-ended structure which is more suitable for investing in underlying illiquid infrastructure investments. There are a number of open-ended infrastructure funds that tend to invest in listed infrastructure corporate entities, such as companies that manage infrastructure assets such as airports, ports, toll roads and water companies.

While the 14 closed-ended funds all invest in infrastructure, their returns and the risks underlying their portfolios vary. The infrastructure asset class is often described as though it is one homogenous group of comparable assets, but in reality the asset class encompasses investment opportunities with a broad range of risk/return profiles.

When considering an infrastructure investment, key points to consider include:

• How predictable the income stream is. For example, PPP projects have contractual availability payments based on performance, whereas an airport is dependent on the number of passengers and hence usage.

• How predictable the costs of managing and running the infrastructure asset are. The greater the contractual certainty on costs and expenses, the more predictable the investment return.

• The level of leverage. Infrastructure assets are normally financed with debt (secured against the project cash flows) and equity. The level of leverage should be appropriate to the infrastructure asset type. In the past, a number of toll roads were financed with too much debt and when traffic levels did not meet base case, they struggled to pay their debt costs.

Some of the advantages of investing in infrastructure projects include:

• Attractive long-term returns. By their nature, infrastructure assets are essential for the functioning of society and tend to feature long-term (or in perpetuity) cash flows.

• Stable cash flows, if structured appropriately. Revenues are often insensitive to the economy, and in the case of demand-based revenues streams (such as toll roads and airports) the demand is often stable due to the monopolistic nature of the asset.

• Diversification benefits. A portfolio of infrastructure assets has low correlation to other major asset classes resulting in compelling diversification benefits.

• Inflation protection. Through various mechanisms (for example, rates determined by regulators or contract payment terms with public sector clients) infrastructure assets generally benefit from a degree of correlation between returns and inflation.

• Share liquidity. The larger infrastructure investment companies enjoy good levels of share liquidity.

• Attractive yield. Infrastructure companies provide a solution for investors looking for yield in a continued lower-rate environment. Annual yields of between 4 and 7 per cent are currently available.

With these attractive potential returns, it is important to consider the potential risks, which vary by asset sub-sector within the overall infrastructure market. In addition, the 14 listed infrastructure investments companies have different specific investments within their portfolios and hence different perceived risk characteristics.

A number of the key risks to consider are:

• Sub-sector. As noted above, each infrastructure sub-sector has different risk factors, return drivers, and economic sensitivities.

• Political and regulatory. The counterparty to an infrastructure concession is often a government or a local authority. For regulated assets (such as water companies and electricity or gas transmission and distribution) there will also be a regulator involved. Clearly, the investment return will be dependent on the public sector abiding by the concession agreements to which they have contracted and, in the case of regulators, on each regulatory review being properly run. Regulation and the political decision-making process may differ between different countries and regions.

• Stage of development. An investment in a project in its construction phrase (often called a “greenfield” investment) has the additional risks of construction completing on time and to budget. Normally, construction risk is passed to a suitable construction contractor or consortium on a fixed-price date-certain contract.

• Counterparty risk. To ensure cost certainty, most infrastructure projects contract out the operational services and the maintenance of the asset to specialist companies on a fixed-price contract. In this situation, the investor’s return is dependent on that contractor providing those services to an agreed standard as poor performance or cost overruns may impact investment returns.

• Financial counterparties. As already noted, infrastructure projects are financed with debt and the nature of this financing means that long-term interest rate hedges will be put in place (to reduce interest rate volatility). During the financial crisis of 2008/9, the concern was that infrastructure projects had cash on deposit with a range of financial institutions, the credit quality of which, in some instances, declined fairly rapidly. Management of these cash deposits was required to move them to acceptable credit counter-parties.

Often, infrastructure investments are compared with government debt or gilts as they have local authority counterparties. The risks involved are different across the asset class and that is why infrastructure investments have higher yields commensurate with the risks attached. Nonetheless, a number of investors are increasing their allocation to infrastructure as they are becoming more familiar with the risks and returns involved. With its diversification benefits, stable yields and inflation-linked upside, infrastructure should not be overlooked as an integral component to the investment portfolios for retail and institutional investors alike.

Tony Roper is managing partner of InfraRed Capital Partners (which acts as the Investment Adviser to HICL Infrastructure Company)

Key points

Investors seeking an attractive yield are looking at alternative assets, and at infrastructure in particular

A number of listed infrastructure vehicles have traded for a considerable time at sizeable premiums to their prevailing net asset value per share

A key point to consider includes how predictable the income stream is