The brainchild of entrepreneurs Alex Michael and Victor Trokoudes (a former trader with Morgan Stanley), Plum aims to get young people engaged with building up a savings pot.

According to Mr Trokoudes, the duo noted two trends: a yawning savings gap and a shift towards robo advice and financial services technology.

They decided to create something that could use secure automation to help close the savings gap, particularly among young people.

He commented: "We realised, however, that trying to get people to put money aside in the first place was a big, uphill challenge.

"Not only are young people struggling to pay rent and meet the bills, but also having a savings habit requires commitment, planning and being prepared for the future. Many young people can find this boring.

"We created Plum to be as seamless as possible, using technological developments and behavioural inertia to help people build up small amounts of savings incrementally."

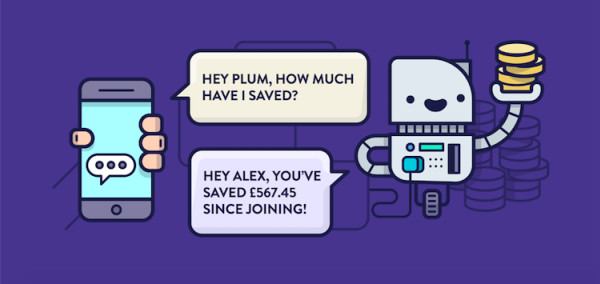

Plum is a robot - an artificial intelligence-powered Facebook Chatbot which connects securely to users' current accounts, and uses algorithms to work out how much an individual can afford to set aside throughout the month.

For example, it might consider a person could set aside £100 a month but it would take this in smaller increments throughout the period, which Mr Trokoudes said "took the friction" out of people making a commitment to saving money.

"It takes out small amounts incrementally, adjusting according to an individual's spending patterns. So, for example, if someone has a lean month, Plum will not take out very much", he explained.

The accumulated savings are put into an account with an FCA-regulated e-money provider, Mango Pay, and individuals are sent messages via Facebook about how much can be put aside. The individual has final control, however.

According to Mr Trokoudes, this will start people on a savings habit that will lead towards bigger things, such as Isas, and eventually to regulated advice.

He said: "There's no interest available in high street current or even savings accounts at the moment, and many of the decent savings rates that are available require bigger deposits of £1,000 or £2,000.

"Plum is designed to help people discretely and painlessly build up a suitable savings deposit so they can invest their money into a tax-incentivised savings plan", he said.

"Products such as Isas make sense and once people have gotten into the savings habit, they can transfer their savings into these products and, hopefully, continue to build upon their investments.

"Later on, when they have accumulated wealth, they will be ready to talk with a financial adviser who can help them with proper financial planning.

"This is where we fit in: we want to help people overcome the initial challenges to saving, and get them to a point where they have the option to go to a financial adviser", Mr Trokoudes added.

The beta-testing of Plum started in October 2016, and is now available for the wider public to sign up.

Eventually, the team wish to develop a service to help young people "stop getting ripped off on bills", Mr Trokoudes said, "and point them towards and financial planning they may need at different points in their life".

simoney.kyriakou@ft.com