The recent groundswell of demand for passive funds has begun to manifest itself more visibly in the discretionary space, as cost scrutiny pushes wealth managers into offering cheaper propositions using trackers and other forms of index fund.

Discretionary fund managers (DFMs) have typically relied on active funds to demonstrate the benefits of their approach, but preferences are changing. Earlier this month Brewin Dolphin introduced a range of managed portfolios that invest predominantly in passives, following swiftly on from AJ Bell’s decision to launch a model portfolio service (MPS) using passives and similar moves by Tilney and others.

Other wealth managers, such as Plutus Wealth’s P1, are set to follow suit this year, Investment Adviser understands. Commentators believe a mix of client demand and cost pressures are prompting the shift.

“I would not be surprised to see more of this type of proposition coming to market, offering a combination of passive funds with active asset allocation,” noted Gillian Hepburn, director at DFM specialist Discus.

Graham Bentley, of investment consultancy gbi2, added that discretionary firms could increasingly turn to passives as a painless way of cutting costs.

“One way to alleviate [competition] is to lose 60 basis points by going the passive route rather than going to active,” he explained.

Such activity in the wealth space comes at a time when asset managers have been taking similar action on their own multi-asset ranges.

Last week, Iboss Asset Management announced it was cutting the charges on its multi-manager funds by upping the use of passives, citing client demand and regulatory scrutiny on costs.

Chris Chancellor, partner at research provider Mackay Williams, predicted that passives would also start to occupy a bigger part of asset managers’ launch slates more broadly.

With increased demand, providers are playing catch up to launch more passive funds and more groups are entering into passive provision,” Mr Chancellor said. “It’s a very fast-growing area and is now large, so it’s natural groups look to this as an opportunity.”

The push stands in stark contrast to the drop in the number of active fund launches seen since the start of last year.

Figures provided to Investment Adviser by Thomson Reuters Lipper indicate there were 138 UK-domiciled active fund launches in 2016, the second lowest level in the past decade.

Last year proved a testing time for active managers, who struggled to keep base with benchmarks that ended the year much higher despite sell-offs and market rotations.

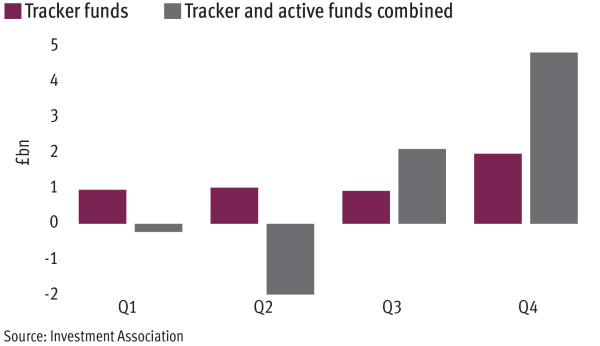

Investment Association figures suggest the demand for trackers was able to hold up well in this environment. Net inflows of £4.8bn, while well down on 2015’s figure, helped the products increase their market share by 2.2 percentage points to 13.5 per cent.

But with discretionaries looking to tap into the shift, commentators have cautioned that a rush into the passive space could produce diminishing returns.

“There will be more [passive-based launches], for sure,” said Mr Bentley. “But I’m not sure about the efficacy of launching more. It’s a question of what makes them more distinctive. If you will have similar asset allocations and they all have passive, what makes them different from anyone else?”

IN NUMBERS

£4.8bn

Tracker fund inflows in 2016

0.42ppt

Fee reduction in Iboss’s 20-40% Equities multi-asset fund