But this industry rarely stands still and 2016 provided plenty of challenges for traditional wealth management businesses – whether it was the demands of ever-present and ever-changing regulation, or the rise of the digital consumer and propensity for an ‘ask the audience’ approach to seeking advice from peer groups and ‘open investment communities’.

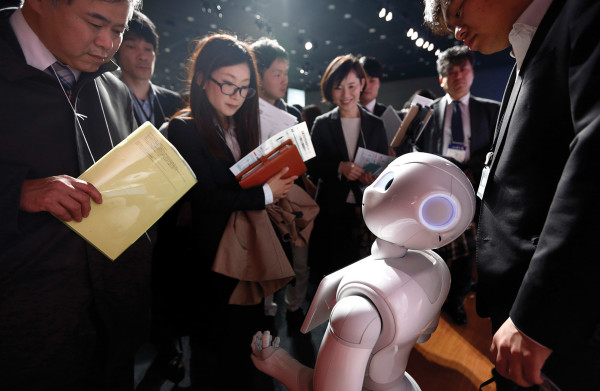

Against this shifting landscape, there has been considerable technological innovation from both new entrants and established players.

Over the past 12 months, we have glimpsed the possible benefits so called ‘robo-advice’ can deliver. This suggests that in 2017 wealth management firms will gain a competitive advantage by adopting integrated digital capabilities that are aligned with their more holistic offline propositions.

To fully realise this potential, firms need to ensure they are delivering consistent services and customer experiences through a unified technology platform. Just bolting on digital solutions without ensuring they are aligned with – and able to ‘speak’ to – existing technology is likely to result in legacy issues in the future or, worse still, regulatory enforcement if the advice and suitability processes are misaligned.

Digital capability is now viewed by many as both a necessity and an opportunity, with Capgemini’s World Wealth Report 2016 finding that more than 80 per cent of wealth managers recognise the potential positive impact of digital tools on clients’ interactions.

It is not something that has to be adopted wholesale; it is about implementing a digital strategy as part of an overall proposition that can provide a point of difference and enhance traditional wealth management. No matter what route wealth managers decide to take, the focus should be about providing greater choice and flexibility for the end customer, whether it be face to face, digital or a combination of the two.

Everyone in the wealth management sector will be familiar with the increasing emphasis on controlling costs while keeping pace with regulatory change, including preparations for the upcoming Markets in Financial Instruments Directive (Mifid II).

In the past year, some wealth managers have embraced technology as a way of tackling these issues, thanks to its ability to create efficiencies that can reduce overheads.

Good technology is designed with scalability and adaptability in mind, allowing savvy wealth management firms to focus on growth with the additional security that this technology will develop alongside the business while adjusting to changing regulations.

But the most interesting development in 2016 was the recognition among key industry players of the powerful data that lies at their fingertips. After all, a crucial part of what makes good wealth management is the ability to interpret data provided by the client.

Properly connected data not only saves time and reduces duplication of manual inputs, it can also build a much clearer picture of a client’s needs, helping improve a firm’s understanding of its end customers.

Looking at each of these developments together, it is clear there is a need for the wealth management industry, with an eye on 2017, to future-proof business against the potentially distracting – and even debilitating – effect of the increasing regulatory burden and governance controls. And, perhaps even more importantly, future-proofing against global trends in all areas of our lives by enhancing client service.

While some in the industry are putting this into action, it is concerning that there are far more firms out there that have yet to take the crucial step of upgrading their technology.

Further challenges are on the horizon this year, including the growing need for robust cyber security and, more broadly, the pace of technological change.

All the more reason, then, for wealth managers to maintain their focus on improving technology over the next 12 months.

Andrew Foster is executive general manager, private wealth, at Iress