Fund buyers have lamented the increasing difficulty of adequately diversifying portfolios in light of an escalating level of correlation between global bonds and equities.

With sterling weakness aiding overseas investments but political risk making investing on a country-by-country basis more difficult, global approaches have proved popular with fund buyers in the past 12 months.

The Investment Association (IA) said its Global peer group was the best-selling equity sector among retail investors in 2016, with £2.6bn in net inflows at a time of redemptions more broadly. But data indicates that correlations between global equity and bond funds have risen sharply in the same period.

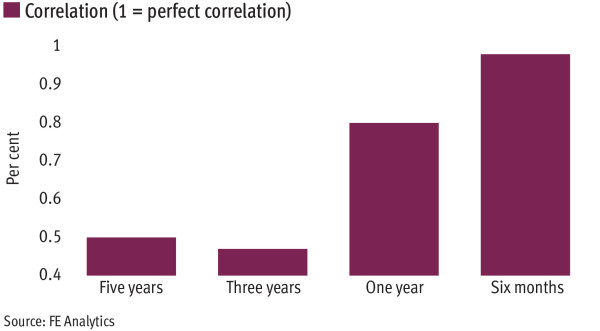

Analysis of FE data by Investment Adviser shows the correlation between the IA’s Global Bond and Global sectors, which stands at 0.47 on a three-year view, has increased to 0.8 per cent over one year and 0.98 per cent across six months, indicating a near-perfect parallel.

Asset allocators have suggested the dilemma has a number of possible driving factors.

David Amphlett-Lewis, co-manager on Smith & Williamson’s managed portfolio service, said that while a positive correlation between stocks and bonds had previously emerged as a result of quantitative easing in developed markets, the gradual tightening of US monetary policy had strengthened this link due to uncertainty about how far rates will rise.

“Positive correlations, which make portfolio risk management more difficult, are likely to persist until US interest rates are more closely aligned with expected nominal GDP growth,” Mr Amphlett-Lewis added.

Others believe the explanation lies with the dramatic weakening of sterling in the past year.

Tim Stubbs, an independent investment consultant and fund buyer, said: “The critical point is that the decline in sterling was large. Therefore it will dominate proportionately the total returns for both sectors relative to normal years.”

He said this emphasised the need to consider both currency hedges and a broad international exposure.

“Although this can introduce volatility, both good and bad, the merits of being more diversified geographically should outweigh the disadvantages presented by currency movements over longer time periods,” Mr Stubbs added. “Asset allocators can of course look to hedge currency exposures if required.”

Mike Horseman, managing director of Cockburn Lucas Independent Financial Consulting, said: “I am not convinced it won’t right itself as we see currency issues fade into the background again.”

But the increase in correlation over the past six months, a period in which sterling has been relatively flat against the dollar, suggests that currency is not the sole explanation. Those who believe the situation is not just a result of exchange rates have given renewed thought to how they diversify portfolios.

Mr Amphlett-Lewis said his team had been buying US Treasury inflation-protected securities (Tips) and also increasing turnover in the lower-risk parts of their portfolios.

“Yields are lower so changes [in bond prices] can be bigger. You have to be more active in your lower-risk bucket than ever before,” he said.