A lack of surprises in the first round of the French elections has left investors asking whether monetary policy, rather than populism, may prove to be the biggest challenge for European equities this year.

In an outcome that relieved markets, centrist candidate Emmanuel Macron topped the first round of presidential voting last week and will now face Marine Le Pen of the National Front in a run-off vote on May 7.

Mr Macron is currently predicted to win that contest by 20 percentage points, and equity markets rallied last week in expectation of that outcome. However, the sense of optimism was tempered by suggestions that the next hurdle for investors may stem from the eurozone’s continued economic recovery.

“The focus will now shift to the improving eurozone economy and the prospect of the European Central Bank (ECB) beginning to withdraw monetary policy stimulus,” said Anthony Doyle, fixed interest investment director at M&G.

Last week’s ECB policy meeting provided little indication that the central bank planned to begin tapering its quantitative easing programme soon, although president Mario Draghi acknowledged the “balance of risk” was no longer tilted towards the downside.

Mr Doyle, who said that any withdrawal would be “gradual”, outlined: “We expect the tapering of asset purchases to be announced by the ECB in the third quarter, with a deposit rate hike in early 2018, and a potential refinancing rate hike to come in late 2018.”

The European Commission reported last week that its April economic sentiment indicators for the euro area and the EU had risen to the highest levels since mid-2007.

Frederik Ducrozet, senior economist at Pictet, said the ECB was in “no rush to embark on policy normalisation” while core inflation levels remained low.

“Still, when the time comes to open a proper debate on exit from unconventional measures, the risk of market overreaction will likely be elevated, especially if expectations remain relatively dovish,” he added.

In the meantime, attention has turned to European earnings season. The region’s equity markets are trading on a forward price-earnings ratio of 16 times, lower than that seen in the US, but above that for emerging markets, ahead of the next round of company results.

Barclays’ European equity strategists said last week that “earnings are everything” for Europe, and predicted: “A pick-up in global inflation should lead to better pricing from European companies and better profit margins.

“Therefore, the seven-year stagnation in European earnings should be behind us.”

The analysts also asserted that relative valuations compared with the US were near the lowest level for 40 years, and claimed the disconnect looks unwarranted now returns on equity are increasing.

But others are less confident. “Without an upside earnings surprise to already full [expectations of 12 per cent growth], European valuations are full,” HSBC strategists said.

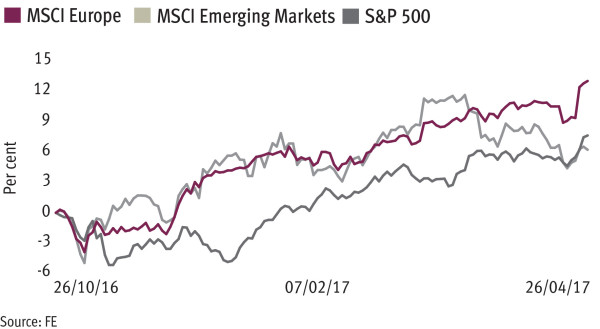

This, in part, reflects a 13 per cent rise for the MSCI Europe over the past six months – a figure which outpaces the US and emerging markets in local currency terms.

One sector that could ultimately benefit from both tapering and a removal of political risk is banks. Goldman Sachs analysts noted last week that “the performance of banks remains closely dependent on interest rates.”

But they predicted a revival of the reflation trade would be required for the sector to rebound materially in the short term.