Attractive valuations and a desire to “diversify away from Brexit” have led Franklin Templeton manager David Zahn to favour debt issued by US industrial names within the firm’s recently launched UK Corporate Bond fund.

Mr Zahn, the asset manager’s head of European fixed income, has pointed to the attractive nature of yields on offer from UK corporates relative to credit in other developed economies as one reason for the fund’s launch last month.

“UK credit is still some of the cheapest credit globally [among developed markets] on a hedged basis,” he said.

However, the potential volatility unleashed by Brexit-induced uncertainty has prompted Mr Zahn, who runs the vehicle with Roderick MacPhee, to take advantage of the UK debt market’s global character.

“We have been looking at some US industrials that have been issuing over here,” he said.

“The UK corporate bond industry is very international. We have got quite a good global supply. US industry helps us diversify away from Brexit.”

With the UK triggering Article 50 this week, commencing divorce proceedings from the EU, the manager believes UK corporate yields could remain attractive as investors potentially rush to safe assets such as gilts.

Mr Zahn said: “You have this little thing called Article 50. People will be slightly more nervous and want more defensive assets. Gilts should do well in that environment. With that as an undercurrent, I think that UK corporates offer some fundamental yield.”

The portfolio has a yield of around 2.5 per cent as a result of its current approach.

Mr Zahn was relatively sanguine on duration risk. While he notes the portfolio’s primary role is as a credit fund, its current duration is only slightly less than that of its benchmark.

“Longer-dated credit is one area where we think there’s some value, [particularly] in the industrials space,” he explained.

“We are probably just a little under the benchmark. Inflation is ticking up in the UK, but we think that is transitory off the drop in sterling and [recovering] oil prices. We think the MPC will look beyond that.”

In the shorter-dated segment of the market, the team has continued to back industrials but has also picked up some financial exposure.

“We have more financials at the short-dated end – the volatility won’t be quite as high down there,” Mr Zahn said.

While he was less enthusiastic about longer-dated debt from financials, he said this view mainly centred around price.

“We don’t think there’s a huge amount of value,” he added.

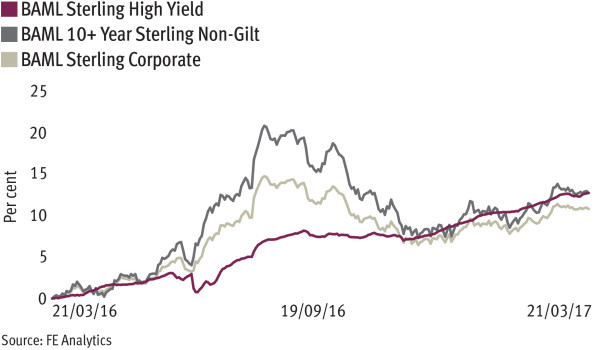

The manager also shares the view of several fixed income specialists, among them Invesco Perpetual’s bond team, who argue that much of the high-yield debt market looks too expensive. As such only a few of the names in his portfolio, which has between 60 and 70 holdings, come from the space.

Mr Zahn explained: “An area we haven’t done much in is high yield. At this juncture we think investment grade is probably favourable compared with high yield.

“We get higher yields in investment grade than we do on government bonds, but we don’t have as much volatility as in high yield. If we get better quality names, we don’t have as much spread risk.

“I don’t see why we should go chasing high yield at the moment.”

IN NUMBERS

2.5%

Yield from the Franklin Templeton UK Corporate Bond fund

60-70

Range of holdings in the portfolio