Almost two decades on from the dotcom bubble, technology is fast becoming a key trend for many investors.

The evolution of smaller and more powerful processing chips, a thirst for the latest technological advances and even the launch of indices covering robotics companies are all helping to drive global interest.

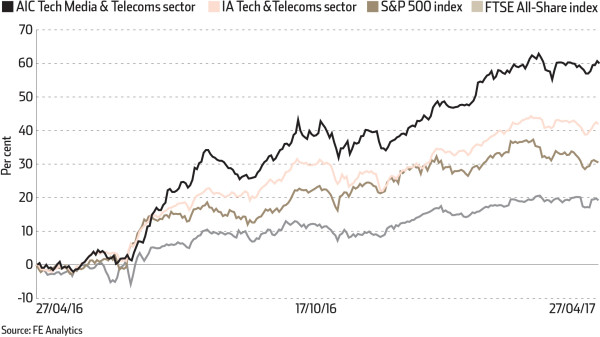

Figures from the Investment Association show that UK fund buyers are starting to pick up on this, with the Technology and Telecommunications sector recording small yet positive inflows for the seven months to the end of February 2017.

Richard Turnill, global chief investment strategist at BlackRock, says: “Technological disruption is becoming a key market theme, with its impact most clearly seen in the traditional consumer sector. The auto industry is no exception – hardly a day goes by without a headline on self-driving or electric vehicles.

“The technology sector has outperformed global equities this year, whereas consumer discretionary stocks have lagged. The bottom line is that for every winner that arises from disruption there will be many losers.”

SVM fund manager Colin McLean suggests: “High-capacity broadband, combined with cloud and mobile computing, big data and smartphones, is disrupting many sectors and forcing new entrants to apply innovative business models. The risk that this creates for UK blue chips should ring alarm bells for investors.”

However, Julian Chillingworth, chief investment officer at Rathbones and an author of the research report: ‘How soon is now? The investment impact of disruptive technologies’ warns: “As investors, it is imperative that we understand how even for those companies that are at the forefront of technological change, investment success is not guaranteed.”

Mr Chillingworth adds that while investors may be right about the potential of a particular technology, they also need to identify how it will be adopted, and ultimately, which companies will profit.

“The problem is that even after the dotcom crash of 2000, the ability to value a company properly remains superseded by the desire to re-imagine a future.

“The graveyard is littered with those corporate corpses that went bust before their technologies reached critical mass. Simply ‘buying the story’ isn’t enough.

“While innovation is a facet of disruption, they are not the same thing, and this misunderstanding can be a sure-fire way to destroy wealth.”

Meanwhile, Ken Wotton, director at Livingbridge and lead manager of the Wood Street Microcap fund, suggests that small and medium-sized companies are particular drivers for the technology sector as more SMEs are now outsourcing their business needs to managed IT providers.

Mr Wotton adds that among the tailwinds for the sector is greater recognition among senior executives of the impact of digital transformation and how that is affecting a company’s ability to grow, to protect itself and to interact with customers or clients.

“Technology companies most likely to succeed over the coming months and years are those providing advice, consultancy and support as well as software that underpins core business. They are the companies providing outsourced infrastructure and IT solutions,” he says.