Both June’s Brexit vote and November’s election of Donald Trump as the next US president caused markets to react violently in the short term, suggesting investors were caught off guard.

Although equity indices resumed their upward trajectories following both events, the political shocks hastened a switch in market leadership – from small caps to large caps in the case of Brexit, and from defensives to cyclicals following the US election.

Daniel Greenhough, an investment manager at Lumin Wealth Management, warned that 2016 was “not the year for high-conviction views” because of the presence of market-moving political events.

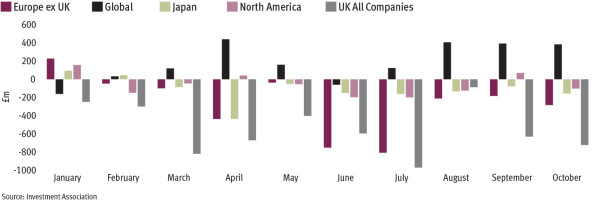

The sense of caution among retail investors has been reflected in equity fund flows: the asset class has seen almost £10bn in net redemptions in the first 10 months of 2016.

Just one of the 18 Investment Association equity sectors has seen inflows this year: the IA Global sector, driven almost entirely by the popularity of Terry Smith’s Fundsmith Equity fund. The product’s strong relative returns have started to dip for the first time since launch in the past three months as a result of the market’s move away from consumer staples.

Rory McPherson, head of investment strategy at Psigma, highlighted the benefits of diversification. “It would be irresponsible to put all your eggs in one basket [in the current conditions],” he said.

“You either look like an absolute hero or blow yourself up. It pays to be broadly diversified.”

Peter Fitzgerald, global head of multi-asset at Aviva Investors, said 2016 had seen misplaced conviction bets because investors had misunderstood probability theory.

He said: “When people have a 70 per cent probability [as in the odds of Hillary Clinton winning the US election] they think it’s a nailed-on certainty. But that is very close to 66 per cent, which is two thirds.

“It’s like rolling a die and hoping a five or six doesn’t come up. People need to understand that better when they invest in portfolios and comment on events.”

But as another year punctuated by major elections approaches, other fund buyers have reiterated the merits of conviction investing.

Ben Kumar, a manager at Seven Investment Management, said the firm would continue to back high-conviction funds such as Majedie’s UK Focus offering and Jupiter UK Growth because of their long-term performance.

“We are looking for concentrated managers who are prepared to be wrong for a period of time,” he explained.

“It’s really hard but there are areas where concentration is well rewarded.”

Mr Kumar also dismissed concerns that 2017 would be a similarly challenging year in which to make bold calls – noting that 2013 and 2014 had proved fruitful for investors despite being littered with surprise macro events such as the taper tantrum.

Mona Shah, a senior research analyst at Rathbones, added: “The current environment isn’t really relevant. You have got to have a long-term time horizon if you are going to use a concentrated strategy.”

SBN Wealth Management’s Dan Farrow said the industry should be taking “directional risk” to avoid the risk of becoming “closet trackers”.

However, Mr Farrow’s approach for 2017 has been to put 75 per cent of client portfolios into passives – because of both costs and the downside risks facing active propositions.

“Sterling could really damage many active funds that have ridden the wave of Brexit currency turmoil,” he said.