The proportion of funds achieving consistent outperformance plummeted to a seven-year low last year as volatility and sector rotations took their toll on active managers.

By the end of December just 13 vehicles from a universe of 1,140 funds had produced a top-quartile sector performance every month over the past three years, according to BMO Asset Management’s Fundwatch study.

The survey, based on analysis of the 12 main Investment Association sectors, showed that the number of consistent funds fell steadily throughout 2016.

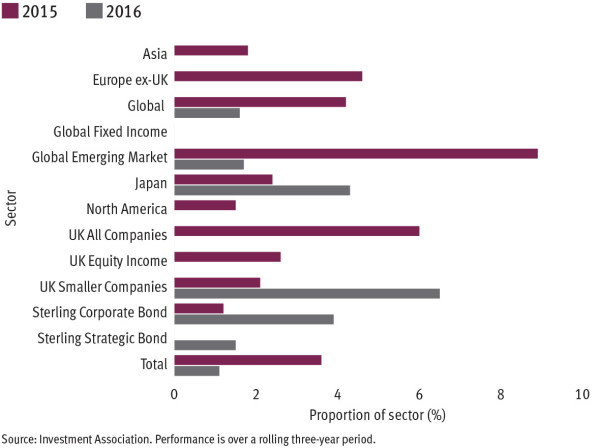

A year ago the proportion was 3.6 per cent, with global fixed income funds the only sector not to have at least one standout.

The figure had fallen to 2.5 per cent by September 30 and then suffered a sharp downturn to reach 1.1 per cent by the end of the year.

Last year’s volatility caused much disruption to fund managers – and nowhere was this more apparent than in the UK Smaller Companies sector.

At the end of the 2015 the sector was home to the lowest proportion of consistent performers.

But 12 months on and the sector has become the most consistent, albeit thanks to just three of the 47 eligible products.

Next most consistent was the IA Japan sector, in which 4.3 per cent of funds displayed the required levels of outperformance, followed by the Sterling Strategic Bond grouping’s 4 per cent.

At the end of 2015, the Global Emerging Markets sector was the most consistent, with 8.9 per cent of its funds regularly outperforming, but by the end of last year this proportion had fallen to 1.7 per cent.

“Amazingly, half of the 12 sectors failed to have any consistently top-quartile funds over the period,” the report said.

The sharp fall in consistency is most likely due to the shake-up of outperforming sectors and asset classes witnessed last year – where value stocks outperformed growth companies and bond yields rose notably following the US election.

The report authors, F&C multi-manager co-heads Gary Potter and Rob Burdett, likened the change to that of the 2013 taper tantrum.

“The end of 2013 saw the taper tantrum in the US, with the final quarter of 2016 seeing unusual moves following the result of the US presidential election,” they said.

“Both events saw rotation in market leadership and therefore a change in the style of fund that would benefit the market environment, which undoubtedly contributed heavily to the fall in consistency.”

At the end of 2015, 37 funds held the accolade of being consistently top-quartile, with 15 coming from the UK All Companies sector and seven from the Global equity grouping.

Twelve months on and the UK All Companies peer group had lost all of its consistent performers.

Only the IA Japan sector saw an increase in the numbers of consistent funds, from one to two, but these accounted for a lower proportion of the sector as the total number of vehicles rose from 41 to 47.