A “sharp fall” in the number of companies listed in the US could be supporting the growth of passive strategies and also limiting retail investors’ opportunity to access returns in the region.

A research paper authored by Credit Suisse’s global financial strategies team suggested the dearth of listings in the US has led to more concentrated industries, full of larger and older stocks.

They said this has limited the scope for alpha generation given the market’s “informational efficiency” – the term used to describe the speed at which a company’s share price fully reflects its true value.

The paper also suggested the lack of listings and inefficiency, and growth of passive strategies, meant smaller investors were now less able to fully access the US market’s potential.

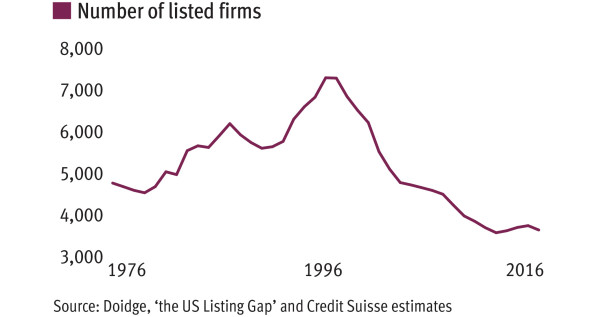

Named The Incredible Shrinking Universe of Stocks, the paper showed that the number of listings in 2016 was half that in 1996 – a trend not replicated in any other developed market.

Mergers, acquisitions and fewer incentives for early-stage companies to enter public markets were behind the fall.

The shrinking number was the main “feature of change” in the market over the past 20 years, and was significant given US stocks account for more than half of global equity markets, according to authors Michael Mauboussin, Dan Callahan and Darius Majd.

“There are fewer listed companies today than there were in 1976, despite the fact that the GDP is three times larger now than it was then,” the authors wrote.

“The companies that are listed on exchanges are bigger, older, and in more concentrated sectors than two decades ago.

“This likely contributes to public markets that are more efficient than ever before.”

The lack of listings and survival of mature stocks meant “gaining an edge” was more difficult.

Thus the fall was a likely catalyst for the growing number of passive strategies and growing perception US equities are difficult for active managers.

The average manager in the IA North American sector has significantly underperformed the S&P 500 on all time bases up to 10 years.

The proportion of active funds outperforming the index is only 13.6 per cent on a 10-year basis, and falls to 9.3 per cent over five and 6.4 per cent over three.

The authors added: “We speculate that the maturation of listed companies has also contributed to informational efficiency in the stock market…[and] be one of the catalysts for the shift that investors are making from active to indexed or rule-based strategies.”

However, the paper’s conclusion also noted investors now needed a much higher level of sophistication to access “reasonable” exposure to US equities.

The authors said investors in the 1970s could use an early stage venture capital fund and have S&P 500 exposure and be aligned with corporate growth.

“Today, [investors] need to participate in early- and late-stage venture capital, a private equity buyout fund, and the S&P 500. Only a few investors have access to all of these alternatives,” they said.

However, plummeting numbers of US stocks would benefit income investors, the authors noted.

“The overall size and maturity of listed companies means they are more likely to pay out cash to shareholders in the form of dividends and share buybacks than companies were in the past,” they said.