Article 2 / 5

The Guide: Multi-Asset InvestingPolitical risk clouding positive equity market sentiment

Even if we can’t really speak about a complete irrational exuberance, markets appear to be pricing in a perfect world where economic and earnings growth may only surprise on the upside, inflation pressures do not exist, central banks will continue to sit on the accommodative side forever and political risk will never materialise.

This begs the question: are investors walking on egg shells?

Despite some recent value creeping into US Treasuries, in a wider context they continue to defy the forces of economic reality.

There is something surprising about the relatively anodyne reaction, given the increasingly hawkish tone in the US Federal Reserve’s recent comments regarding the inflation figures that came out above expectations.

There has also been further acceleration in leading indicators, confidence surveys and economic activity in the US. Either the bond market has already anticipated a large part of the cyclical upturn and its consequences on the monetary policy of the Fed – quite possible given the already extremely speculative net short positioning on US Treasury futures – or there is some form of complacency or blindness that now reigns in the bond markets.

Concerns have been raised regarding bond valuations for some time, yet during the past few months it can be argued some value has resurfaced in western government bond markets.

In a relative sense, the US bond market has considerably better value than the other core government bond markets such as German Bunds, UK gilts and Japanese government bonds.

Few financial assets can act as a parachute in portfolios in the event of a risk-off scenario, and particularly those whose valuations have become more attractive since the US election.

The additional value of US Treasuries has improved significantly in terms of risk-adjusted returns in a balanced portfolio. This allows investors to continue to add risk assets, such as stocks, high-yield debt and emerging market currencies, by diluting their volatility and inherent risk with a large dose of these bonds.

The more valuations rise, the more the mix of Treasuries and risk assets become less stable. It may indeed be too early to worry, because inflation does not seem ready to fully manifest in the western world and the economy shows no sign of shortness of breath as the first round of the French presidential elections approaches.

But market participants currently pay very little attention to equity valuations and now more than ever the focus is on sentiment.

A very good example of investors’ complete lack of regard for valuations is the Nasdaq. The index has performed spectacularly well in recent years, and even year to date it has posted almost twice the performance of the S&P 500.

Yet in terms of valuations there is nothing that would justify such euphoria. The trailing price-to-earnings (p/e) ratio is close to 41, almost twice the p/e ratio of the S&P 500, and analysts expect the earnings of this index to more than double in the coming year.

In Europe, political risk clouds any of the positives that equity markets have to offer.

While some believe the French election – despite the outcome – might well be the catalyst for a meaningful rally in European equities, investors must be aware of the potential volatility that could materialise in the run-up to the election.

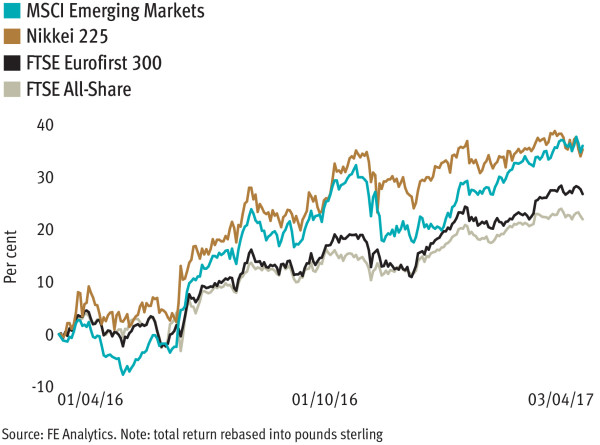

It might also be appropriate for investors to consider upgrading their stance on emerging markets. The rationale for this is partially due to the fact that valuations have improved somewhat and that the US dollar’s strength seems to be fading.

When it comes to global equity markets, investors are stuck between a rock and a hard place. Ignoring Japan for a moment, US equities are too expensive and European equities are too risky. Hence emerging markets might well become a ‘cheapish’ safe haven market for investors in the coming months.

Hartwig Kos is deputy chief investment officer at SYZ Asset Management