The team behind the £1.7bn Witan Investment Trust has turned its focus to the likes of emerging market small caps, in a bid to correlate exposure more closely with growth in the region.

Last year the team opted to invest in Somerset’s Emerging Markets Small Cap fund, run by Mark Asquith, as part of an onus on local exposure.

“We bought a small-cap fund because those companies tend to be more closely aligned with the [economies] where they are based,” Witan investment director James Hart explained.

“If you take Samsung or Taiwan Semiconductor, they are global in character. This fund invests in companies that are more closely aligned with the economic growth.”

While Witan can invest 10 per cent of its assets into collective vehicles such as Somerset’s, it generally outsources investment management to a series of third parties using segregated mandates.

Earlier this year the trust appointed GQG Partners to run a £70m emerging market portfolio, making up around 4 per cent of the trust’s assets.

Mr Hart said the appointment came in part to allow selective exposure to the region, which remains fraught with potential risks.

“We didn’t want blanket exposure, because we would get China-owned banks or companies like Samsung,” he said.

“We wanted someone to sniff out the best opportunities, wherever they are in emerging markets. There’s no restriction on [GQG] – if [for example] they don’t want to be invested in Brazil, they don’t have to be.”

An increased focus on emerging markets has also been reflected in the trust’s benchmark, which acts as a rough guide for allocations.

At the end of 2016 the benchmark was overhauled, with emerging markets being included for the first time with a weighting of around 5 per cent. This came at the expense of the UK benchmark weighting, which fell from 40 to 30 per cent, in part because of income considerations.

“One of the reasons people kept an unnaturally high exposure to the UK was this reliance on income that the UK was able to provide,” Mr Hart said, suggesting it was also because of UK companies’ exposure to emerging market customers.

He added: “It has become easier and more attractive to invest directly in Asia and emerging markets in local terms, rather than getting exposure through UK-based businesses.”

While Mr Hart said that the trust would never “lean dramatically” towards Asia and emerging markets due to its global remit, the joint weighting of these two geographies was not insignificant.

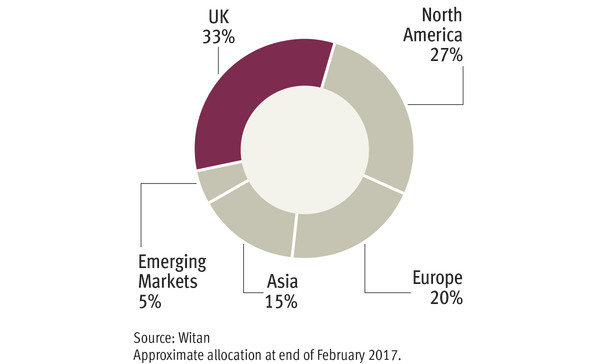

Emerging markets represent around 5 per cent of assets, while Asia has a weighting of roughly 15 per cent. The UK makes up around 33 per cent, while 27 per cent is allocated to the US and 20 per cent to Europe.

In another move, late last year the Witan team invested in Syncona, formerly known as the Battle Against Cancer Investment Trust. The vehicle seeks to provide patient capital for life science companies.

“We wanted to be involved with a vehicle that’s evergreen rather than in a venture capital structure,” Mr Hart said.

The Witan trust has returned 49 per cent over three years, compared with an average of 45.2 per cent from its AIC Global peer group, data from FE Analytics shows.

Witan works to recover from Aviva’s disposal

Another area of focus for the Witan team has been buying back Aviva’s stake in the investment trust.

Last year Witan announced plans to buy all of Aviva’s shares in the trust – to the extent they were not placed with other buyers – at a discount of 6.5 per cent.

Investment director James Hart noted that the trust had normally traded at “close to net asset value (NAV)”, but had seen its share price suffer because of concerns about Aviva’s planned divestments.

“There was a sell-off for a number of investment trusts,” he said. “That was because of Aviva selling a big stake in the Mercantile trust. People said ‘what else do these people own?’ and it was Witan.”

Since buybacks commenced, the discount has retreated to around 4.5 per cent.

“We are hoping to trade at NAV soon,” Mr Hart said.