Article 6 / 6

The Guide: Tax Efficient InvestingLack of supply spurs ‘mad dash’ for VCTs

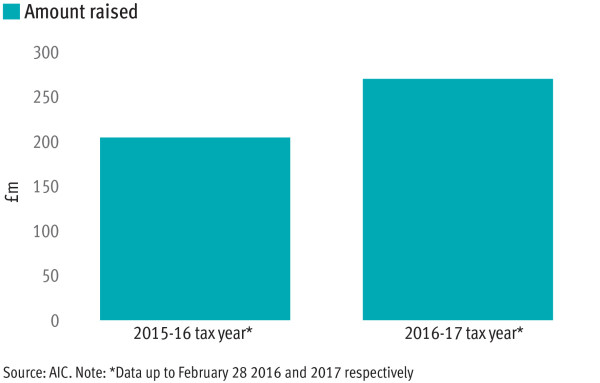

Figures from the Association of Investment Companies show fundraising in VCTs for the 2016-17 tax year to February 17 2017 had reached £265m, a 43 per cent increase on the £186m raised in the same period in the previous year.

This has led to some suggesting there has been a “mad dash” for VCTs to offset the pension changes, but this may not be the only driver. Recent rule changes to VCTs in November 2015 to focus on ‘younger’ growth companies have also had an effect.

Alex Davies, co-founder and chief executive of Wealth Club, suggests there is a capacity crunch in the sector that is driven by both less supply and more demand.

He explains: “VCTs are looking to raise £389m this year compared with £458m in the previous tax years. The main reason for the reduction is rule changes, which have banned management buyouts and restricted the size of company you can invest in.

“New rules in general have made managers quite cautious – before they raise lots of money they need to ensure they fully understand the rules and have a likely home for their money. Popular VCTs [such as] Mobeus and Baronsmead have not raised at all this year.”

More than 10 VCTs had already sold out as of March 10 2017, with a couple also filling their overallotment facilities, while the Octopus Titan Venture Capital Trust secured its largest ever fundraising of £120m.

Mr Davies notes: “The velocity of this shows the remaining offers are likely to sell out very quickly. Once advisers and investors see how suddenly these offers have filled up, even those offers that have been steadily bumbling along are likely to be suddenly bombarded with a wall of cash.”

He believes the catalyst to this demand is threefold – pension changes, the increased dividend tax and the crackdown on buy to let. “If you are wealthy your ability to save simply and tax efficiently has been crushed. EISs [enterprise investment schemes] and VCTs are the last place those with significant assets can go,” he says.

But he adds: “Typically, big investors leave their VCT contributions to the last few weeks of the tax year. We believe many people will get to the end of March and suddenly realise there is no home for their money. A lot of this excess capacity will end up in EISs, [which] have their own capacity issues, but there are still some decent deals out there.”

Will Fraser-Allen, deputy managing partner at Albion Ventures, agrees there has been a lack of supply, with a number of established managers not raising money partly because of the rule changes.

“VCT managers were getting familiar with the new rules and HMRC were getting familiar with the practical implementation,” Mr Fraser-Allen says.

“A number of managers [probably] had sufficient cash that they didn’t feel the need to raise more this year given the relatively low investment levels last year. Now the rules are bedded in, the investment rate is increasing.”

But while the supply may be smaller, he says the demand may not be that much higher than normal, in spite of the pension restrictions. Instead it could simply be a timing difference, where investors have been encouraged to invest sooner rather than later because of the well-documented changes.

Tony McGing, chief executive of Downing, agrees this fundraising trend is “not unexpected, given that supply has been reduced as a consequence of restrictions on the number of companies that qualify for VCT funding”. He also highlights that the consistency of dividends among VCTs has been a key driver for those affected by pension changes.

Mr McGing adds: “We’re also beginning to see the typical last-minute spike in fundraising, as people will always leave this to the last minute despite encouragement from the industry to invest early – it’s just human nature.”

Looking ahead, Mr Davies says: “It seems that we will face at least the same capacity issues as we did this [tax] year, next year. In addition, I don’t think the effect of pension changes has really kicked in yet. A lot of people still don’t understand that they have been affected.

“This year there are still quite a few high earners who can carry forward unused pension contributions from previous years, so will only start seriously considering alternatives next tax year or the year after.”

Nyree Stewart is features editor at Investment Adviser

Closed generalist VCTs with track record

| Fund | Tax year 2016-17 (excluding overallotment) | Amount raised at close | Closing date(fully subscribed) |

| Albion Crown Place VCT ord share | £6m | £6m | 22/02/17 |

| Albion Development VCT ord share | £4m | £4m | 30/01/17 |

| Albion Enterprise VCT ord share | £6m | £6m | 20/02/17 |

| Albion Kings Arms Yard VCT ord share | £6m | £6m | 22/02/17 |

| Albion Technology & General VCT ord share | £6m | £6m | 02/02/17 |

| Albion Venture Capital Trust ord share | £6m | £6m | 09/02/17 |

| British Smaller Companies VCT | £4.25m | £4.25m | 27/02/17 |

| British Smaller Companies VCT 2 (top up Jan 2017) | £4.25m | £4.25m | 27/02/17 |

| British Smaller Companies VCT 2 (top up Jan 2017) | £4.25m | £4.25m | 09/01/17 |

| Calculus VCT D shares | £4m | £4m | 02/02/17 |

| Maven Income & Growth VCT 6 ord shares | £8m | £8m | 07/02/17 |

| Northern 2 VCT ord share | £4.3m | £4.3m | 09/02/17 |

| Northern 3 VCT ord share | £4.3m | £4.3m | 09/02/17 |

| Northern Venture Trust ord share | £4.3m | £4.3m | 09/02/17 |

| Proven Growth & Income VCT ord shares | £40m | £39.2m | Closed 31/01/2017 |

| Source: www.taxefficientreview.com. As at March 10 2017 | |||